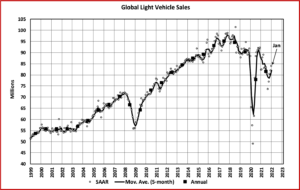

Click to Enlarge.

The Global Light Vehicle selling rate improved to 84 mn units/year in January of 2022, up 3% year-over-year, according to consultancy LMC Automotive. Nonetheless, LMC noted that supply chain issues remain the “key headwind for demand, though last month also saw the rapid spread of Omicron deal a blow to some potential market activity.

“Reports of an improving supply environment in some markets, including China, means the worst of the crisis is likely over, it remains the key headwind to sales during 2022, overshadowing concerns over inflation and a more subdued economic outlook.”

North America

US Light Vehicle sales fell by 10.1% YoY in January, to just under 1 mn units. The selling rate jumped to 15.1 mn units/year, from 12.4 mn units/year in December, but these rates should be treated with caution as a true indicator of demand, since supply is such a limiting factor at the current time. Seasonality brought January transaction prices down MoM, but at US$44,600, they were the second highest on record, just behind December’s. Incentives continued to trend down, to just US$1,319 in January. As fleet sales remain depressed, retail was once again the main driving force in the market.

In Canada, LV sales decreased by 0.6% YoY in January, to just under 94k units. This was the smallest YoY decline since the comparison turned negative in July 2021. The selling rate increased to 1.76 mn units/year in January, from 1.43 mn units/year in December. Constrained inventory continued to hold back sales. The Mexican LV market contracted by 3.2% YoY, to 78k units, while the selling rate picked up to 1.01 mn units/year, from 860k units/year in December, the strongest rate since June 2021.

Europe

The West European selling rate slipped to 11.5 mn units/year in January, from 13.0 mn units/year in December. While the completion of some parts-lacking vehicles may have been part of the reason for improvement in the final month of last year, the result at the beginning of 2022 shows once again the enduring supply-side issues.

The East European selling rate was 4.4 mn units/year last month, outperforming the region’s final 2021 result of 4 mn units, which itself was 4% up on 2020’s last month. For the region’s largest market, Russia, sales appeared to be resilient in January despite news of continued production stoppages.

China

Advance data indicates that the Chinese market started the New Year on a positive note. The January selling rate was 27.9 mn units/year, up 1.2% from December. The selling rate increased MoM for the fourth consecutive month in January after slowing sharply in September 2021 due to the chip shortage. In YoY terms, growth finally turned positive, with sales (i.e. wholesales) expanding by 4.4% in January after eight consecutive months of contraction.

The continued improvement in the chip supply was the main factor behind January’s good performance. OEMs ramped up production and deliveries to dealerships during the strong sales season ahead of the Chinese New Year. Sales of New Electric Vehicles expanded by 139% YoY in January, despite the 30% cut in government subsidies for 2022. NEVs are expected to continue to lead the market this year.

Elsewhere in Asia

The Japanese market is off to a solid start in the New Year. The January selling rate was 4.7 mn units/year, up 5% from December, continuing to improve from the recent trough of 3.2 mn units/year in September 2021. In YoY terms, however, sales fell by nearly 15% in January, the seventh consecutive month of decline. While the supply of semiconductors continued to improve, the soaring cases of the Omicron variant disrupted production and sales.

The Korean market started the New Year weakly with a January selling rate at 1.5 mn units/year, impacted largely by Hyundai’s temporary shutdown of its Asan plant (to upgrade for BEV production). In YoY terms, sales declined by nearly 20% in January, the 11th consecutive month of decline, against exceptionally high year-ago levels. Sales of Hyundai fell by 22% YoY, while all other OEMs also registered declines, due to the global supply bottlenecks and/or their own financial problems.

South America

Brazilian LV sales fell by 28.2% YoY in January, to 117k units. The result brought an abrupt end to a three- month run of improving selling rates, which dropped to 1.63 mn units/year in January, from 2.17 mn units/year in December, and was the worst rate since June 2020. Inventories remain tight, and the country was also experiencing a surge in COVID-19 cases during the month, due to the Omicron variant. In addition, more expensive vehicles, rising interest rates and inflation are pushing price-sensitive consumers out of the new vehicle market.

In Argentina, LV sales declined by 11.1% YoY in January, to 41k units. The selling rate inched up to 335k units/year, from 328k units/year in December. On top of the inventory shortages experienced globally, the Argentinian government’s import restrictions have made supply even tighter, heavily favoring locally built models.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales Improved in January 2022

Click to Enlarge.

