Used vehicle prices in the U.S. dropped once again in November, marking the third consecutive month of declines. As a result, the Seasonally Adjusted Used Vehicle Price Index declined by -0.8 point, relative to October, to 119.7, according to J.D. Power.

Used vehicle prices in the U.S. dropped once again in November, marking the third consecutive month of declines. As a result, the Seasonally Adjusted Used Vehicle Price Index declined by -0.8 point, relative to October, to 119.7, according to J.D. Power.

Some of the worst losses are in the luxury mid-size car segment, which has seen steady year-over-year declines since 2012. Prices for this segment are expected to decline by more than 7% annually.

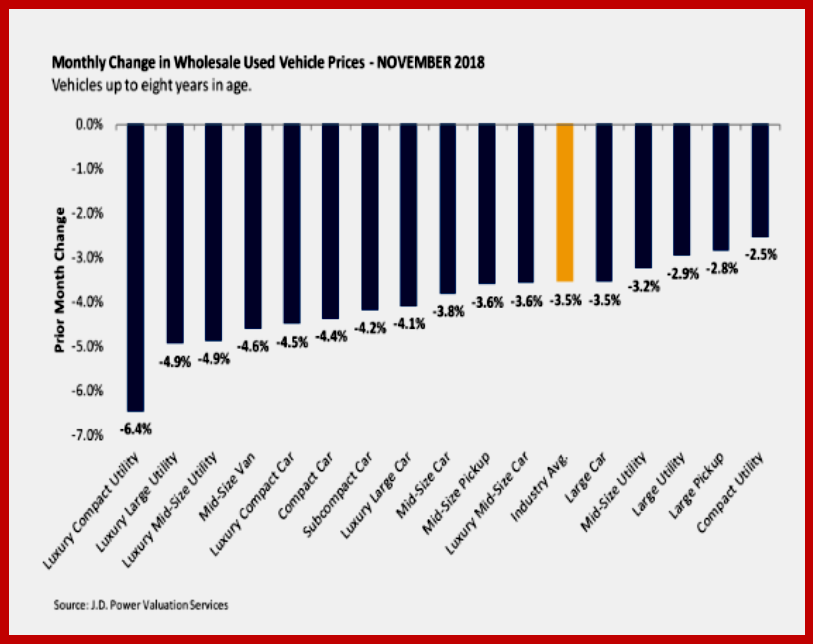

In non-index terms, wholesale prices of used vehicles up to 8-years in age fell by -3.5% in November relative to October. November’s performance was almost identical to the period last year. However, going back further, the previous 5-year average for the period has been a lesser -2%.

Losses at the segment level were mixed in November. On the mainstream side, passenger car losses accelerated while SUV and truck losses returned to

being some of the leanest in the industry. The opposite was true for premium segments in November.

Losses were the most severe for luxury SUV segments, however passenger car segments followed closely behind Automakers decreased incentive spending in November for the third time since April 2015. On average, according to AutoData, spending reached $3,718 per unit versus $3,811 per unit in November 2017.

Among the U.S. Big Three, GM decreased incentives by 3.9% in November to an average of $4,584 per unit. Spending at Ford Motor Company dropped by 7% to $4,358 per unit, while FCA incentive spend decreased by 4% to $4,370 per unit.

As for import automakers, Toyota Motor Sales dropped incentives by 8% in November, reaching an average of $2,572 per unit, while Nissan North America increased spending by 6% to $4,574 per unit and American Honda increased incentives by 5% to $2,041. Luxury automaker BMW decreased incentives by 1% to an average of $5,589 in November. Audi increased spending by 24% to $5,162 per unit, while Mercedes-Benz boosted spending by 26% to $6,526.

At the mainstream brand level, Chrysler’s $5,355 average incentive spend was the highest among the non-luxury brands. At the other end of the spectrum, Subaru spent only $1,146 per unit, down 8% compared to the same period in 2017.

Inventory 72 Days

Total supply level increased to 72 days for the period, compared to 70 days in November 2017, according to WardsAuto. Compared to October, days’ supply went down by 3 days in November.

General Motors’ inventory stayed at 83 days, the same as in November 2017. Ford Motor Company’s supply stretched by 7 days to 85, while FCA’s inventory increased by 7 days to 95 days. On the import side, Toyota Motor Sales’ supply stayed at 59 days. Inventory for American Honda Motors increased by 18 days to 77 days, while Nissan North America’s supply increased by 6 days to reach 86 days.

