Click to Enlarge. Courtesy Auto Forecast Solutions.

If the proposed FCA-PSA merger goes forward it’s a complicated way to spread costs as a consolation would result in FCA-PSA group emerging as the fourth-largest Global Automaker. Its annual production volume would be +8 million Light Vehicles per year. It would be larger than Hyundai Group, General Motors, Ford and Honda. It could compete with the current Global Big Three – Volkswagen Group, Toyota and Renault-Nissan-Mitsubishi.

Consultancy AutoForecast Solutions says that right now FCA primarily uses four global front-drive platforms for passenger cars and crossovers. (autoforecastsolutions.com)

The 169 platform underpins the smallest products such as the Fiat 500 hatch and convertible. Covering B-segment models, the 199 platform was originally developed in a joint-venture with GM nearly two decades ago. C-segment cars and crossovers use the SUSW platform which was introduced in 2012 and is used for the Fiat Egea/Dodge Neon and Jeep Renegade. The company’s largest front-drive platform is the CUSW launched in 2007 and is used under the Jeep Cherokee. With the ages of these platforms, modern replacements will come as a welcome addition to the FCA lineup. Platforms underpinning trucks and vans remains FCA’s strength.

PSA has developed a range of up-to-date architectures on which it has based newer offerings. The smaller CMP (Common Modular Platform) was introduced in 2019 and the larger EMP2 (Efficient Modular Platform) was introduced in 2012. These two platforms will be the basis for more than 70% of all PSA models by 2021 and over 94% by 2024. CMP and EMP2 should also be a suitable replacement the older front-wheel drive FCA platforms over the next 3-6 years.

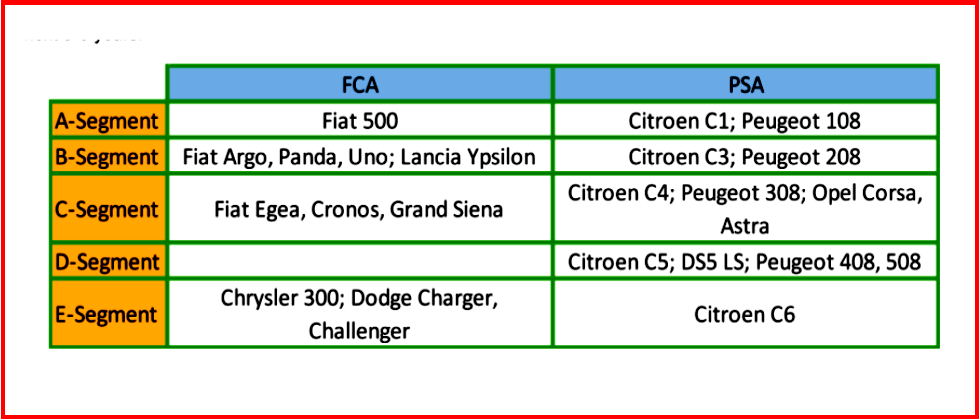

- A-Segment: among the smallest cars, Fiat currently has the 500 coupe and convertible while PSA offers the Citroen C1 and Peugeot 108. After the merger, FCA will drop the Fiat 500 in order to concentrate on larger models. Groupe PSA produces the C1 and 108 along with the Toyota Aygo in Kolin, Czech Republic. Sales are primarily focused in Europe

- B-Segment: FCA produces its B-segment models in Europe and South America including the Fiat Argo and Lancia Ypsilon, combining for about 300k units per year. Citroen C3 and Peugeot 208 add another 540k units. All models are due for major revisions in 2024-2025, allowing enough development time to merge them onto a single platform and improving their economies of scale.

- A-Segment CUV: the global shift toward crossovers requires manufacturers to fill a range of sub -segments. With entry-level hatchbacks becoming less important, the smallest CUVs, like the Fiat Mobi and the upcoming small Jeep, are necessary to introduce young buyers and emerging markets to the brands.

- B-Segment CUV: like the smaller segment, models in this segment, such as the Fiat Panda, Fiat 500X, Opel/ Vauxhall Mokka, and Jeep Renegade, become entry-level models in more established markets. More than half a million units this year will grow to nearly 700k in years to come.

- C-Segment CUV: important around the world, these compact (in North America) or mid -sized (in Europe) CUVs are involved in intense competition from nearly every vehicle maker around the world. Variations of the Citroen C3 (Aircross, Cactus, and XR) are produced with the DS3 Crossback, Fiat Toro CUV, Opel/Vauxhall Crossland X, Peugeot 2008, and Jeep Compass.

