A link with Volkswagen or a sellout? With money short and competition from mega-billionaires and Silicone Valley startups building, CEO Hackett above is sailing in harm’s way.

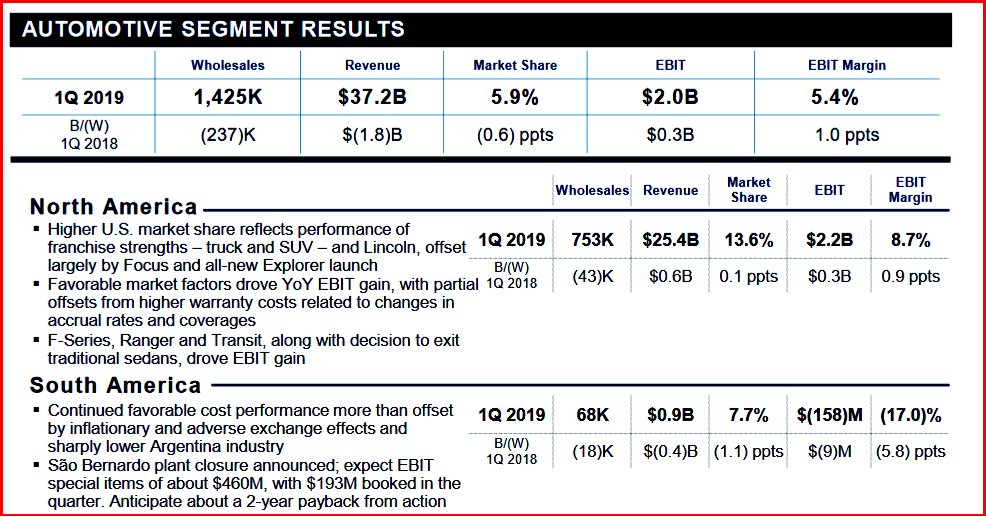

Ford Motor Company During Q1 of 2019 saw weak but improved financial results as it continues its latest global reorganization efforts. Revenue was down on lower volume, as was net income hurt by the the discontinuation of the North America Focus, as well as the production ramp up for the all-new Explorer.

Overall Ford continues to struggle finding a balance between global operations, product mix, manufacturing efficiency, shareholder returns and changing into an automobility company that can compete with old industry giants and emerging new ones such as Lyft, Google and Uber.

Click to Enlarge.

Net income was down at $1.1B because of special item charges of about $600 million, most associated with the exit of heavy truck operations in South America announced in February, and the redesign of European operations including the restructuring of the company’s Russia joint venture, announced in March.

Company adjusted EBIT was $2.4 billion, up $262 million year over year, driven by strong performance in North America and at Ford Credit.

“With a solid plan in place, we promised 2019 would be a year of action and execution for Ford, and that’s what we delivered in the first quarter,” claimed Jim Hackett, Ford president and CEO. There continues to be speculation, perhaps groundless, about his future at Ford.

Shareholders with the stock trading in the $10 range saw some bump up on the news, but the price is still well below $15.55 it was five years ago in Q1. Earnings per share for Q1 were 29 cents per share, down from. 44 cents year-over-year, but better than expected. Ford is yielding a 5.7% dividend.

In North America, share and revenue both improved year over year, from sales of trucks and utilities. EBIT was $2.2 billion, up year-over-year, with stronger net pricing and product mix. EBIT margin was 8.7% (the S&P was roughly twice that), improved by nearly a percentage point from the same quarter last year. F-Series continued with sales and segment share both up year-over-year. However, competition from GM and Ram made the retail average transaction price flat at about $47,000 per vehicle, because of all-new products from competitors.

North America should by helped this year from a significant wave of product launches focused on trucks and utilities, including Ranger, Super Duty, Explorer and Escape, as well as the all-new Aviator and all-new Corsair from Lincoln. By the end of 2020, Ford will have replaced 75% of its current U.S. product lineup.