Subaru’s 28 days of supply remained lowest on the mainstream side of the industry. As for luxury automakers, Tesla’s 3-day inventory was the lowest on the premium side of the market.

Economy

The Bureau of Economic Analysis [BEA] second estimate for third quarter 2018 GOP growth is 3.5%. This estimate was unrevised compared to the advanced estimate from the prior month. The increase in GOP reflected an increase in personal consumption expenditures private inventory investment, federal government spending, and state and local government spending. These increases were partly offset by negative contributions from exports and residential fixed investment.

The third quarter GDP growth is slower compared to the second quarter 2018 GDP growth rate of 4.2%. Real GDP grew by an annual average of 2.6% in 2017, a marked increased from 1.8% growth during 2016.

Employment

The unemployment rate remained unchanged 3.7% in November and the number of unemployed individuals remained the essentially unchanged at 6.0 million. Employment grew in transportation and warehousing, health care, and manufacturing. The U- 6 unemployment rate which measures discouraged, part-time, or underemployed workers in the economy, is at 7.6% for the month of November which is slightly higher from 7.4% in October.

Non-farm employment increased by 155,000 jobs in November which was a decrease following October’s growth of 250,000 jobs. Employment continued to trend up in several industries including manufacturing, transportation, and health care while the wholesale and retail trade, information, and financial activities remained stagnant. The average monthly gain in jobs over the past 12 months stands at 209,000.

Wages

In November, average hourly earnings for all employees on private non-farm payrolls rose by 6 cents to $27.35. Over the year, average hourly earnings have increased by 81 cents, or 3.1%. Hourly wages in nonfarm payrolls went from $27.25 to $27.30 and average weekly earnings decreased by $0.67 from $941.51 to $940.84 compared to October.

Housing

The National Association of Realtors – known at AutoInformed for fiddling numbers – reported existing home sales at a seasonally adjusted annual rate of approximately 5.22 million homes during the month of October. This illustrated an increase of 1% from September and a decrease of 5.1% from October of last year. The median home price for existing home sales decreased to $255,400 in October. It is still up 3.8% from a year ago. Existing home inventory for October is at 1.85m, down from 1.88m last month and up from 1.80m one year ago. This reflects a decrease of 1.60% from last month and an increase of 2.78% last October.

Energy, Oil, Gas

Energy prices reached a bear market in November. Many factors contributed to the sudden and unexpected sharp selloff, including surging production and Iran sanctions, which were not as stringent as once thought. U.S. gasoline prices averaged $2.64 per gallon in November, a decrease of 22 cents/gal as compared to October. The year-over-year increase in gasoline prices was approximately $0.08 per gallon [3.0%] higher than the prior year.

Brent crude oil prices averaged $65 per barrel in November which is a decrease of almost $16 from the October average. November saw the largest monthly average price decline since December 2014. EIA estimates that U.S. crude oil production averaged 11.5 million barrels per day [b/d] in November, up slightly from the October level due to platforms resuming normal operations after hurricane related outages in the Gulf of Mexico. EIA projects that U.S. crude oil production will average 10.9 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 12.1 million b/d in 2019.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

November Used Vehicle Prices Drop for Third Month

Some of the worst losses are in the luxury mid-size car segment, which has seen steady year-over-year declines since 2012. Prices for this segment are expected to decline by more than 7% annually.

In non-index terms, wholesale prices of used vehicles up to 8-years in age fell by -3.5% in November relative to October. November’s performance was almost identical to the period last year. However, going back further, the previous 5-year average for the period has been a lesser -2%.

Losses at the segment level were mixed in November. On the mainstream side, passenger car losses accelerated while SUV and truck losses returned to

being some of the leanest in the industry. The opposite was true for premium segments in November.

Losses were the most severe for luxury SUV segments, however passenger car segments followed closely behind Automakers decreased incentive spending in November for the third time since April 2015. On average, according to AutoData, spending reached $3,718 per unit versus $3,811 per unit in November 2017.

Among the U.S. Big Three, GM decreased incentives by 3.9% in November to an average of $4,584 per unit. Spending at Ford Motor Company dropped by 7% to $4,358 per unit, while FCA incentive spend decreased by 4% to $4,370 per unit.