- D-Segment CUV: larger crossovers, like the Citroen C5 Aircross, Dodge Journey, DS7 Crossback, Jeep Cherokee, Opel/Vauxhall Grandland X, Peugeot 3008, Peugeot 4008, and Peugeot 5008, as well as the premium Alfa Romeo Stelvio and Maserati Levante, are needed especially in markets where three-rows of seats are demanded.

MPV, Pickup, and Van Analysis

Overlap between the FCA and PSA brands in the MPV, pickup, and van segments is minimal. Small pickups are Fiat for South America only. Like SUVs, production of mid-sized and full-sized pickups are the Jeep and Ram brands in North America but marketed around the world. Small people carriers including the C-segment Fiat 500L and the D-segment Citroen C4 Space Tourer, both produced in Europe.

- Between PSA and FCA, the two companies offer 19 van nameplates across six brand names. The small and mid-sized vans are currently produced on a range of platforms that should be consolidated within five years. However, with the exception of the formerly GM-owned Opel/Vauxhall models, the full-sized vans are already consolidated on a platform from FCA.

Powertrain

The new consolidated company can be broken down into three basic engine categories: North America, Gasoline and Diesel.

North America will stand separate as Ram and Jeep make up a considerable portion of the vehicles, which tend to be a lot larger than the other vehicles around the world. Because of this, V8s and V6s will continue to be produced in this region in significant volumes. Both of these engines were developed by the former Chrysler Group prior to the merger with Fiat. Neither is expected to be replaced anytime soon.

Larger four-cylinders of older Chrysler design will continue for years, standing apart from the global engine updates currently occurring. At some point, there will be a significant correction in engine programs and a much-needed displacement/downsizing will occur. Ironically, a more sophisticated Fiat-designed 2.0L turbo four-cylinder engine (Global Medium Engine or GME) had gone into production in North America but has since been cancelled. Production is now sourced only out of Italy, in lower volumes than originally expected.

The GME family will continue to be used in larger vehicles, like the Alfa Romeos. European production of GME has been solidified by export volumes to North America for Jeep products. Most of the volumes from engines this size is expected to come from the FCA side of the deal, so the production of the GME family should remain fairly strong. Additional production is expected to eventually move back to North America as the four-cylinder replaces larger six- cylinder engines.

- The EB family from PSA debuted recently and has been doing quite well. Engines are available in 1.0L and 1.2L three-cylinder variations. The 1.2L makes up the bulk of the applications: naturally aspirated, turbocharged and high-end turbocharged. The turbo 1.2L has already replaced the 1.4L four leaving just the older Prince family 1.6L in the PSA lineup. With older Opel units being replaced by the 1.2L engines, PSA has converted over the older GM Szentgotthard engine plant to produce more EB engines. It is expected that these engines will replace the smaller FCA Global Small Engine (GSE) units, even though GSE is a more recently developed family.

- Medium engines are currently shrinking in volume, being replaced by the smaller EB family from PSA. One configuration seems to persist, the 1.6L turbo, which is primarily used in performance vehicles. In using just traditional internal combustion engine packages, this would be difficult to replace with a larger and smaller family option. However, in keeping with the strategy of electrifying vehicles, a fully-hybridized version of the 1.2L I3 could be used to replace the 1.6L turbo as a performance option. This would eliminate the need for a medium I4 program and provide many other benefits like lower emissions and improved fuel economy.

- Outside of North America, diesel engine sizes can be grouped into small (1.5L/1.6L) and large (2.0L) categories. There is a great deal of overlap from PSA and FCA in this area. Both PSA and Fiat are well known for their diesel engines, and both have additionally licensed other manufacturers to build them. While some of these agreements will continue, consolidation within the merged company is expected to focus on hybrids and PSA diesels.

- Licensed from Fiat, the JTD diesel is produced for export and for use in Opel/Vauxhall vehicles. Demand for JTD engines will diminish as the Opel/Vauxhall models continue their switch to PSA diesels. Fiat-built engines will also eventually be replaced by PSA engines where diesels are required.

Assembly Plants

The two automakers currently operate forty (40) assembly plants around the world, not including joint – venture facilities. North American plants are all on the FCA side, while plants in the Middle East/Africa are all part of Groupe PSA.

- In Eastern Europe, FCA’s smaller Kragujevac (Serbia) and larger Tychy (Poland) plants are running well below capacity and could see consolidation. Groupe PSA is running the Trnava (Slovakia) plant wide-open while the Gliwice (Poland) plant acquired with Opel is expected to operate at below capacity in the longer term.

- FCA operates six plants in Italy with one (Grugliasco) scheduled for closure in 2022. Even though two of the remaining plants are significantly below capacity, the government and unions in Italy will make it extremely difficult to close any of them.

