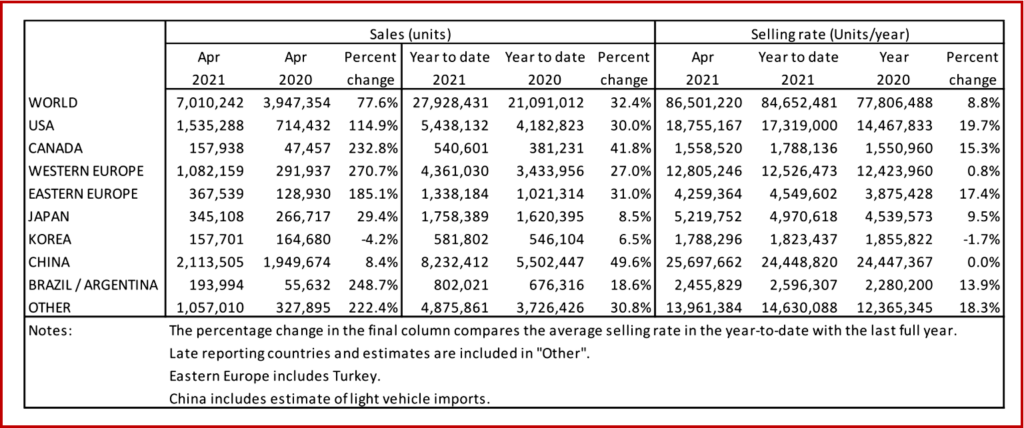

The global Light Vehicle (LV) selling rate slipped to 86.5 million units/year in April, from 87.8 million units/year in March, according to Consultancy LMC. In year-on-year (YoY) terms, sales rose 77.6%. However, this seeming jump in market performance is distorted by the global-pandemic caused shutdowns in March of 2020. In the US, sales jumped, while China’s sales were hurt by the semiconductor famine. In Europe, fluctuating restrictions in several markets blocked any significant improvement from March 2021. (see chart following Continue reading jump)

Helped by President Biden’s economic stimulus in the face of Republican obstructionism, and states re-opening, the record setting rate of US Light Vehicle sales continued in April. Sales of 1.54 million units were the highest-ever volume for that month.

“From an extremely low base, sales increased by 114.9% YoY, while the selling rate accelerated to 18.8 million units/year, from 18.0 million units/year in March, the fourth-strongest month on record. Low inventory is helping to keep average transaction prices at near-record highs, reaching $37,909 in April, but elevated trade-in values helped to keep monthly payments in check,” LMC said.

“From an extremely low base, sales increased by 114.9% YoY, while the selling rate accelerated to 18.8 million units/year, from 18.0 million units/year in March, the fourth-strongest month on record. Low inventory is helping to keep average transaction prices at near-record highs, reaching $37,909 in April, but elevated trade-in values helped to keep monthly payments in check,” LMC said.

In Canada, sales were up by 232.8% YoY in April, to 158k units. However, the selling rate declined to 1.56 million units/year in April, from 1.91 million units/year in March. For much of March, big markets within the country – such as Ontario – remained under lockdown or restrictions, stifling demand. The Mexican market grew by 140.2% YoY in April, to 83k units, while the selling rate moved towards 1.15 million units/year, from 1.11 million units/year in March.

Europe

The West European selling rate dropped a tad to 12.8 million units/year in April. “while vaccine progress is being made and consumer confidence is improving, varying degrees of restrictions across the region are acting as a brake on demand,” said LMC. The year-to-date (YTD) figure emphasizes the recent poor results, with sales for 2021 so far off 23% compared to the same period (Jan-Apr) in 2019.

In Eastern Europe, the LV selling rate fell to 4.3 million units/year, from 4.6 million units/year. However, March’s result did include another strong selling rate result of 1.8 million units/year for Russia.

China

According to preliminary data, the Chinese market – the world’s largest – remained lethargic in April as it was impacted by the semiconductor shortage. The April selling rate was 25.7 million units/year, unchanged from March. In the first four months of this year, the selling rate averaged only 24.4 million units/year, compared to the average selling rate of 28.6 million units/year in Q4 2020. YoY sales (wholesales) rose by 8% last month and 50% year-to-date (YTD), as a result of the abnormally weak sales a year earlier.

While the semiconductor shortage continues to disrupt supply and wholesales, underlying demand appears strong, particularly for New Energy Vehicles (NEVs) as more young new vehicle buyers are enticed by the latest technologies. From around 180 new models exhibited at the Shanghai Auto Show last month, nearly 40% of them were NEVs. “The market has clearly shifted from post-pandemic survival mode into a new era of electric and intelligent vehicles,” said LMC.

Elsewhere in Asia

The Japanese market accelerated in April as the selling rate reached a strong 5.2 million units, up 11% from a relatively weak March. In YoY terms, sales increased by nearly 30% from March and 9% YTD, although levels were miserable last year due to the pandemic. “The April result likely stems from the lifting of the state of emergency in Tokyo and other major prefectures on March 21st, which could have helped boost consumers’ confidence and mobility. However, while dealerships will continue to remain open, the state of emergency was reinstated on the 25th of April which could damage confidence in the short term,” notes LMC.

