During March 2020, demand for new commercial vehicles plummeted by 47.3% across the EU, as measures to prevent the spread of the coronavirus lead to the closure of dealerships.

Every vehicle segment was deeply affected by the fallout of the COVID-19 outbreak. All 27 EU markets recorded substantial declines last month. The strongest drops were posted by Italy (-66.1%), Spain (-64.4%) and France (-63.1%).

During Q1 of 2020, the EU commercial vehicle market contracted by 23.2% to 413,327 units as a direct result of March’s substantial downturn. The four major markets, Spain (-31.7%), France (-26.9%), Italy (-26.6%) and Germany (-14.4%), all faced double-digit losses so far this year.

During Q1 of 2020, the EU commercial vehicle market contracted by 23.2% to 413,327 units as a direct result of March’s substantial downturn. The four major markets, Spain (-31.7%), France (-26.9%), Italy (-26.6%) and Germany (-14.4%), all faced double-digit losses so far this year.

New Light Commercial Vehicles up to 3.5 tons

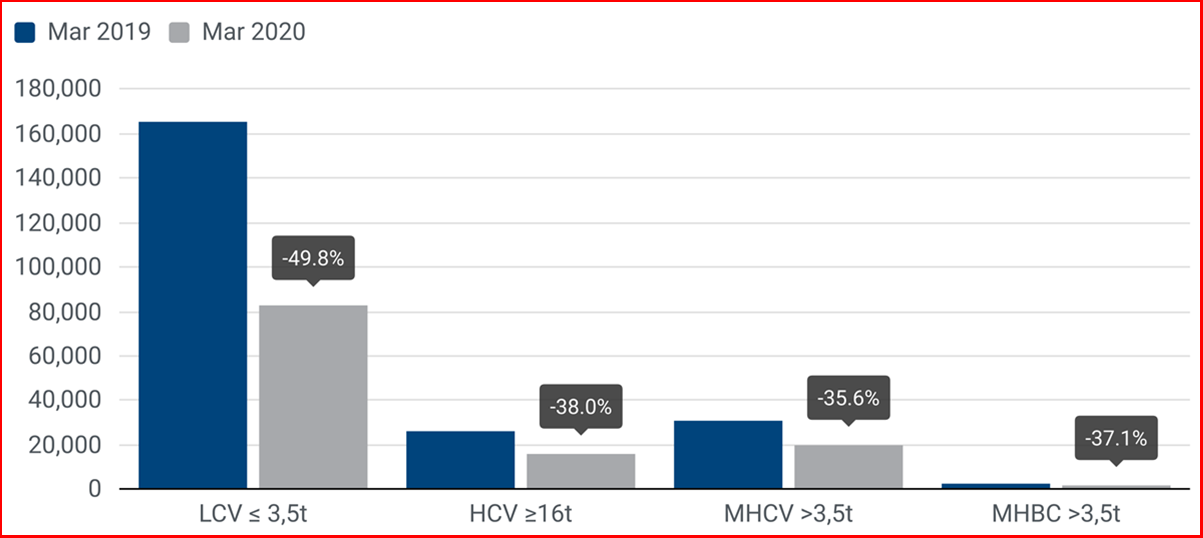

March registrations of light commercial vehicles took the biggest blow of all segments. Demand fell by half (-49.8%) compared to the year before, with registrations dropping from 165,455 vans in March 2019 to 83,141 units this year. With the exception of Hungary, which posted a more modest decline than other countries, all EU markets saw double-digit percentage drops last month, including the major ones. In Italy registrations tumbled by -71.2% and Spain saw a -67.2% drop.

From January to March, demand for new vans in the European Union shrank by -23.1%. Each of the four main EU markets performed worse than in 2019. Spain recorded the biggest drop (-33.5%), followed by Italy (-29.4%), France (-27.3%) and Germany (-11.8%).

New Heavy Commercial Vehicles of 16+ Tons

During the third month of 2020, EU demand for new heavy trucks declined significantly (-38.0%), marking the ninth consecutive month of decline. As a result of the COVID-19 pandemic, registrations dropped in all European markets and especially in France, where demand for heavy trucks was cut by more than half (-50.2%).

During Q1 2020, heavy truck sales fell in all major EU markets, with France (-27.7%) and Germany (-25.9%) posting the strongest drops. This brought total registrations down to 54,168 heavy trucks so far in 2020, or -26.9% less than last year.

New Medium and Heavy Vehicles +3.5 tons

In March of this year, total new truck registrations in the EU continued to suffer from the slowdown in demand for heavy-duty trucks, decreasing by -35.6%. The four largest EU markets all recorded significant declines last month: France (-49.3%), Italy (-33.5%), Spain (-30.8%) and Germany (-27.6%).

During Q1 2020, 66,376 new trucks were registered across the European Union, down -24.8% compared to the first quarter of 2019. Similar to the performance in the heavy‐truck segment, Germany (-26.4%) and France (-23.1%) reported the biggest losses, followed by Spain (-15.1%) and Italy (-12.3%).

New medium/heavy buses & coaches +3.5 tons

In March 2020, EU demand for new buses and coaches plunged by -37.1% to 1,905 units. Germany (+11.8%), Austria (+12.3%), Estonia (+800.0%) and Cyprus (+33.3%) were the only markets in the region to post growth last month. All other EU countries recorded significant losses in March, and Spain (-68.8%) in particular.

During Q1 2020, bus and coach registrations contracted by -10.3%, with 7,637 new vehicles registered in total across the European Union. Despite the March drop, overall demand remained positive in three of the four major EU markets so far this year: Germany (+12.4%), Italy (+9.5%) and France (+6.8%). By contrast, Spanish registrations were down -37.2% during the first quarter.

Zita Zigan, Director, Global Commercial Vehicle Forecasting at LMC Automotive: The calamitous unfolding of the COVID-19 pandemic in 2020 has prompted us to slash our MHCV sales and production forecasts compared to last quarter’s update. In many cases, the revisions have been in an order of magnitude not seen since the global financial meltdown of 2008/2009. Global truck sales for the year as a whole are expected to fall by 25%. Global truck output is expected to decline by 30%. For comparison: our December forecast called for an 8-9% decline.