Click to Enlarge.

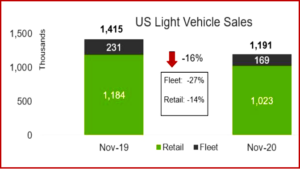

New light-vehicle sales fell to 1.19 million light vehicles in November – a likely dark foreshadowing of things to come as the Covid virus runs rampant in the US in a surge of the waning days of the Trump Administration, which ignored the crisis with the result it lost a reelection. One American is now dying every 34 seconds, unemployment is rising so much that 12 million Americans could lose their jobless benefits by year’s end, and an earlier Covid federal relief package expires at the end of December meaning extended unemployment benefits and help for small businesses will evaporate as millions will face evictions. This is not a recipe for improved consumer confidence.

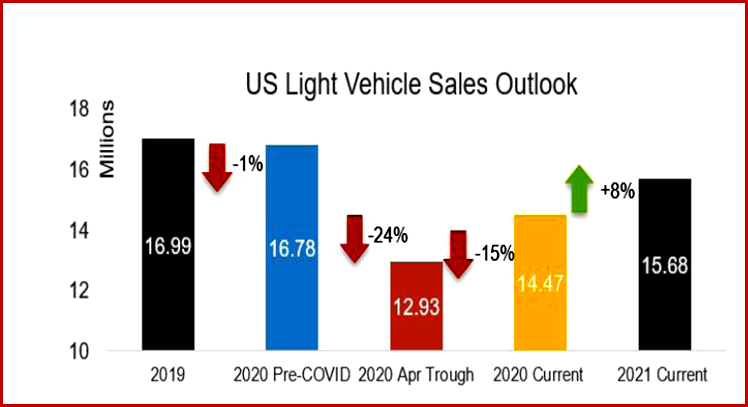

The November 2020 SAAR of 15.6 million units is a decline of -8.4% from November 2019 and -4.5% from October 2020. This was before the Thanksgiving Holiday travel rush that saw Americans ignore or defy the CDC’s recommendation to stay at home. The increasing COVID-19 infections will assuredly continue to set records for the near future.

Affordability is once again emerging as a potential negative trend in the industry.

During the first 11 months of 2020, new light-vehicle sales dropped -16.7% compared with the same period last year. November 2020 had a calendar effect that resulted in only 23 selling days and one fewer selling weekend than November 2019, which had 26 selling days.

After adjusting for selling days, retail sales are expected to fall by 1% year-over-year following two months of year-over-year gains, according to Wards Intelligence. Fleet sales were down -25% from November 2019. Pre-COVID-19 a -25% decline would be viewed negatively as a disaster, but some analysts say this is an upgrade compared with the average monthly fleet sales decline of -53% seen from March through September 2020.

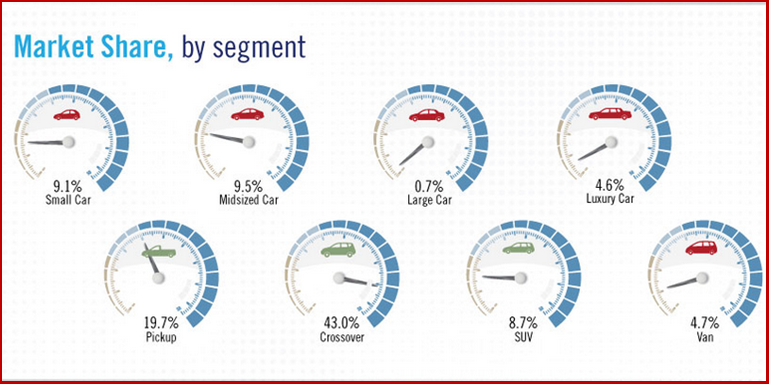

Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive said: “Midsize SUVs led the market for the second consecutive month and performed better than Compact models YoY. Midsize SUVs fell by -10.1%, but Compact SUV were down by -21.0%. The third largest segment was Large Pickups, under-performing the total industry due to the Ford F-150 changeover. Dealers are likely to receive the new model this month. Low inventory continues to hurt some Premium makes, and the segment was down by -17.1% YoY, but despite this, prices continued to rise, reaching a new record of more than $37,000. However, because of ultra-low interest rates monthly payments have remained in line with those of last year.”

This looks way too optimistic given current conditions.

NADA – a consistent cheerleader for auto dealers who love to claim things are great and now is a good time to buy a new vehicle is doing its own whistling past the graveyard performance. It said this morning, “For 2020, we expect that new light-vehicle sales will total 14.2 million units. There may be some regional ups and downs in sales as the country deals with spikes in COVID-19 cases throughout the winter months. Still, recent news suggests that widespread vaccine deployment is on the horizon in the first half of 2021. Once a majority of Americans can return to their pre-pandemic lives, we could be in for quite an economic boom, which would certainly be a positive for franchised dealers and the entire auto industry.”

LMC says “Our forecast for US auto sales in 2021 is for 15.7 million units, an increase of 8% from 2020.”