As for import automakers, Toyota Motor Sales dropped incentives by 8% in November, reaching an average of $2,572 per unit, while Nissan North America increased spending by 6% to $4,574 per unit and American Honda increased incentives by 5% to $2,041. Luxury automaker BMW decreased incentives by 1% to an average of $5,589 in November. Audi increased spending by 24% to $5,162 per unit, while Mercedes-Benz boosted spending by 26% to $6,526.

At the mainstream brand level, Chrysler’s $5,355 average incentive spend was the highest among the non-luxury brands. At the other end of the spectrum, Subaru spent only $1,146 per unit, down 8% compared to the same period in 2017.

Inventory 72 Days

Total supply level increased to 72 days for the period, compared to 70 days in November 2017, according to WardsAuto. Compared to October, days’ supply went down by 3 days in November.

General Motors’ inventory stayed at 83 days, the same as in November 2017. Ford Motor Company’s supply stretched by 7 days to 85, while FCA’s inventory increased by 7 days to 95 days. On the import side, Toyota Motor Sales’ supply stayed at 59 days. Inventory for American Honda Motors increased by 18 days to 77 days, while Nissan North America’s supply increased by 6 days to reach 86 days.

Subaru’s 28 days of supply remained lowest on the mainstream side of the industry. As for luxury automakers, Tesla’s 3-day inventory was the lowest on the premium side of the market.

Economy

The Bureau of Economic Analysis [BEA] second estimate for third quarter 2018 GOP growth is 3.5%. This estimate was unrevised compared to the advanced estimate from the prior month. The increase in GOP reflected an increase in personal consumption expenditures private inventory investment, federal government spending, and state and local government spending. These increases were partly offset by negative contributions from exports and residential fixed investment.

The third quarter GDP growth is slower compared to the second quarter 2018 GDP growth rate of 4.2%. Real GDP grew by an annual average of 2.6% in 2017, a marked increased from 1.8% growth during 2016.

Employment

The unemployment rate remained unchanged 3.7% in November and the number of unemployed individuals remained the essentially unchanged at 6.0 million. Employment grew in transportation and warehousing, health care, and manufacturing. The U- 6 unemployment rate which measures discouraged, part-time, or underemployed workers in the economy, is at 7.6% for the month of November which is slightly higher from 7.4% in October.

Non-farm employment increased by 155,000 jobs in November which was a decrease following October’s growth of 250,000 jobs. Employment continued to trend up in several industries including manufacturing, transportation, and health care while the wholesale and retail trade, information, and financial activities remained stagnant. The average monthly gain in jobs over the past 12 months stands at 209,000.

Wages

In November, average hourly earnings for all employees on private non-farm payrolls rose by 6 cents to $27.35. Over the year, average hourly earnings have increased by 81 cents, or 3.1%. Hourly wages in nonfarm payrolls went from $27.25 to $27.30 and average weekly earnings decreased by $0.67 from $941.51 to $940.84 compared to October.

Housing

The National Association of Realtors – known at AutoInformed for fiddling numbers – reported existing home sales at a seasonally adjusted annual rate of approximately 5.22 million homes during the month of October. This illustrated an increase of 1% from September and a decrease of 5.1% from October of last year. The median home price for existing home sales decreased to $255,400 in October. It is still up 3.8% from a year ago. Existing home inventory for October is at 1.85m, down from 1.88m last month and up from 1.80m one year ago. This reflects a decrease of 1.60% from last month and an increase of 2.78% last October.

Energy, Oil, Gas

Energy prices reached a bear market in November. Many factors contributed to the sudden and unexpected sharp selloff, including surging production and Iran sanctions, which were not as stringent as once thought. U.S. gasoline prices averaged $2.64 per gallon in November, a decrease of 22 cents/gal as compared to October. The year-over-year increase in gasoline prices was approximately $0.08 per gallon [3.0%] higher than the prior year.

Brent crude oil prices averaged $65 per barrel in November which is a decrease of almost $16 from the October average. November saw the largest monthly average price decline since December 2014. EIA estimates that U.S. crude oil production averaged 11.5 million barrels per day [b/d] in November, up slightly from the October level due to platforms resuming normal operations after hurricane related outages in the Gulf of Mexico. EIA projects that U.S. crude oil production will average 10.9 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 12.1 million b/d in 2019.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.