Click to Enlarge.

US Light Vehicle sales in April reached their highest level so far this year, according to LMC Automotive, a leading automotive forecasting and market intelligence company.

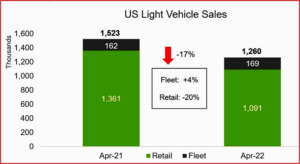

The 1.26 million units sold represent a -17% YoY decline, but volumes were up by about 5,000 units from March. The annualized rate grew to 14.7 million units, about 1.3 million units more than in March.

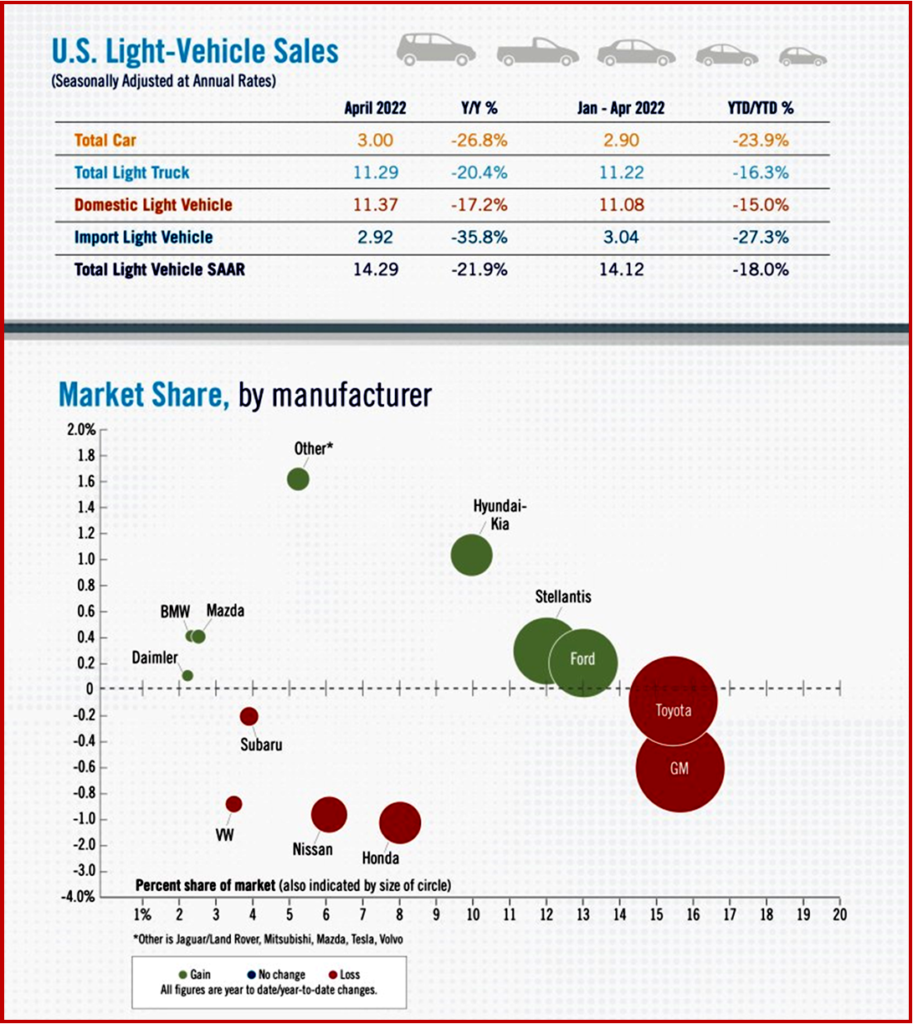

“However, April 2022’s SAAR was down by 21.9% compared to the stellar sales pace seen in April of 2021 which was driven by strong consumer demand and enough inventory available to meet that demand. April 2021 was one of the last sales months before inventory began to decline significantly and limit the sales pace. We don’t expect that April’s month-end inventory level will change much from March’s level of 1.23 million units as the industry is still unable to produce enough vehicles to meet current demand, let alone restock dealer lots,” said Patrick Manzi, NADA’s Chief Economist. Indeed, Ford truck sales dropped~18%.

Click to Enlarge.

“For the rest of the year vehicle availability will continue to be the principal limiting factor for new light-vehicle sales. Our forecast for sales in all of 2022 remains unchanged at 15.4 million units,” said Manzi.

According to J.D. Power the industry average transaction price in April 2022 is expected to be an April record of $45,232, up 18.7% year-over-year and just slightly behind the all-time record observed in December 2021.

