Seem right?

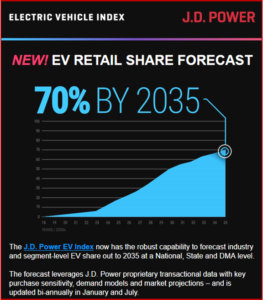

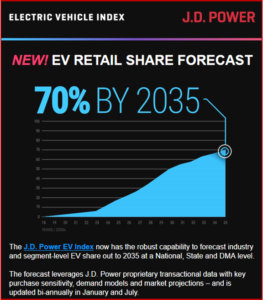

The J.D. Power EV Index now has the capability to forecast industry and segment-level Electric Vehicle share out to 2035 at a National, State and DMA level. (AutoInformed: Current Flows – J.D. Power Now Tracking EV Parity)

The forecast uses J.D. Power proprietary transactional data with key purchase sensitivity, demand models and market projections – and is updated bi-annually in January and July. In its latest update released today Power forecast US EV Retail Share at 70% by 3035!

Time will tell… However, AutoInformed notes this:

“Of consumers who bought a car in the past three years, only 53%s ay they were very satisfied with the experience. Top pain points included price transparency, vehicle availability, and process complexity. In addition, as supply chains catch up in the wake of the COVID-19 pandemic, lack of availability for test drives and long delivery wait times are high on consumers’ minds,” according to a McKinsey Mobility Consumer Pulse Survey.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

According to the McKinsey Mobility Consumer Pulse Survey, the proportion of consumers considering battery-electric vehicles (BEVs) rose by five percentage points to 20% between December 2021 and December 2022, while the proportion considering a plug-in hybrid (PHEV) rose by four percentage points to 22%. The survey also shows a four- percentage point point drop in EV skepticism by consumers, from 23% of consumers who categorically do not want to switch to EVs, to 19%.

These insights were developed by the McKinsey Center for Future Mobility (MCFM). Since 2011, the MCFM has collaborated with stakeholders across the mobility ecosystem by providing independent and integrated evidence about possible future-mobility scenarios. With our unique, bottom-up modeling approach, our insights enable an end-to-end analytics journey through the future of mobility – from consumer needs to modal mix across urban/rural areas, sales, value pools, and life cycle sustainability. Find out more about the McKinsey Center for Future Mobility on McKinsey.com