Click to Enlarge.

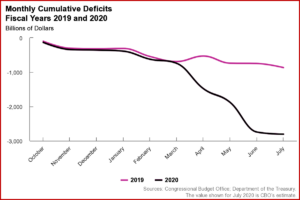

The federal budget deficit in July 2020 was $61 billion, CBO estimates, compared with a deficit of $120 billion in the same month last year. That decrease, following three months of mind-blowing larger deficits, happened because payment deadlines for individual and corporate income taxes were delayed from April and June to July. Tax receipts were unusually large in July as a result. All told, from April through July, revenues were down 10% from last year’s amounts.

The cumulative federal budget deficit for the first 10 months of fiscal year 2020 reached $2.8 trillion, +$1.9 trillion more than the deficit recorded during the same period last year. Revenues were 1% lower and outlays were 51% higher through July 2020 than during the same 10-month period in fiscal year 2019.

Spending in July Rose by 68%

Total spending in July 2020 was $624 billion – $253 billion more than outlays in July 2019 – largely from legislation enacted in response to the corona virus pandemic. If not for the shift of some federal payments from August 2020 to July 2020, total spending would have been $197 billion (+53%) more than in the same month last year.

COVID 19 Spending

Major pandemic-related changes in expenses in July were as follows (the CBO amounts are adjusted to exclude the effects of the timing shifts):

- Outlays for unemployment compensation increased from $3 billion in July 2019 to $110 billion this year. More than half of that is attributable to a $600 increase in the weekly benefit amount provided under the CARES Act. Benefits for regular unemployment compensation too.

- Outlays by the Small Business Administration increased from $103 million to $26 billion, primarily because of loans and loan guarantees to small businesses through the Paycheck Protection Program authorized by the CARES Act and PPPHCEA.

- Outlays for the Public Health and Social Services Emergency Fund totaled $17 billion this July, compared with $243 million last July. Funding was increased by legislation to reimburse health care providers (such as hospitals) for health care costs or for revenues lost because of the pandemic. That fund also provides money for testing for and treatment of COVID-19.

- Outlays from the Department of the Treasury’s Exchange Stabilization Fund increased from –$62 million to $8 billion, almost entirely because of equity investments in certain Federal Reserve facilities, which provide liquidity for a wide range of economic activities. Those facilities are designed to address financial strain caused by the pandemic. CBO expects order ativan online legally that the increase in the deficit caused by those outlays will probably be offset in future years by payments to the Treasury from the facilities’ proceeds.

- Spending for Medicaid was $7 billion higher this July than last July for three reasons: increased enrollment; the 6.2% increase in federal matching rates that states began to access in April 2020 (enacted in FFCRA); and FFCRA’s requirement that states retain enrollees on Medicaid until the end of the public-health emergency.

- Spending for Food and Nutrition Service was $5 billion higher, $12 billion in July 2020 compared with $7 billion in July 2019, largely because of the increase in Supplemental Nutrition Assistance Program benefits authorized by FFCRA, but also because more people were receiving such benefits this July, CBO estimates.

- Department of the Treasury taxpayer subsidies for aviation worker relief totaled $3 billion in July. The CARES Act authorized that assistance for payroll support in the form of grants and loans.

Other major payments in July:

- Social Security benefits rose by $4 billion (or 5%) because of increases in the number of beneficiaries and the average benefit payment.

- Pending for net interest payments on the public debt decreased from $37 billion in July 2019 to $30 billion this year. Although the debt was greater this July, inflation was considerably lower, resulting in smaller adjustments to inflation-protected securities, and interest rates were lower as well.

- For other programs and activities, spending increased or decreased by smaller amounts.

Deficit More Than Tripled in the First 10 Months

- The federal budget deficit was $2.8 trillion in the first 10 months of fiscal year 2020, CBO says, compared with $0.9 trillion during the same period last year.

- Revenues were lower and outlays were higher than during the same period in fiscal year 2019.

- Shifts in the timing of certain payments increased outlays in the first 10 months of this year by $57 billion. If not for those shifts, the increase in the deficit so far this fiscal year would have been $1,882 billion.

Revenue collections and outlays in fiscal year 2020 can be divided into two periods: before and after the start of the economic disruption caused by the pandemic. After Covid, from April through July, the deficit this year was an estimated $2.1 trillion, compared with $176 billion during the same period last year. If not for the shift of some payments from August into July this year, the deficit for April through July would have been $2.0 trillion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Federal Deficit for FY 2020 To Date – $2.8 Trillion or +$1.9 Trillion Year-over-Year

Click to Enlarge.

The federal budget deficit in July 2020 was $61 billion, CBO estimates, compared with a deficit of $120 billion in the same month last year. That decrease, following three months of mind-blowing larger deficits, happened because payment deadlines for individual and corporate income taxes were delayed from April and June to July. Tax receipts were unusually large in July as a result. All told, from April through July, revenues were down 10% from last year’s amounts.

The cumulative federal budget deficit for the first 10 months of fiscal year 2020 reached $2.8 trillion, +$1.9 trillion more than the deficit recorded during the same period last year. Revenues were 1% lower and outlays were 51% higher through July 2020 than during the same 10-month period in fiscal year 2019.

Spending in July Rose by 68%

Total spending in July 2020 was $624 billion – $253 billion more than outlays in July 2019 – largely from legislation enacted in response to the corona virus pandemic. If not for the shift of some federal payments from August 2020 to July 2020, total spending would have been $197 billion (+53%) more than in the same month last year.

COVID 19 Spending

Major pandemic-related changes in expenses in July were as follows (the CBO amounts are adjusted to exclude the effects of the timing shifts):

Other major payments in July:

Deficit More Than Tripled in the First 10 Months

Revenue collections and outlays in fiscal year 2020 can be divided into two periods: before and after the start of the economic disruption caused by the pandemic. After Covid, from April through July, the deficit this year was an estimated $2.1 trillion, compared with $176 billion during the same period last year. If not for the shift of some payments from August into July this year, the deficit for April through July would have been $2.0 trillion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.