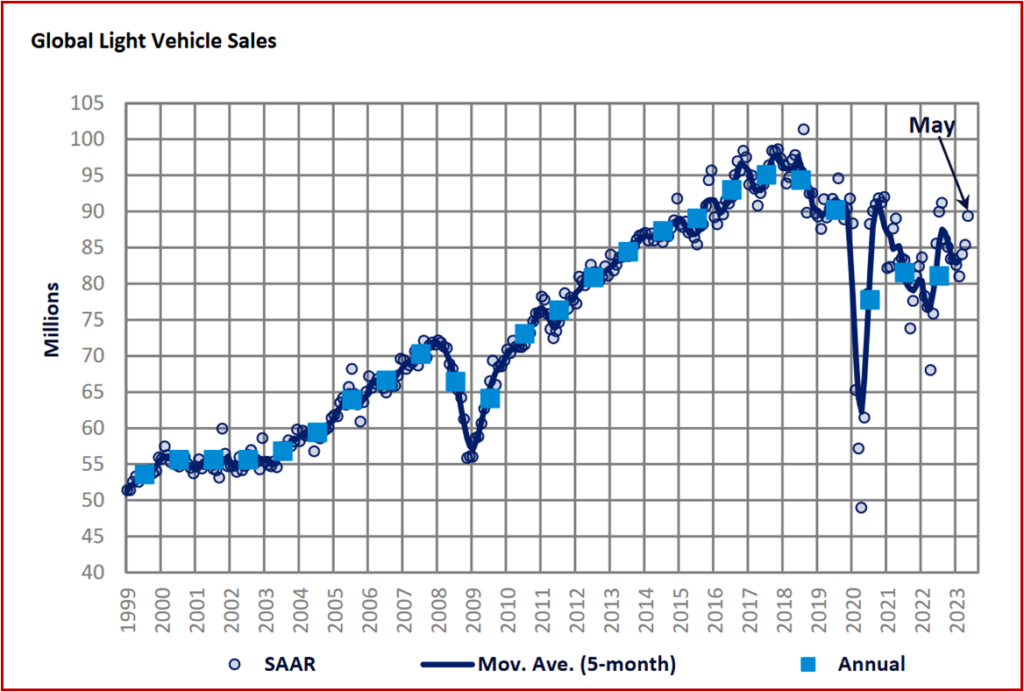

The Global Light Vehicle (LV) selling rate rose to 89 million units/year in May (aka SAAR), from 85 million units/year in April according to data just released by the respected LMC Automotive* consultancy. (AutoInformed:Global Light Vehicle Sales Soar in April 2023; May US Light Vehicles Sales Forecast Up 20%)

“US LV sales grew 23.5% YoY to 1.4 million units as OEMs raised vehicle production on the back of fewer supply issues. China performed stronger than the first four months of the year with a selling rate of 29.6 million units/year. All major West European countries reported positive YoY growth as their markets continue to recover with the easing of supply issues,” LMC said in copyrighted report for clients.

There’s still a ways to go for a full recovery.

Global Light Vehicle Sales Forecasting Team Notes

The US light vehicle market continued its strong run of growth in May, as sales were up by 23.5% Year over Year (YoY), reaching 1.4 million units. The selling rate decreased from 16.2 million units/year in April to 15.1 million units/year in May, possibly due to relatively fewer sales events for Memorial Day. The average transaction price slightly decreased in May to US $46,079, likely caused by the OEMs increasing production of lower-profit vehicles as the supply crisis has eased. Incentives increased by US $102 to US $1781 in May, the highest monthly incentive spend so far in 2023.

Canadian LV sales increased by 10.1% YoY to 154.5k units, increasing volumes by 13,000 units month-on-month. The selling rate increased in May, to 1.5 million units/year, from 1.4 million units/year in April. LV sales in Mexico grew by 17.3% YoY in May, reaching 106.3k units. While the country saw strong growth in May, the selling rate declined to 1.3 million units/year, a reduction of 64k units/year compared to April.

Europe

The West European selling rate in May was 13 million units/year, up from 12.2 million units/year in April. Vehicle registrations stood at 1.13 million units with a 17.2% YoY growth. Supply constraints continued to ease allowing OEMs to fulfill their backlogged orders and increase their delivery rates. Aside from Spain, the top five West European markets recognized double-digit YoY growth in their LV registration figures for May.

The East European selling rate grew 3.7 million units/year in May from 3.6 million units/year in April. LV sales were at 320k units which is almost 45% higher than May 2022, however, continue to lag pre-pandemic 2019 levels. Year-to-date the region recorded 1.4 million units, up 16.4% from this time last year. Russia LV sales drove this growth with 62,000 units sold with a YoY growth of almost 129%.