“This quarter was a really good start for the year,” said Bob Shanks, Ford chief financial officer. “We expect first quarter EBIT to be the strongest of the year due to seasonal factors and major product launches ahead. It does, however, put us on track to deliver better company results in 2019 than last year.”

Click to enlarge.

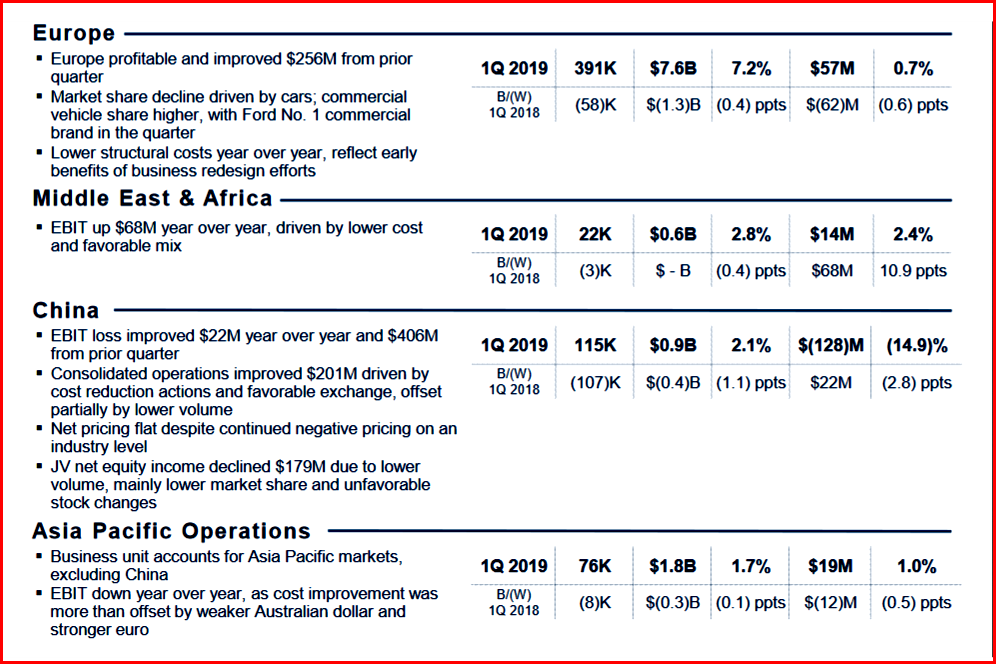

Outside North America, the Ford had an EBIT loss of $196 million, which was an improvement of $632 million from the prior quarter, with Europe, Asia Pacific Operations and Middle East and Africa all profitable.

In South America, Ford is moving toward a “more lean and agile business model.” It announced in the quarter that it would close its São Bernardo manufacturing facility, ceasing production of heavy trucks and the Fiesta small car.

Click to Enlarge.

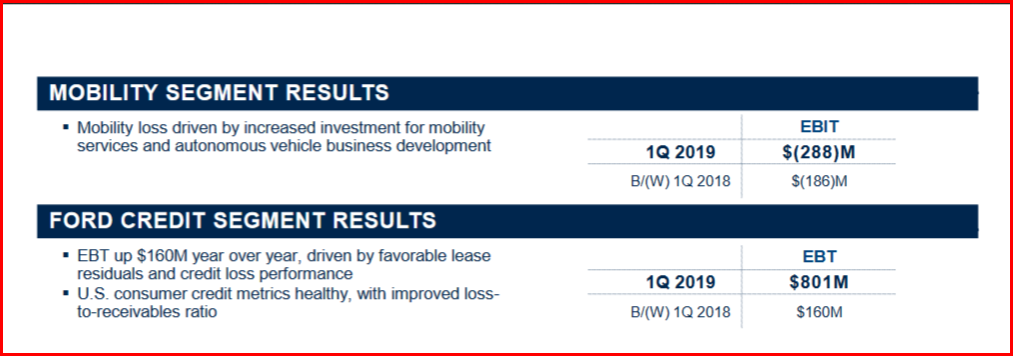

Ford Credit had EBT of $801 million, up 25% year-over-year and the best quarterly result since 2010, because of favorable lease residual values and credit loss performance.

