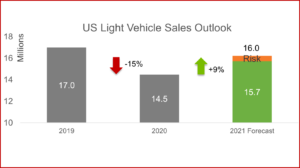

LMC’s outlook for US Light Vehicle sales in 2021 has been upgraded again, to 16.0 million units, an increase of 11% from 2020. Retail sales are projected to grow by 9% and fleet by more than 20% from 2020. Click to Enlarge.

Blame the weather since US light vehicle sales dropped to 1.18 million in February, according LMC Automotive, an automotive global forecasting consultancy. The -3% Year-over-Y decline in LMC’s view was caused by two fewer selling days this year, as well as abnormally cold weather and winter storms across many key markets. Any way you look at it, the selling-day adjusted sales volume was still down by -5.5% YoY. The annualized rate dropped to 15.7 million units, down from 16.6 mn units in January.

Compact and mid-size SUVs performed better than large pickups. They were the two most popular segments, which appears the long-term trend with mid-size SUVs gaining 0.9 percentage points of share from February 2020. Only Compact Premium SUVs grew more, up by 1.2 pp, likely from new product launches. Not surprisingly, mid-size Cars lost 2.5 pp of share from a year ago, more than any other segment. Here LMC hedges, “although consumers have been moving away from cars, lower fleet volume also hurt the segment significantly. While six segments sold more than 100,000 units last February, only four reached the threshold this year – Compact SUV, Mid-size SUV, Large Pickup and Small SUV. Combined, they accounted for 57% of total sales.”

“After two consecutive increases to the forecast since the start of 2021, the level of downside risk has dissipated and there continues to be strong upside opportunity given the outlook for GDP growth was increased to 5.9% in 2021 and the vaccination rollout remains on target. While the auto market is clearly not fully out of the woods, and additional interruptions to the recovery pace are still possible from chip and parts shortages depleting inventory, the worst does now appear to be in the rear-view mirror,” claimed Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive.

AutoInformed is more skeptical. (AutoInformed: Whither US Vehicle Sales in 2021? Is 14 Million a Stretch?)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ugh – US Light Vehicle Sales Drop during February 2021

LMC’s outlook for US Light Vehicle sales in 2021 has been upgraded again, to 16.0 million units, an increase of 11% from 2020. Retail sales are projected to grow by 9% and fleet by more than 20% from 2020. Click to Enlarge.

Blame the weather since US light vehicle sales dropped to 1.18 million in February, according LMC Automotive, an automotive global forecasting consultancy. The -3% Year-over-Y decline in LMC’s view was caused by two fewer selling days this year, as well as abnormally cold weather and winter storms across many key markets. Any way you look at it, the selling-day adjusted sales volume was still down by -5.5% YoY. The annualized rate dropped to 15.7 million units, down from 16.6 mn units in January.

Compact and mid-size SUVs performed better than large pickups. They were the two most popular segments, which appears the long-term trend with mid-size SUVs gaining 0.9 percentage points of share from February 2020. Only Compact Premium SUVs grew more, up by 1.2 pp, likely from new product launches. Not surprisingly, mid-size Cars lost 2.5 pp of share from a year ago, more than any other segment. Here LMC hedges, “although consumers have been moving away from cars, lower fleet volume also hurt the segment significantly. While six segments sold more than 100,000 units last February, only four reached the threshold this year – Compact SUV, Mid-size SUV, Large Pickup and Small SUV. Combined, they accounted for 57% of total sales.”

“After two consecutive increases to the forecast since the start of 2021, the level of downside risk has dissipated and there continues to be strong upside opportunity given the outlook for GDP growth was increased to 5.9% in 2021 and the vaccination rollout remains on target. While the auto market is clearly not fully out of the woods, and additional interruptions to the recovery pace are still possible from chip and parts shortages depleting inventory, the worst does now appear to be in the rear-view mirror,” claimed Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive.

AutoInformed is more skeptical. (AutoInformed: Whither US Vehicle Sales in 2021? Is 14 Million a Stretch?)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.