Click to Enlarge.

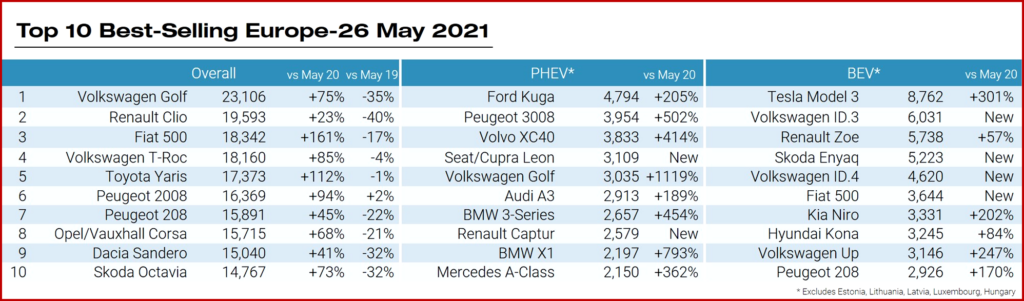

Last month, the European new car market saw a total volume increase of 73% compared with May 2020. According to data from JATO Dynamics for 26 European markets, volume totaled 1,073,987 units. Year-to-date tallies at 5,150,831 units. Notwithstanding this increase, volume was 25% lower than May 2019 as the market continued to feel the effects of the pandemic and an unconscionably bad vaccination record. EVs posted a record share of registrations in May – with 16% – while SUVs made up almost 45% of the total volume. (May US Light Vehicle Sales – Start of an Affordability Slump?, US New Vehicle Sales in May Forecast as Record Setting. Global Sales are Another Matter Entirely, EU Parliament Confirms Deal on Climate Neutrality by 2050)

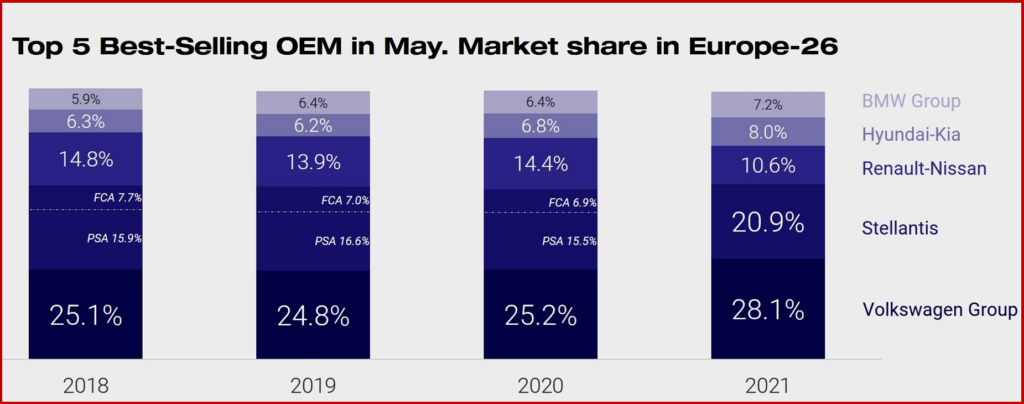

Volkswagen Group took its second highest monthly market share since 2001. The German manufacturer’s share totaled 28.14% during May, second only to April 2020 when had 29.23% as competitive sales were hit to a greater degree by the onset of the pandemic in Europe. The results in May were due to strong performance from brands such as Audi, Skoda, Seat, and Cupra, formerly known as SEAT Sport. Total sales were boosted by increasing consumer demand for EVs and SUVs – with Volkswagen Group now leading in Europe across both segments.

Click to Enlarge.

Registrations of pure electric cars and plug-in hybrids totaled 171,415 units*, up by 279% compared with May 2020. BEV volume totaled 83,700 (+261%), and PHEVs totaled 87,700 (+299%). The market share for SUVs jumped from 40.2% in May 2020 to 44.6% last month. In May 2018, SUVs accounted for 34% of the market.

Felipe Munoz, global analyst at JATO Dynamics* said: “The data is encouraging but the market is recovering slower than many had hoped. Economic uncertainty and a lack of consumer confidence are limiting growth at a time when the industry is also shifting away from traditional powertrains and adapting to strict CO2 emissions regulations.”