In addition to the production mix, fewer OEM incentives have pushed transaction prices higher. J.D. Power expects average incentive spending per unit to fall to an all-time low of $1,034 in April. While average transaction prices have risen steadily, average monthly payments have not increased as rapidly due to higher trade-in equity.

Average monthly payments, expected to hit an April high of $685, have increased by 15.6% year-over-year while transaction prices are up 18.7% over the same period, J.D. Power says.

The Federal Reserve is expected this week to increase interest rates for the second time this year and is expected to significantly increase interest rates throughout the rest of the year. As a result, vehicle finance rates, which have been a tailwind for vehicle sales over the past few years, will likely shift to a headwind for vehicle sales and vehicle affordability, said Power.

“While most measurements would indicate a positive April, the industry is still being impacted by the parts shortage that has plagued sales for almost a year now. General Motors, Toyota and Stellantis sold fewer vehicles in April than in March, and Honda sales fell more than those of any other OEM. Yet, for GM, the worst seems to be behind them. They led April sales, being the only OEM to sell more than 200,000 units, and the Chevrolet Silverado was the bestselling vehicle in the country.

“The Ford F-150, which traditionally holds the bestseller title, was outsold not only by the Silverado, but also by the Toyota RAV4. In the Premium market, Tesla continues to grow its leadership, especially now that it is resuming sales of the Model X. Its more than 44k units sold helped the Premium segment to reach a 17% market share, a record for any given month,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

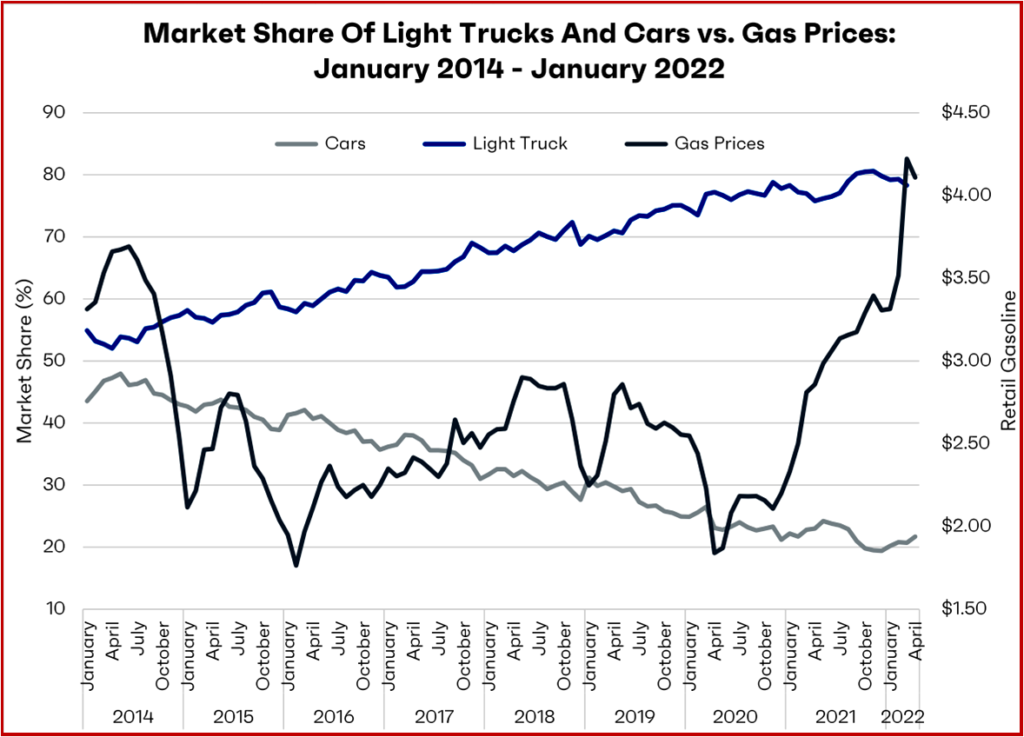

Thus far trucks still dominate.

SUVs accounted for ~55% of total sales, with Compact and Midsize Non-Premium models virtually tied for the market leadership. Compact models had a 17.7% share, just 0.2 ppts more than mid-size counterparts. Large Pickups ran a distant third place, accounting for 13.6% of sales. The Tesla Model Y spurred Compact Premium SUVs to a gain 1.2 ppts of share, more than any other segment. The best-ever month for the Ford Maverick made Compact Pickup represent 1% of sales – the segment did not exist in April 2021, of course.