Despite the ongoing temporary tax cut for PVs, the Korean market lost momentum in April as the chip shortage started to hurt supply. The April selling rate was 1.79 million units/year, down nearly 7% from a hardy March. On a YoY basis, sales declined by 4% in April, due to a high base effect (last year, sales in March through to November were exceptionally strong thanks to the temporary tax cut and consumers’ demand for personal mobility during the pandemic).

South America

Brazilian Light Vehicle sales grew by 217.5% YoY in April, to 164k units. The strong YoY result was foreseeable, given the market slump in April 2020 at the beginning of the pandemic. LMC observes it was “somewhat remarkable that the selling rate accelerated in April 2021, to 2.10 million units/year, from 1.94 million units/year in March. While the virus remains rampant in Brazil, lockdowns were eased during April in some key regions, helping to increase consumer confidence.”

In Argentina, Light Vehicle sales increased by 649% YoY in April, to 30k units, as sales tanked a year earlier. The selling rate slowed to 356k units/year in April, from 384k units/year in March. This was the fifth consecutive month where the selling rate had slowed, which could indicate that the surge brought about by the ‘blue dollar’ phenomenon is starting to fade, as well as ongoing pandemic-caused tussles.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

April Global Sales – North America Up, Elsewhere Unsettled

The global Light Vehicle (LV) selling rate slipped to 86.5 million units/year in April, from 87.8 million units/year in March, according to Consultancy LMC. In year-on-year (YoY) terms, sales rose 77.6%. However, this seeming jump in market performance is distorted by the global-pandemic caused shutdowns in March of 2020. In the US, sales jumped, while China’s sales were hurt by the semiconductor famine. In Europe, fluctuating restrictions in several markets blocked any significant improvement from March 2021. (see chart following Continue reading jump)

Helped by President Biden’s economic stimulus in the face of Republican obstructionism, and states re-opening, the record setting rate of US Light Vehicle sales continued in April. Sales of 1.54 million units were the highest-ever volume for that month.

In Canada, sales were up by 232.8% YoY in April, to 158k units. However, the selling rate declined to 1.56 million units/year in April, from 1.91 million units/year in March. For much of March, big markets within the country – such as Ontario – remained under lockdown or restrictions, stifling demand. The Mexican market grew by 140.2% YoY in April, to 83k units, while the selling rate moved towards 1.15 million units/year, from 1.11 million units/year in March.

Europe

The West European selling rate dropped a tad to 12.8 million units/year in April. “while vaccine progress is being made and consumer confidence is improving, varying degrees of restrictions across the region are acting as a brake on demand,” said LMC. The year-to-date (YTD) figure emphasizes the recent poor results, with sales for 2021 so far off 23% compared to the same period (Jan-Apr) in 2019.

In Eastern Europe, the LV selling rate fell to 4.3 million units/year, from 4.6 million units/year. However, March’s result did include another strong selling rate result of 1.8 million units/year for Russia.

China

According to preliminary data, the Chinese market – the world’s largest – remained lethargic in April as it was impacted by the semiconductor shortage. The April selling rate was 25.7 million units/year, unchanged from March. In the first four months of this year, the selling rate averaged only 24.4 million units/year, compared to the average selling rate of 28.6 million units/year in Q4 2020. YoY sales (wholesales) rose by 8% last month and 50% year-to-date (YTD), as a result of the abnormally weak sales a year earlier.

While the semiconductor shortage continues to disrupt supply and wholesales, underlying demand appears strong, particularly for New Energy Vehicles (NEVs) as more young new vehicle buyers are enticed by the latest technologies. From around 180 new models exhibited at the Shanghai Auto Show last month, nearly 40% of them were NEVs. “The market has clearly shifted from post-pandemic survival mode into a new era of electric and intelligent vehicles,” said LMC.

Elsewhere in Asia

The Japanese market accelerated in April as the selling rate reached a strong 5.2 million units, up 11% from a relatively weak March. In YoY terms, sales increased by nearly 30% from March and 9% YTD, although levels were miserable last year due to the pandemic. “The April result likely stems from the lifting of the state of emergency in Tokyo and other major prefectures on March 21st, which could have helped boost consumers’ confidence and mobility. However, while dealerships will continue to remain open, the state of emergency was reinstated on the 25th of April which could damage confidence in the short term,” notes LMC.

Despite the ongoing temporary tax cut for PVs, the Korean market lost momentum in April as the chip shortage started to hurt supply. The April selling rate was 1.79 million units/year, down nearly 7% from a hardy March. On a YoY basis, sales declined by 4% in April, due to a high base effect (last year, sales in March through to November were exceptionally strong thanks to the temporary tax cut and consumers’ demand for personal mobility during the pandemic).

South America

Brazilian Light Vehicle sales grew by 217.5% YoY in April, to 164k units. The strong YoY result was foreseeable, given the market slump in April 2020 at the beginning of the pandemic. LMC observes it was “somewhat remarkable that the selling rate accelerated in April 2021, to 2.10 million units/year, from 1.94 million units/year in March. While the virus remains rampant in Brazil, lockdowns were eased during April in some key regions, helping to increase consumer confidence.”

In Argentina, Light Vehicle sales increased by 649% YoY in April, to 30k units, as sales tanked a year earlier. The selling rate slowed to 356k units/year in April, from 384k units/year in March. This was the fifth consecutive month where the selling rate had slowed, which could indicate that the surge brought about by the ‘blue dollar’ phenomenon is starting to fade, as well as ongoing pandemic-caused tussles.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.