The Volkswagen Golf led the model ranking, while the Volkswagen T-Roc was the most registered SUV. The Tesla Model 3 topped the BEV ranking, and the Ford Kuga was the most popular PHEV during the month. Other strong performers include the Fiat 500, which came third in the general rankings, the Peugeot 2008 which saw an increase in sales of 2% compared with May 2019, and the Ford Puma which took twelfth position.

These models posted double-digit growth compared with May 2019: Hyundai Tucson, Volkswagen T-Cross, Volvo XC40, Mini Hatch, Hyundai Kona, Tesla Model 3, Kia Niro, Fiat Ducato, Renault Zoe, BMW 4-Series, Skoda Scala, BMW 2- Series, Honda Jazz, Volkswagen Arteon, Nissan Leaf, Citroen Jumper, Audi e-tron, MG ZS, Kia Sorento, Kia Proceed, Volkswagen California, Mercedes Sprinter, Hyundai Santa Fe, BMW X6, and Jeep Wrangler.

*JATO Dynamics, founded in 1984, has representation in more than 51 countries globally. It claims to provide world’s most timely, accurate and up-to-date automotive information on vehicle specifications, pricing, sales and registrations.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Botched Vaccinations Haunt EU Vehicle Sales During May

Click to Enlarge.

Last month, the European new car market saw a total volume increase of 73% compared with May 2020. According to data from JATO Dynamics for 26 European markets, volume totaled 1,073,987 units. Year-to-date tallies at 5,150,831 units. Notwithstanding this increase, volume was 25% lower than May 2019 as the market continued to feel the effects of the pandemic and an unconscionably bad vaccination record. EVs posted a record share of registrations in May – with 16% – while SUVs made up almost 45% of the total volume. (May US Light Vehicle Sales – Start of an Affordability Slump?, US New Vehicle Sales in May Forecast as Record Setting. Global Sales are Another Matter Entirely, EU Parliament Confirms Deal on Climate Neutrality by 2050)

Volkswagen Group took its second highest monthly market share since 2001. The German manufacturer’s share totaled 28.14% during May, second only to April 2020 when had 29.23% as competitive sales were hit to a greater degree by the onset of the pandemic in Europe. The results in May were due to strong performance from brands such as Audi, Skoda, Seat, and Cupra, formerly known as SEAT Sport. Total sales were boosted by increasing consumer demand for EVs and SUVs – with Volkswagen Group now leading in Europe across both segments.

Click to Enlarge.

Registrations of pure electric cars and plug-in hybrids totaled 171,415 units*, up by 279% compared with May 2020. BEV volume totaled 83,700 (+261%), and PHEVs totaled 87,700 (+299%). The market share for SUVs jumped from 40.2% in May 2020 to 44.6% last month. In May 2018, SUVs accounted for 34% of the market.

Felipe Munoz, global analyst at JATO Dynamics* said: “The data is encouraging but the market is recovering slower than many had hoped. Economic uncertainty and a lack of consumer confidence are limiting growth at a time when the industry is also shifting away from traditional powertrains and adapting to strict CO2 emissions regulations.”

The Volkswagen Golf led the model ranking, while the Volkswagen T-Roc was the most registered SUV. The Tesla Model 3 topped the BEV ranking, and the Ford Kuga was the most popular PHEV during the month. Other strong performers include the Fiat 500, which came third in the general rankings, the Peugeot 2008 which saw an increase in sales of 2% compared with May 2019, and the Ford Puma which took twelfth position.

These models posted double-digit growth compared with May 2019: Hyundai Tucson, Volkswagen T-Cross, Volvo XC40, Mini Hatch, Hyundai Kona, Tesla Model 3, Kia Niro, Fiat Ducato, Renault Zoe, BMW 4-Series, Skoda Scala, BMW 2- Series, Honda Jazz, Volkswagen Arteon, Nissan Leaf, Citroen Jumper, Audi e-tron, MG ZS, Kia Sorento, Kia Proceed, Volkswagen California, Mercedes Sprinter, Hyundai Santa Fe, BMW X6, and Jeep Wrangler.

*JATO Dynamics, founded in 1984, has representation in more than 51 countries globally. It claims to provide world’s most timely, accurate and up-to-date automotive information on vehicle specifications, pricing, sales and registrations.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.