Ford’s balance sheet remains okay, with $24.2 billion in cash and $35.2 billion in liquidity, both above company targets of $20 billion and $30 billion, respectively. In addition, following the end of the quarter, on April 23, Ford closed on a $3.5 billion supplemental credit facility, strengthening its liquidity and providing additional financial flexibility. This is on top of Ford’s corporate revolving facility of $13.4 billion.

AutoInformed.com on:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Q1 Results Improve Somewhat

A link with Volkswagen or a sellout? With money short and competition from mega-billionaires and Silicone Valley startups building, CEO Hackett above is sailing in harm’s way.

Ford Motor Company During Q1 of 2019 saw weak but improved financial results as it continues its latest global reorganization efforts. Revenue was down on lower volume, as was net income hurt by the the discontinuation of the North America Focus, as well as the production ramp up for the all-new Explorer.

Overall Ford continues to struggle finding a balance between global operations, product mix, manufacturing efficiency, shareholder returns and changing into an automobility company that can compete with old industry giants and emerging new ones such as Lyft, Google and Uber.

Click to Enlarge.

Net income was down at $1.1B because of special item charges of about $600 million, most associated with the exit of heavy truck operations in South America announced in February, and the redesign of European operations including the restructuring of the company’s Russia joint venture, announced in March.

Company adjusted EBIT was $2.4 billion, up $262 million year over year, driven by strong performance in North America and at Ford Credit.

“With a solid plan in place, we promised 2019 would be a year of action and execution for Ford, and that’s what we delivered in the first quarter,” claimed Jim Hackett, Ford president and CEO. There continues to be speculation, perhaps groundless, about his future at Ford.

Shareholders with the stock trading in the $10 range saw some bump up on the news, but the price is still well below $15.55 it was five years ago in Q1. Earnings per share for Q1 were 29 cents per share, down from. 44 cents year-over-year, but better than expected. Ford is yielding a 5.7% dividend.

In North America, share and revenue both improved year over year, from sales of trucks and utilities. EBIT was $2.2 billion, up year-over-year, with stronger net pricing and product mix. EBIT margin was 8.7% (the S&P was roughly twice that), improved by nearly a percentage point from the same quarter last year. F-Series continued with sales and segment share both up year-over-year. However, competition from GM and Ram made the retail average transaction price flat at about $47,000 per vehicle, because of all-new products from competitors.

North America should by helped this year from a significant wave of product launches focused on trucks and utilities, including Ranger, Super Duty, Explorer and Escape, as well as the all-new Aviator and all-new Corsair from Lincoln. By the end of 2020, Ford will have replaced 75% of its current U.S. product lineup.

“This quarter was a really good start for the year,” said Bob Shanks, Ford chief financial officer. “We expect first quarter EBIT to be the strongest of the year due to seasonal factors and major product launches ahead. It does, however, put us on track to deliver better company results in 2019 than last year.”

Click to enlarge.

Outside North America, the Ford had an EBIT loss of $196 million, which was an improvement of $632 million from the prior quarter, with Europe, Asia Pacific Operations and Middle East and Africa all profitable.

In South America, Ford is moving toward a “more lean and agile business model.” It announced in the quarter that it would close its São Bernardo manufacturing facility, ceasing production of heavy trucks and the Fiesta small car.

Click to Enlarge.

Ford Credit had EBT of $801 million, up 25% year-over-year and the best quarterly result since 2010, because of favorable lease residual values and credit loss performance.

Ford’s balance sheet remains okay, with $24.2 billion in cash and $35.2 billion in liquidity, both above company targets of $20 billion and $30 billion, respectively. In addition, following the end of the quarter, on April 23, Ford closed on a $3.5 billion supplemental credit facility, strengthening its liquidity and providing additional financial flexibility. This is on top of Ford’s corporate revolving facility of $13.4 billion.

AutoInformed.com on:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.