- While PSA has 12 plants in Western Europe, many are operating near or above capacity. Ellesmere Port becomes the riskiest plant and could close if conditions following Brexit are not optimal. Other plants, including Russelsheim (Germany), Rennes-la-Janis (France), Poissy (France), and Mulhouse (France), will be under-utilized into the next decade and could see some consolidation.

- Six plants in South America could be combined. Aside from FCA’s Pernambuco facility, assembly plants in the region are operating well below optimal levels. Unless the economy of the region suddenly picks up, plant closures are anticipated.

“Like the older PSA-Opel and Fiat-Chrysler mergers, the combination of FCA and PSA will concentrate brands and platforms where they are strongest. Brands such as Lancia and Dodge could be dropped as their products become less relevant. Sales of the Alfa Romeo and Maserati brands could be considered as their development has lagged behind expectations,” in Auto Forecast Solution’s opinion. (sfiorani@autoforecastsolutions.com)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

FCA-PSA Merger – Surviving Platforms and Powertrains

Click to Enlarge. Courtesy Auto Forecast Solutions.

If the proposed FCA-PSA merger goes forward it’s a complicated way to spread costs as a consolation would result in FCA-PSA group emerging as the fourth-largest Global Automaker. Its annual production volume would be +8 million Light Vehicles per year. It would be larger than Hyundai Group, General Motors, Ford and Honda. It could compete with the current Global Big Three – Volkswagen Group, Toyota and Renault-Nissan-Mitsubishi.

Consultancy AutoForecast Solutions says that right now FCA primarily uses four global front-drive platforms for passenger cars and crossovers. (autoforecastsolutions.com)

The 169 platform underpins the smallest products such as the Fiat 500 hatch and convertible. Covering B-segment models, the 199 platform was originally developed in a joint-venture with GM nearly two decades ago. C-segment cars and crossovers use the SUSW platform which was introduced in 2012 and is used for the Fiat Egea/Dodge Neon and Jeep Renegade. The company’s largest front-drive platform is the CUSW launched in 2007 and is used under the Jeep Cherokee. With the ages of these platforms, modern replacements will come as a welcome addition to the FCA lineup. Platforms underpinning trucks and vans remains FCA’s strength.

PSA has developed a range of up-to-date architectures on which it has based newer offerings. The smaller CMP (Common Modular Platform) was introduced in 2019 and the larger EMP2 (Efficient Modular Platform) was introduced in 2012. These two platforms will be the basis for more than 70% of all PSA models by 2021 and over 94% by 2024. CMP and EMP2 should also be a suitable replacement the older front-wheel drive FCA platforms over the next 3-6 years.

MPV, Pickup, and Van Analysis

Overlap between the FCA and PSA brands in the MPV, pickup, and van segments is minimal. Small pickups are Fiat for South America only. Like SUVs, production of mid-sized and full-sized pickups are the Jeep and Ram brands in North America but marketed around the world. Small people carriers including the C-segment Fiat 500L and the D-segment Citroen C4 Space Tourer, both produced in Europe.

Powertrain

The new consolidated company can be broken down into three basic engine categories: North America, Gasoline and Diesel.

North America will stand separate as Ram and Jeep make up a considerable portion of the vehicles, which tend to be a lot larger than the other vehicles around the world. Because of this, V8s and V6s will continue to be produced in this region in significant volumes. Both of these engines were developed by the former Chrysler Group prior to the merger with Fiat. Neither is expected to be replaced anytime soon.

Larger four-cylinders of older Chrysler design will continue for years, standing apart from the global engine updates currently occurring. At some point, there will be a significant correction in engine programs and a much-needed displacement/downsizing will occur. Ironically, a more sophisticated Fiat-designed 2.0L turbo four-cylinder engine (Global Medium Engine or GME) had gone into production in North America but has since been cancelled. Production is now sourced only out of Italy, in lower volumes than originally expected.

The GME family will continue to be used in larger vehicles, like the Alfa Romeos. European production of GME has been solidified by export volumes to North America for Jeep products. Most of the volumes from engines this size is expected to come from the FCA side of the deal, so the production of the GME family should remain fairly strong. Additional production is expected to eventually move back to North America as the four-cylinder replaces larger six- cylinder engines.

Assembly Plants

The two automakers currently operate forty (40) assembly plants around the world, not including joint – venture facilities. North American plants are all on the FCA side, while plants in the Middle East/Africa are all part of Groupe PSA.

“Like the older PSA-Opel and Fiat-Chrysler mergers, the combination of FCA and PSA will concentrate brands and platforms where they are strongest. Brands such as Lancia and Dodge could be dropped as their products become less relevant. Sales of the Alfa Romeo and Maserati brands could be considered as their development has lagged behind expectations,” in Auto Forecast Solution’s opinion. (sfiorani@autoforecastsolutions.com)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.