Click to Enlarge.

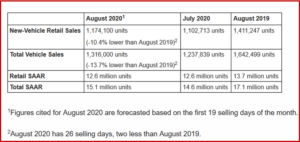

New-vehicle retail sales in August are expected to be down from a year ago, according to a forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,174,100 units, a -3.7% decrease compared with the Power pre-virus forecast, and a -10.4% decrease compared with August 2019. Transaction prices are expected to rise 7.0% to $35,420, the highest level ever for any month.

Reporting the same numbers without controlling for the number of selling days translates to a decrease of -16.8% from a year ago. While the decline vs. August 2019 is substantial and reflects the ongoing do nothing about COVID-19 attitude of the hapless Trump reign, August 2020 contains two fewer selling days than August 2019. It also has no help from promotions during the Labor Day weekend, which is after the August sales close.

Total Sales Forecast

Total sales in August are projected to reach 1,316,000 units, a -13.7% decrease from August 2019. Reporting the same numbers without controlling for the number of selling days translates to a decrease of -19.9% from August 2019. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 15.1 million units, down 2.0 million units from a year ago.

“Constraints are directly curtailing sales where vehicles are not simply available and are creating follow-on effects that are affecting overall volumes,” claims Thomas King, president of the data and analytics division at J.D. Power. “Specifically, the constraints mean that manufacturers are reducing vehicle incentives while dealerships are reducing the discounts off MSRP that they have historically needed to offer.”

While inventory levels are low, newly produced vehicles are arriving at dealerships daily and are selling quickly with lower discounts. Nearly 45% of all vehicles sold in August will spend fewer than 20 days on dealer lots, up from 35% last year. This is helping retailers to post significant growth in margins on new-vehicle sales. Total grosses per unit, inclusive of finance and insurance incomes, are on pace to reach $2,064, an increase of $759 from last year.

Incentive spending is also expected to fall to the lowest level since July 2019. Spending is on pace to reach $4,105, a decrease of $49 from last year and a decrease of $848 from the peak spending levels in April 2020.

August also represents the first time the industry will post a year-over-year incentive decline in 16 months. Spending on cars is expected to be up $22 to $3,709, with trucks and SUVs down $99 to $4,226. Reporting spending expressed as a percentage of the average vehicle MSRP is 10%, down 0.5 percentage points from last year.

For the fifth consecutive month, trucks/SUVs are on pace to account for more than three-fourths of retail sales. The continued shift towards more expensive trucks/SUVs is responsible for record transaction prices in August. Transaction prices are expected to rise 7.0% to $35,420, the highest level ever for any month.

Lower interest rates are helping to mitigate some of the increases in overall prices, as the average interest rate for loans in August is 4.5%, down 100 basis points from a year ago. Over the same time, the average monthly finance payment is up only $19 to $584, while the average finance term length is up only one month to 70 months.

Consumers are expected to spend $41.6 billion on new vehicles in August, a decline from a year ago but the highest level since December 2019. This represents a decline of $5.1 billion or -10.9%.

The September calendar may provide some additional benefit to sales for the month. The Labor Day weekend, a period with heavy sales promotion activity, occurs one week later than it typically falls in the month.

“The unusual gap between the August close and Labor Day weekend means there is the potential for higher-than-average promotional activity and, therefore, stronger sales,” King said. “Consumer demand coupled with any inventory improvement could help the industry take another step forward in the recovery.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

August Vehicle Sales to Drop as Prices Hit Record High

Click to Enlarge.

New-vehicle retail sales in August are expected to be down from a year ago, according to a forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,174,100 units, a -3.7% decrease compared with the Power pre-virus forecast, and a -10.4% decrease compared with August 2019. Transaction prices are expected to rise 7.0% to $35,420, the highest level ever for any month.

Reporting the same numbers without controlling for the number of selling days translates to a decrease of -16.8% from a year ago. While the decline vs. August 2019 is substantial and reflects the ongoing do nothing about COVID-19 attitude of the hapless Trump reign, August 2020 contains two fewer selling days than August 2019. It also has no help from promotions during the Labor Day weekend, which is after the August sales close.

Total Sales Forecast

Total sales in August are projected to reach 1,316,000 units, a -13.7% decrease from August 2019. Reporting the same numbers without controlling for the number of selling days translates to a decrease of -19.9% from August 2019. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 15.1 million units, down 2.0 million units from a year ago.

“Constraints are directly curtailing sales where vehicles are not simply available and are creating follow-on effects that are affecting overall volumes,” claims Thomas King, president of the data and analytics division at J.D. Power. “Specifically, the constraints mean that manufacturers are reducing vehicle incentives while dealerships are reducing the discounts off MSRP that they have historically needed to offer.”

While inventory levels are low, newly produced vehicles are arriving at dealerships daily and are selling quickly with lower discounts. Nearly 45% of all vehicles sold in August will spend fewer than 20 days on dealer lots, up from 35% last year. This is helping retailers to post significant growth in margins on new-vehicle sales. Total grosses per unit, inclusive of finance and insurance incomes, are on pace to reach $2,064, an increase of $759 from last year.

Incentive spending is also expected to fall to the lowest level since July 2019. Spending is on pace to reach $4,105, a decrease of $49 from last year and a decrease of $848 from the peak spending levels in April 2020.

August also represents the first time the industry will post a year-over-year incentive decline in 16 months. Spending on cars is expected to be up $22 to $3,709, with trucks and SUVs down $99 to $4,226. Reporting spending expressed as a percentage of the average vehicle MSRP is 10%, down 0.5 percentage points from last year.

For the fifth consecutive month, trucks/SUVs are on pace to account for more than three-fourths of retail sales. The continued shift towards more expensive trucks/SUVs is responsible for record transaction prices in August. Transaction prices are expected to rise 7.0% to $35,420, the highest level ever for any month.

Lower interest rates are helping to mitigate some of the increases in overall prices, as the average interest rate for loans in August is 4.5%, down 100 basis points from a year ago. Over the same time, the average monthly finance payment is up only $19 to $584, while the average finance term length is up only one month to 70 months.

Consumers are expected to spend $41.6 billion on new vehicles in August, a decline from a year ago but the highest level since December 2019. This represents a decline of $5.1 billion or -10.9%.

The September calendar may provide some additional benefit to sales for the month. The Labor Day weekend, a period with heavy sales promotion activity, occurs one week later than it typically falls in the month.

“The unusual gap between the August close and Labor Day weekend means there is the potential for higher-than-average promotional activity and, therefore, stronger sales,” King said. “Consumer demand coupled with any inventory improvement could help the industry take another step forward in the recovery.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.