Pre-pandemic lives are a long way off in AutoInformed’s view. See Whether US Vehicle Sales in 2021? Is 14 Million a Stretch?

“Both the average new and used vehicle loan amounts saw increases in Q3 2020. The average loan amount for a new vehicle increased more than $2,000 over the previous year, reaching $34,635, while the average loan amount for a used vehicle saw a $945 increase to $21,438 over the same period. The increases in new and used loan amounts could also be attributed to consumer preference, with consumers leaning toward larger, more expensive vehicles. Small SUVs were the most purchased vehicles, making up 26.01% of loans in Q3 2020, followed by mid-sized SUVs at 24.15%,” according to Experian’s Q3 2020 State of the Automotive Finance Market.

EU

LMC says “The West European selling rate fell to 12.3 million units/year in November, with car registrations down 14.1% year-on-year, as a second wave of COVID-19 induced many national lockdowns across the region and stifled any hope of continued recovery. Consumer confidence nosedived, disrupting previous gains, as the economic reality of more restrictions sunk in. In the UK, the selling rate fell to 1.7 mn units/year – the lowest level since June.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

A Grim Covid Reaper Lurks as November US Auto Sales Drop

Click to Enlarge.

New light-vehicle sales fell to 1.19 million light vehicles in November – a likely dark foreshadowing of things to come as the Covid virus runs rampant in the US in a surge of the waning days of the Trump Administration, which ignored the crisis with the result it lost a reelection. One American is now dying every 34 seconds, unemployment is rising so much that 12 million Americans could lose their jobless benefits by year’s end, and an earlier Covid federal relief package expires at the end of December meaning extended unemployment benefits and help for small businesses will evaporate as millions will face evictions. This is not a recipe for improved consumer confidence.

The November 2020 SAAR of 15.6 million units is a decline of -8.4% from November 2019 and -4.5% from October 2020. This was before the Thanksgiving Holiday travel rush that saw Americans ignore or defy the CDC’s recommendation to stay at home. The increasing COVID-19 infections will assuredly continue to set records for the near future.

Affordability is once again emerging as a potential negative trend in the industry.

During the first 11 months of 2020, new light-vehicle sales dropped -16.7% compared with the same period last year. November 2020 had a calendar effect that resulted in only 23 selling days and one fewer selling weekend than November 2019, which had 26 selling days.

After adjusting for selling days, retail sales are expected to fall by 1% year-over-year following two months of year-over-year gains, according to Wards Intelligence. Fleet sales were down -25% from November 2019. Pre-COVID-19 a -25% decline would be viewed negatively as a disaster, but some analysts say this is an upgrade compared with the average monthly fleet sales decline of -53% seen from March through September 2020.

Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive said: “Midsize SUVs led the market for the second consecutive month and performed better than Compact models YoY. Midsize SUVs fell by -10.1%, but Compact SUV were down by -21.0%. The third largest segment was Large Pickups, under-performing the total industry due to the Ford F-150 changeover. Dealers are likely to receive the new model this month. Low inventory continues to hurt some Premium makes, and the segment was down by -17.1% YoY, but despite this, prices continued to rise, reaching a new record of more than $37,000. However, because of ultra-low interest rates monthly payments have remained in line with those of last year.”

This looks way too optimistic given current conditions.

NADA – a consistent cheerleader for auto dealers who love to claim things are great and now is a good time to buy a new vehicle is doing its own whistling past the graveyard performance. It said this morning, “For 2020, we expect that new light-vehicle sales will total 14.2 million units. There may be some regional ups and downs in sales as the country deals with spikes in COVID-19 cases throughout the winter months. Still, recent news suggests that widespread vaccine deployment is on the horizon in the first half of 2021. Once a majority of Americans can return to their pre-pandemic lives, we could be in for quite an economic boom, which would certainly be a positive for franchised dealers and the entire auto industry.”

LMC says “Our forecast for US auto sales in 2021 is for 15.7 million units, an increase of 8% from 2020.”

Pre-pandemic lives are a long way off in AutoInformed’s view. See Whether US Vehicle Sales in 2021? Is 14 Million a Stretch?

“Both the average new and used vehicle loan amounts saw increases in Q3 2020. The average loan amount for a new vehicle increased more than $2,000 over the previous year, reaching $34,635, while the average loan amount for a used vehicle saw a $945 increase to $21,438 over the same period. The increases in new and used loan amounts could also be attributed to consumer preference, with consumers leaning toward larger, more expensive vehicles. Small SUVs were the most purchased vehicles, making up 26.01% of loans in Q3 2020, followed by mid-sized SUVs at 24.15%,” according to Experian’s Q3 2020 State of the Automotive Finance Market.

EU

LMC says “The West European selling rate fell to 12.3 million units/year in November, with car registrations down 14.1% year-on-year, as a second wave of COVID-19 induced many national lockdowns across the region and stifled any hope of continued recovery. Consumer confidence nosedived, disrupting previous gains, as the economic reality of more restrictions sunk in. In the UK, the selling rate fell to 1.7 mn units/year – the lowest level since June.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.