China

According to preliminary May data, the Chinese market surprised on the upside after posting disappointing results in the first four months of this year. The May selling rate was 29.6 million units/year, up 14% from a lackluster April, and the highest rate since September 2022. In YoY terms, sales (wholesales) increased by almost 26% in May against lockdown-caused weak sales a year ago, and 10.5% YTD. NEVs (New Electric Vehicles) remained the key driver of the market, with sales of BEVs and PHEVs increasing by 50% and 94% YoY, respectively, in May.

“As the price war appears to be peaking out, consumers, who were taking a wait-and-see approach, started to go ahead with their purchases. Special sales campaigns during the week-long national holiday helped support sales, too. Yet, the post-pandemic recovery in the market has been sluggish. The YTD selling rate averaged 25.3 million units/year, which is lower than last year’s total LV sales of 26.7 million units. It is reported that the central government instructed local governments and financial institutions to introduce measures to boost vehicle sales and automotive financing.”

Elsewhere in Asia

The Japanese market remained robust in May, as improved supply of semiconductors continued to help boost production. “The removal of pandemic-related restrictions, the return of foreign tourists, and strong wage growth have lifted consumer confidence, too. The May selling rate reached 4.8 million units/year. In YoY terms, sales increased by 25.4% in May (the fifth consecutive month of double-digit growth) and 18% YTD against a low year-ago base. Yet, OEMs are still struggling to meet many backlogged orders. ”

The Korean market maintained solid sales in May, with the selling rate reaching 1.8 million units/year. Sales of locally assembled vehicles increased by 9% YoY, with all OEMs (except Renault Korea) posting positive YoY growth. In contrast, sales of imported vehicles declined by almost 15% YoY in May, as the popular German brands continued to experience supply shortages. “Of note, Tesla’s sales plunged by 77% YoY in May, facing increasing competition from Korean BEVs, which are benefiting from the greater government BEV subsidies.”

South America

Brazilian LV sales are estimated to have decreased by 5.3% YoY in May, as 166.4k units were sold. However, the selling rate slightly increased by 4.2k units/year to 1.97 million units/year in May, from 1.96 million units/year in April. Inventory levels increased greatly in May, to 251.7k units, rising dramatically compared to the 206.1k units in April. Also following the increase in inventory, the days’ supply increased strongly, to 43 days in May, compared to 35 in April.

In Argentina, LV sales are estimated to have increased in May to 37.2k units, up by 13.6% YoY. Also following this increase, the selling rate slightly increased to 425.2k units/year in May, up from 421.6k units/year in April. “This is the third consecutive month in which the selling rate has exceeded the 400k units/year mark, as the market appears to remain resilient against economic headwinds.”

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. “We are a gold standard information provider to the world’s largest industries, and continuously collect, update, and enrich 50+ terabytes of unique data to create comprehensive, authoritative, and granular industry intelligence.

“We leverage the collective expertise of over 2,000 in-house industry analysts, researchers, consultants, and business journalists, as well as thousands of external thought-leaders, to create timely, differentiated and actionable insight.

“We help you work smarter and faster by giving you access to powerful analytics and customizable workflow tools tailored to your role, alongside direct access to our expert community of research analysts.

One Platform

“We have a single taxonomy across all of our data assets and integrate our capabilities into a single platform – giving you easy access to a complete, dynamic, and comparable view of the world’s largest industries. Contact Us For any questions or further inquiries please contact us at: customersuccess.automotive@globaldata.com.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales at ~89 Million Rose Again in May

The Global Light Vehicle (LV) selling rate rose to 89 million units/year in May (aka SAAR), from 85 million units/year in April according to data just released by the respected LMC Automotive* consultancy. (AutoInformed:Global Light Vehicle Sales Soar in April 2023; May US Light Vehicles Sales Forecast Up 20%)

“US LV sales grew 23.5% YoY to 1.4 million units as OEMs raised vehicle production on the back of fewer supply issues. China performed stronger than the first four months of the year with a selling rate of 29.6 million units/year. All major West European countries reported positive YoY growth as their markets continue to recover with the easing of supply issues,” LMC said in copyrighted report for clients.

There’s still a ways to go for a full recovery.

Global Light Vehicle Sales Forecasting Team Notes

The US light vehicle market continued its strong run of growth in May, as sales were up by 23.5% Year over Year (YoY), reaching 1.4 million units. The selling rate decreased from 16.2 million units/year in April to 15.1 million units/year in May, possibly due to relatively fewer sales events for Memorial Day. The average transaction price slightly decreased in May to US $46,079, likely caused by the OEMs increasing production of lower-profit vehicles as the supply crisis has eased. Incentives increased by US $102 to US $1781 in May, the highest monthly incentive spend so far in 2023.