LMC notes that April had the same 27 selling days as March, but it is traditionally a weaker month. Yet, slightly better inventory levels and some recovery in fleet sales helped OEMs to sell 300 units more by selling day. Initial estimates for fleet sales indicate that they accounted for about 13% of total sales, down from 15% in March but in line with the level registered in February. This would be equivalent to a 4% YoY increase, while retail deliveries likely plunged by 20% from a very strong April in 2021. The highest annualized rate in 2021 was in April, at 18.3 million units.

During the first four months of 2022, Light Vehicle sales totaled 4.55 million units, down by 16% from a year ago. This volume is also down by 14% from 2019, but up by 8% from 2020, when the pandemic was already impacting sales negatively, observed LMC.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US April Sales Up 6.5%. SAAR Down -21.9% YoY

Click to Enlarge.

US Light Vehicle sales in April reached their highest level so far this year, according to LMC Automotive, a leading automotive forecasting and market intelligence company.

The 1.26 million units sold represent a -17% YoY decline, but volumes were up by about 5,000 units from March. The annualized rate grew to 14.7 million units, about 1.3 million units more than in March.

“However, April 2022’s SAAR was down by 21.9% compared to the stellar sales pace seen in April of 2021 which was driven by strong consumer demand and enough inventory available to meet that demand. April 2021 was one of the last sales months before inventory began to decline significantly and limit the sales pace. We don’t expect that April’s month-end inventory level will change much from March’s level of 1.23 million units as the industry is still unable to produce enough vehicles to meet current demand, let alone restock dealer lots,” said Patrick Manzi, NADA’s Chief Economist. Indeed, Ford truck sales dropped~18%.

Click to Enlarge.

“For the rest of the year vehicle availability will continue to be the principal limiting factor for new light-vehicle sales. Our forecast for sales in all of 2022 remains unchanged at 15.4 million units,” said Manzi.

According to J.D. Power the industry average transaction price in April 2022 is expected to be an April record of $45,232, up 18.7% year-over-year and just slightly behind the all-time record observed in December 2021.

In addition to the production mix, fewer OEM incentives have pushed transaction prices higher. J.D. Power expects average incentive spending per unit to fall to an all-time low of $1,034 in April. While average transaction prices have risen steadily, average monthly payments have not increased as rapidly due to higher trade-in equity.

Average monthly payments, expected to hit an April high of $685, have increased by 15.6% year-over-year while transaction prices are up 18.7% over the same period, J.D. Power says.

The Federal Reserve is expected this week to increase interest rates for the second time this year and is expected to significantly increase interest rates throughout the rest of the year. As a result, vehicle finance rates, which have been a tailwind for vehicle sales over the past few years, will likely shift to a headwind for vehicle sales and vehicle affordability, said Power.

“While most measurements would indicate a positive April, the industry is still being impacted by the parts shortage that has plagued sales for almost a year now. General Motors, Toyota and Stellantis sold fewer vehicles in April than in March, and Honda sales fell more than those of any other OEM. Yet, for GM, the worst seems to be behind them. They led April sales, being the only OEM to sell more than 200,000 units, and the Chevrolet Silverado was the bestselling vehicle in the country.

“The Ford F-150, which traditionally holds the bestseller title, was outsold not only by the Silverado, but also by the Toyota RAV4. In the Premium market, Tesla continues to grow its leadership, especially now that it is resuming sales of the Model X. Its more than 44k units sold helped the Premium segment to reach a 17% market share, a record for any given month,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

Thus far trucks still dominate.

SUVs accounted for ~55% of total sales, with Compact and Midsize Non-Premium models virtually tied for the market leadership. Compact models had a 17.7% share, just 0.2 ppts more than mid-size counterparts. Large Pickups ran a distant third place, accounting for 13.6% of sales. The Tesla Model Y spurred Compact Premium SUVs to a gain 1.2 ppts of share, more than any other segment. The best-ever month for the Ford Maverick made Compact Pickup represent 1% of sales – the segment did not exist in April 2021, of course.

LMC notes that April had the same 27 selling days as March, but it is traditionally a weaker month. Yet, slightly better inventory levels and some recovery in fleet sales helped OEMs to sell 300 units more by selling day. Initial estimates for fleet sales indicate that they accounted for about 13% of total sales, down from 15% in March but in line with the level registered in February. This would be equivalent to a 4% YoY increase, while retail deliveries likely plunged by 20% from a very strong April in 2021. The highest annualized rate in 2021 was in April, at 18.3 million units.

During the first four months of 2022, Light Vehicle sales totaled 4.55 million units, down by 16% from a year ago. This volume is also down by 14% from 2019, but up by 8% from 2020, when the pandemic was already impacting sales negatively, observed LMC.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.