The Global Light Vehicle selling rate improved to 84 mn units/year in January of 2022, up 3% year-over-year, according to consultancy LMC Automotive. Nonetheless, LMC noted that supply chain issues remain the “key headwind for demand, though last month also saw the rapid spread of Omicron deal a blow to some potential market activity.

“Reports of an improving supply environment in some markets, including China, means the worst of the crisis is likely over, it remains the key headwind to sales during 2022, overshadowing concerns over inflation and a more subdued economic outlook.”

North America

US Light Vehicle sales fell by 10.1% YoY in January, to just under 1 mn units. The selling rate jumped to 15.1 mn units/year, from 12.4 mn units/year in December, but these rates should be treated with caution as a true indicator of demand, since supply is such a limiting factor at the current time. Seasonality brought January transaction prices down MoM, but at US$44,600, they were the second highest on record, just behind December’s. Incentives continued to trend down, to just US$1,319 in January. As fleet sales remain depressed, retail was once again the main driving force in the market.

In Canada, LV sales decreased by 0.6% YoY in January, to just under 94k units. This was the smallest YoY decline since the comparison turned negative in July 2021. The selling rate increased to 1.76 mn units/year in January, from 1.43 mn units/year in December. Constrained inventory continued to hold back sales. The Mexican LV market contracted by 3.2% YoY, to 78k units, while the selling rate picked up to 1.01 mn units/year, from 860k units/year in December, the strongest rate since June 2021.

Europe

The West European selling rate slipped to 11.5 mn units/year in January, from 13.0 mn units/year in December. While the completion of some parts-lacking vehicles may have been part of the reason for improvement in the final month of last year, the result at the beginning of 2022 shows once again the enduring supply-side issues.

The East European selling rate was 4.4 mn units/year last month, outperforming the region’s final 2021 result of 4 mn units, which itself was 4% up on 2020’s last month. For the region’s largest market, Russia, sales appeared to be resilient in January despite news of continued production stoppages.

China

Advance data indicates that the Chinese market started the New Year on a positive note. The January selling rate was 27.9 mn units/year, up 1.2% from December. The selling rate increased MoM for the fourth consecutive month in January after slowing sharply in September 2021 due to the chip shortage. In YoY terms, growth finally turned positive, with sales (i.e. wholesales) expanding by 4.4% in January after eight consecutive months of contraction.

The continued improvement in the chip supply was the main factor behind January’s good performance. OEMs ramped up production and deliveries to dealerships during the strong sales season ahead of the Chinese New Year. Sales of New Electric Vehicles expanded by 139% YoY in January, despite the 30% cut in government subsidies for 2022. NEVs are expected to continue to lead the market this year.

Elsewhere in Asia

The Japanese market is off to a solid start in the New Year. The January selling rate was 4.7 mn units/year, up 5% from December, continuing to improve from the recent trough of 3.2 mn units/year in September 2021. In YoY terms, however, sales fell by nearly 15% in January, the seventh consecutive month of decline. While the supply of semiconductors continued to improve, the soaring cases of the Omicron variant disrupted production and sales.

The Korean market started the New Year weakly with a January selling rate at 1.5 mn units/year, impacted largely by Hyundai’s temporary shutdown of its Asan plant (to upgrade for BEV production). In YoY terms, sales declined by nearly 20% in January, the 11th consecutive month of decline, against exceptionally high year-ago levels. Sales of Hyundai fell by 22% YoY, while all other OEMs also registered declines, due to the global supply bottlenecks and/or their own financial problems.

South America

Brazilian LV sales fell by 28.2% YoY in January, to 117k units. The result brought an abrupt end to a three- month run of improving selling rates, which dropped to 1.63 mn units/year in January, from 2.17 mn units/year in December, and was the worst rate since June 2020. Inventories remain tight, and the country was also experiencing a surge in COVID-19 cases during the month, due to the Omicron variant. In addition, more expensive vehicles, rising interest rates and inflation are pushing price-sensitive consumers out of the new vehicle market.

In Argentina, LV sales declined by 11.1% YoY in January, to 41k units. The selling rate inched up to 335k units/year, from 328k units/year in December. On top of the inventory shortages experienced globally, the Argentinian government’s import restrictions have made supply even tighter, heavily favoring locally built models.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.