Canadian LV sales increased by 10.1% YoY to 154.5k units, increasing volumes by 13,000 units month-on-month. The selling rate increased in May, to 1.5 million units/year, from 1.4 million units/year in April. LV sales in Mexico grew by 17.3% YoY in May, reaching 106.3k units. While the country saw strong growth in May, the selling rate declined to 1.3 million units/year, a reduction of 64k units/year compared to April.

Europe

The West European selling rate in May was 13 million units/year, up from 12.2 million units/year in April. Vehicle registrations stood at 1.13 million units with a 17.2% YoY growth. Supply constraints continued to ease allowing OEMs to fulfill their backlogged orders and increase their delivery rates. Aside from Spain, the top five West European markets recognized double-digit YoY growth in their LV registration figures for May.

The East European selling rate grew 3.7 million units/year in May from 3.6 million units/year in April. LV sales were at 320k units which is almost 45% higher than May 2022, however, continue to lag pre-pandemic 2019 levels. Year-to-date the region recorded 1.4 million units, up 16.4% from this time last year. Russia LV sales drove this growth with 62,000 units sold with a YoY growth of almost 129%.

China

According to preliminary May data, the Chinese market surprised on the upside after posting disappointing results in the first four months of this year. The May selling rate was 29.6 million units/year, up 14% from a lackluster April, and the highest rate since September 2022. In YoY terms, sales (wholesales) increased by almost 26% in May against lockdown-caused weak sales a year ago, and 10.5% YTD. NEVs (New Electric Vehicles) remained the key driver of the market, with sales of BEVs and PHEVs increasing by 50% and 94% YoY, respectively, in May.

“As the price war appears to be peaking out, consumers, who were taking a wait-and-see approach, started to go ahead with their purchases. Special sales campaigns during the week-long national holiday helped support sales, too. Yet, the post-pandemic recovery in the market has been sluggish. The YTD selling rate averaged 25.3 million units/year, which is lower than last year’s total LV sales of 26.7 million units. It is reported that the central government instructed local governments and financial institutions to introduce measures to boost vehicle sales and automotive financing.”

Elsewhere in Asia

The Japanese market remained robust in May, as improved supply of semiconductors continued to help boost production. “The removal of pandemic-related restrictions, the return of foreign tourists, and strong wage growth have lifted consumer confidence, too. The May selling rate reached 4.8 million units/year. In YoY terms, sales increased by 25.4% in May (the fifth consecutive month of double-digit growth) and 18% YTD against a low year-ago base. Yet, OEMs are still struggling to meet many backlogged orders. ”

The Korean market maintained solid sales in May, with the selling rate reaching 1.8 million units/year. Sales of locally assembled vehicles increased by 9% YoY, with all OEMs (except Renault Korea) posting positive YoY growth. In contrast, sales of imported vehicles declined by almost 15% YoY in May, as the popular German brands continued to experience supply shortages. “Of note, Tesla’s sales plunged by 77% YoY in May, facing increasing competition from Korean BEVs, which are benefiting from the greater government BEV subsidies.”

South America

Brazilian LV sales are estimated to have decreased by 5.3% YoY in May, as 166.4k units were sold. However, the selling rate slightly increased by 4.2k units/year to 1.97 million units/year in May, from 1.96 million units/year in April. Inventory levels increased greatly in May, to 251.7k units, rising dramatically compared to the 206.1k units in April. Also following the increase in inventory, the days’ supply increased strongly, to 43 days in May, compared to 35 in April.

In Argentina, LV sales are estimated to have increased in May to 37.2k units, up by 13.6% YoY. Also following this increase, the selling rate slightly increased to 425.2k units/year in May, up from 421.6k units/year in April. “This is the third consecutive month in which the selling rate has exceeded the 400k units/year mark, as the market appears to remain resilient against economic headwinds.”

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. “We are a gold standard information provider to the world’s largest industries, and continuously collect, update, and enrich 50+ terabytes of unique data to create comprehensive, authoritative, and granular industry intelligence.

“We leverage the collective expertise of over 2,000 in-house industry analysts, researchers, consultants, and business journalists, as well as thousands of external thought-leaders, to create timely, differentiated and actionable insight.

“We help you work smarter and faster by giving you access to powerful analytics and customizable workflow tools tailored to your role, alongside direct access to our expert community of research analysts.

One Platform

“We have a single taxonomy across all of our data assets and integrate our capabilities into a single platform – giving you easy access to a complete, dynamic, and comparable view of the world’s largest industries. Contact Us For any questions or further inquiries please contact us at: customersuccess.automotive@globaldata.com.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.