Click to enlarge.

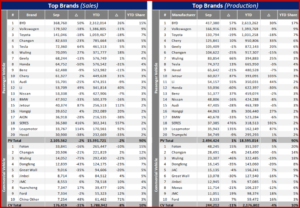

During September 2024, China’s Light Vehicle (LV) market was stable compared to the previous month, with sales and production volumes exhibiting divergent trends. Domestic LV sales, excluding exports, reached 2.3 million units, marking a year-on-year (YoY) decrease of 5.4% but a significant month-on-month (MoM) increase of 17.2%, according to data and analysis released today by the respected GlobalData consultancy.* With the ongoing China trade wars, it’s possible that more than half of passenger vehicles were subsidized. Moreover, auto exports are increasing their importance and significance for the Chinese auto industry. Thus the trade wars will continue. The Chinese government has told giant EV makers BYD, SAIC and Geely to halt investment plans in Europe. This will likely play out globally in other trade blocs and countries.

“The substantial YoY and MoM differences may be attributed to the high sales base in the previous year and the gradual impact of the old-for-new subsidy policy. Breaking down the figures by model type, Passenger Vehicle (PV) sales totaled 2.1 million units, with a 2.4% YoY decline but a substantial MoM increase of 18.0%. In contrast, Light Commercial Vehicles (LCVs) also showed a downward trend, which was much more obvious than PV.

“Although LCV sales increased by 8.4% in September compared with August, they fell sharply, by 31.1%, compared with the same period last year. In the first nine months of 2024, cumulative LV sales reached 17.2 mn units, a YoY decrease of 2.7%. Among that number, cumulative PV sales were 15.4 mn units, a YoY decrease of 2.0%. LCV’s cumulative sales were 1.8 mn units, a YoY decrease of 8.4%,” the GlobalData Asia-Pacific Light Vehicle Sales Forecasting Team said.

GlobalData Commentary, Observations

- Passenger Vehicle (PV) sales totaled 2.1 million units, with a 2.4% YoY decline but a substantial MoM increase of 18.0%. In contrast, Light Commercial Vehicles (LCVs) also showed a downward trend, which was much more obvious than PV.

- Although LCV sales increased by 8.4% in September compared with August, they fell sharply, by 31.1%, compared with the same period last year.

- In the first nine months of 2024, cumulative LV sales reached 17.2 million, a YoY decrease of 2.7%. Among that number, cumulative PV sales were 15.4 mn units, a YoY decrease of 2.0%. LCV’s cumulative sales were1.8 million, a YoY decrease of 8.4%.

- Despite the ongoing scrapping subsidy program and significant price reductions, the Chinese market slowed for the second consecutive month. The September selling rate was 25.6 million units per year, an almost 4% decrease from August. The YTD selling rate averaged 24.4 million units per year, compared to last year’s total LV sales of 25.2 million units. In YoY terms, sales fell by 6% in September and 2.8% YTD. New energy vehicles (NEVs), predominantly Chinese brands, continued to grow, accounting for 55% of PV sales in September, while sales of internal combustion engine (ICE) vehicles continued to decline sharply.

- Although the September data fell short of expectations, the third-quarter average selling rate of 26.5 million units per year showed improvement over the second quarter’s 25.4 million per year and the first quarter’s 21.3 million per year.

- Based on the quarterly average, the PV selling rate accelerated in Q3, offsetting the significant slowdown in the LCV sector. It is also important to note that the YoY declines from June to September were influenced by the exceptionally strong sales levels of the previous year. We anticipate that YoY growth will turn positive in the fourth quarter, driven by a lower base and the temporary scrapping subsidy program.

- As of 25 September, according to the China Passenger Car Association (CPCA), more than 1.1 million vehicles were registered for scrapping and trading-in on the National Auto Trade-in Platform. The actual number of those that have resulted in new vehicle sales remains unclear. If they all did, it would imply that approximately half of the 2.1 million PV sales in September were subsidized.

- “With the government recently doubling scrappage subsidies, reducing the required down payment for automotive financing loans, and planning to gradually lift restrictions on NEV purchases in various regions to boost sales, along with numerous local government incentive programs, the intense price competition at OEMs and dealerships appears to have reached its limit. This, coupled with several new model launches should encourage consumers to make purchases, leading us to expect an acceleration in sales in Q4,” GlobalData said.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Conflicting China September 2024 Light Vehicle Sales

Click to enlarge.

During September 2024, China’s Light Vehicle (LV) market was stable compared to the previous month, with sales and production volumes exhibiting divergent trends. Domestic LV sales, excluding exports, reached 2.3 million units, marking a year-on-year (YoY) decrease of 5.4% but a significant month-on-month (MoM) increase of 17.2%, according to data and analysis released today by the respected GlobalData consultancy.* With the ongoing China trade wars, it’s possible that more than half of passenger vehicles were subsidized. Moreover, auto exports are increasing their importance and significance for the Chinese auto industry. Thus the trade wars will continue. The Chinese government has told giant EV makers BYD, SAIC and Geely to halt investment plans in Europe. This will likely play out globally in other trade blocs and countries.

“The substantial YoY and MoM differences may be attributed to the high sales base in the previous year and the gradual impact of the old-for-new subsidy policy. Breaking down the figures by model type, Passenger Vehicle (PV) sales totaled 2.1 million units, with a 2.4% YoY decline but a substantial MoM increase of 18.0%. In contrast, Light Commercial Vehicles (LCVs) also showed a downward trend, which was much more obvious than PV.

“Although LCV sales increased by 8.4% in September compared with August, they fell sharply, by 31.1%, compared with the same period last year. In the first nine months of 2024, cumulative LV sales reached 17.2 mn units, a YoY decrease of 2.7%. Among that number, cumulative PV sales were 15.4 mn units, a YoY decrease of 2.0%. LCV’s cumulative sales were 1.8 mn units, a YoY decrease of 8.4%,” the GlobalData Asia-Pacific Light Vehicle Sales Forecasting Team said.

GlobalData Commentary, Observations

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.