Foreign exchange rates negatively impacted earnings per share attributable to common shareholders by $0.07 as Trump trade and economic policies weakened the US Dollar.

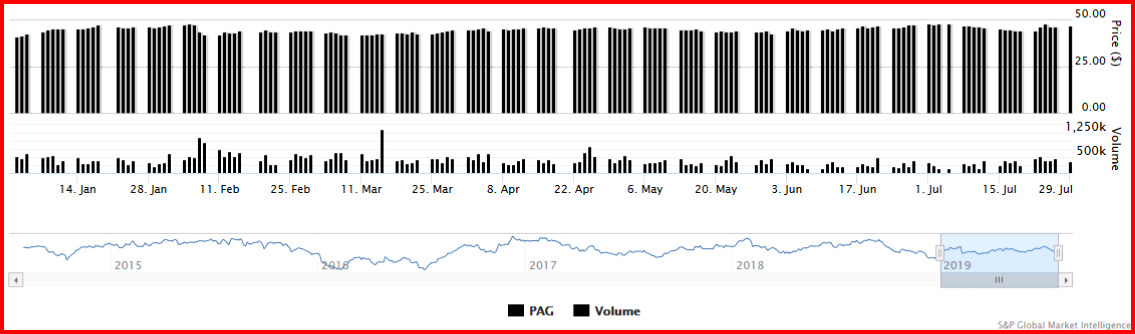

Penske Automotive Group, Inc. (NYSE: PAG), a diversified international transportation services company, today announced lower second quarter and six-month 2019 results, and the acquisition of Warner Truck Centers.

Penske – in AutoInformed’s view – is a leading indicator of where the auto market is going in the US and UK. The decline in new auto sales with an increase in used auto sales could indicate that the economy – here and globally – is on the verge of a recession. (US Deficit and Government Spending Grow in Q2)

For the three months ended June 30, 2019, the PAG reported income from continuing operations attributable to common shareholders of $117.7 million, or $1.42 per share, compared to $134.6 million, or $1.58 per share in the prior year.

For the six months ended June 30, 2019, PAG reported income from continuing operations attributable to common shareholders of $217.8 million, or $2.60 per share, compared to $242.6 million, or $2.84 per share in the prior year. Foreign exchange rates negatively impacted earnings per share attributable to common shareholders by $0.07 as Trump trade wars and economic policies have weakened the US Dollar compared to other currencies.

“The company’s second quarter results were negatively impacted by approximately 16 cents per share, including foreign exchange,” said Chairman Roger Penske.

Automotive Retail Q2

Same-Store Retail Unit Sales -4.4% to 125,951

- New unit retail sales -9.0%,

- Used unit retail sales -0.5%

Same-Store Retail Revenue -4.6%*

- New -8.3%A

- Used -1.9%B

- Finance & Insurance +2.3%C

- Service & Parts +1.0%D

Same-Store Average Gross Profit Per Unit

- New $3,133, +$18/unitE

- Used $1,406, -$140/unitF

- Finance & Insurance $1,302, +$85/unitG

Used Supercenter Operations

For the three months ended June 30, 2019, the used supercenters retailed 17,775 used units and generated $312.1 million in revenue compared to retail unit sales of 18,832 and revenue of $346.7 million in the same period last year.

PAG said the unit decline is mainly attributable to market conditions and the decline in used vehicle market values in the U.K. For the six months ended June 30, 2019, the used supercenters retailed 35,815 used units and generated $626.5 million in revenue compared to retail unit sales of 37,505 and revenue of $677.8 million in the same period last year.

Retail Commercial Truck Operations

For the three months ended June 30, 2019, total medium and heavy-duty units retailed increased 23.2%, and revenue increased 26.0% to $426.8 million. For the six months ended June 30, 2019, total medium and heavy-duty truck units retailed increased 16.9% and revenue increased 20.3% to $759.1 million. Same-store revenue increased 26.1% and 19.7% for the three and six months ended June 30, 2019, respectively.

Penske Truck Leasing

Penske Truck Leasing Co., L.P. (“PTL”) is a provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. The company accounts for its ownership interest in PTL using the equity method of accounting. For the three and six months ended June 30, 2019, the company recorded $38.0 million and $63.8 million in earnings from this investment compared to $35.0 million and $51.0 million for the same periods last year, respectively.

On July 17, 2019, the company announced that its Board of Directors increased the dividend to its common stock shareholders to $0.40 per share, the 33rd consecutive increase in the quarterly dividend.

During the three months ended June 30, 2019, the company repurchased 1,706,866 shares for $76.2 million, or an average of $44.66 per share. For the six months ended June 30, 2019, the company repurchased 2,965,214 shares for $130.6 million, or an average of $44.03 per share. As of June 30, 2019, the company had a remaining share repurchase authorization of approximately $74.4 million.

Footnotes

- * Excluding Foreign Exchange -2.1%

- A Excluding Foreign Exchange -6.2%

- B Excluding Foreign Exchange +1.2%

- C Excluding Foreign Exchange +5.0%

- D Excluding Foreign Exchange +3.1%

- E Excluding Foreign Exchange $3,216, +$101/unit

- F Excluding Foreign Exchange $1,445, -$101/unit

- G Excluding Foreign Exchange $1,336, +$119/unit

Pingback: Penske Automotive Group Buys Another BMW Store | AutoInformed