Click to enlarge.

Toyota Motor Corporations (NYSE: TM and 7203.T) said today in Japan that consolidated vehicle sales for this fiscal year 2025 were 9 million 362 thousand units, which was 99.1% of consolidated vehicle sales for the previous fiscal year. Toyota and Lexus vehicle sales was 10 million 274 thousand units, which was 99.7% of such sales for the previous FY 2024 due to supply constraints caused by the certification issue and other factors. The proportion of electrified vehicles was 46.2%, a significant increase from the previous fiscal year, mainly led by HEVs, which were increased by 850,000 year-over-year.

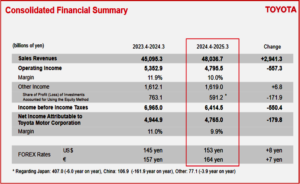

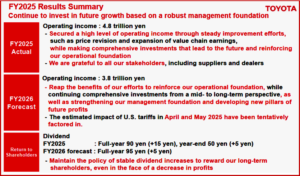

“In facing various challenges over the past year, our entire company has reaffirmed the importance of Toyota’s starting point of carefully making and delivering quality cars. We will continue to build each car with careful attention to safety and quality to demonstrate gratitude to our customers and all other stakeholders through our actions. Currently, the environment surrounding the automobile industry, including trade relations, is in extreme flux. At a time when changes are rapid and the future is unclear, we believe that we must continue to pursue making good cars without wavering from our principles of product-centered management and striving to be the best in town,” said Koji Sato, President and CEO TMC. Toyota reported a 4.77 trillion yen (~$33 billion) profit, down from 4.94 trillion yen the previous fiscal year. ~180% drop year-over-year.

Click to enlarge.

“Japan continued to maintain a high level of profit despite an increase in expenses due to the strengthening of the supplier base. In North America, operating income decreased due to factors such as the impact of lower production volume caused by the four-month shutdown of Toyota Motor Manufacturing, Indiana in the U.S. due to quality issues. Asia and other regions recorded higher profits due to price revisions and other factors Operating income of consolidated subsidiaries and share of profit of investments accounted for using the equity method in China decreased mainly due to an increase in sales expenses. Operating income in the Financial Services business increased, largely due to an increase in loan balances,” Toyota said.

Click for more.

“Toyota has no current plans to pass higher tariff costs on to customers,” said Yoichi Miyazaki, Toyota Chief Financial Officer “We believe that prices should be determined by customers…We will make an appropriate response at the right time.”

Toyota’s earnings forecast is based on an exchange rate of ¥145 to the $U.S. and ¥160 to the €, compared with ¥153 per Dollar and ¥164 per Euro in FY 2024.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota FY 2025 Results – Net Profit Drops 21%

Click to enlarge.

Toyota Motor Corporations (NYSE: TM and 7203.T) said today in Japan that consolidated vehicle sales for this fiscal year 2025 were 9 million 362 thousand units, which was 99.1% of consolidated vehicle sales for the previous fiscal year. Toyota and Lexus vehicle sales was 10 million 274 thousand units, which was 99.7% of such sales for the previous FY 2024 due to supply constraints caused by the certification issue and other factors. The proportion of electrified vehicles was 46.2%, a significant increase from the previous fiscal year, mainly led by HEVs, which were increased by 850,000 year-over-year.

“In facing various challenges over the past year, our entire company has reaffirmed the importance of Toyota’s starting point of carefully making and delivering quality cars. We will continue to build each car with careful attention to safety and quality to demonstrate gratitude to our customers and all other stakeholders through our actions. Currently, the environment surrounding the automobile industry, including trade relations, is in extreme flux. At a time when changes are rapid and the future is unclear, we believe that we must continue to pursue making good cars without wavering from our principles of product-centered management and striving to be the best in town,” said Koji Sato, President and CEO TMC. Toyota reported a 4.77 trillion yen (~$33 billion) profit, down from 4.94 trillion yen the previous fiscal year. ~180% drop year-over-year.

Click to enlarge.

“Japan continued to maintain a high level of profit despite an increase in expenses due to the strengthening of the supplier base. In North America, operating income decreased due to factors such as the impact of lower production volume caused by the four-month shutdown of Toyota Motor Manufacturing, Indiana in the U.S. due to quality issues. Asia and other regions recorded higher profits due to price revisions and other factors Operating income of consolidated subsidiaries and share of profit of investments accounted for using the equity method in China decreased mainly due to an increase in sales expenses. Operating income in the Financial Services business increased, largely due to an increase in loan balances,” Toyota said.

Click for more.

“Toyota has no current plans to pass higher tariff costs on to customers,” said Yoichi Miyazaki, Toyota Chief Financial Officer “We believe that prices should be determined by customers…We will make an appropriate response at the right time.”

Toyota’s earnings forecast is based on an exchange rate of ¥145 to the $U.S. and ¥160 to the €, compared with ¥153 per Dollar and ¥164 per Euro in FY 2024.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.