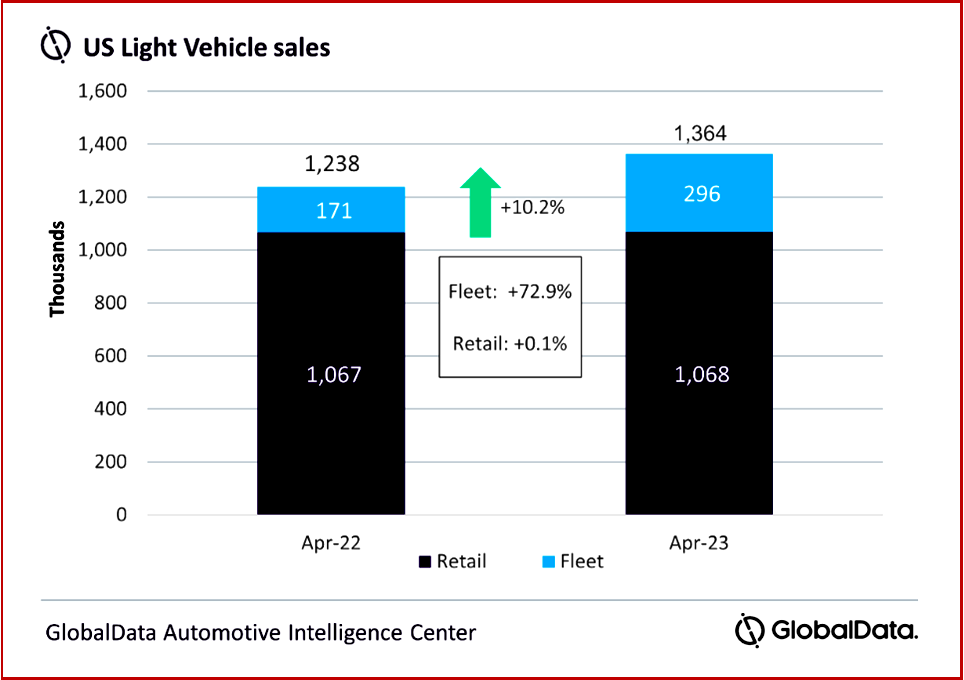

US light vehicle sales grew by 10.2% year-on-year (YoY) in April to 1.36 million units, according to according to preliminary estimates just released by the LMC Automotive* consultancy. This means that April’s volumes were comparable with pre-pandemic levels as the Biden recovery continues. In month-on-month (MoM) terms, April is forecast to be up slightly (+0.2%), even though seasonality would normally suggest that March would be a significantly stronger month – and it had an additional selling day compared to April, LMC noted. (March Global Light Vehicles Sales Up 12%; US New Vehicle Sales Soar in April 2023 at 1.3 Million)

“While sales throughout 2023 to date had given us some reason to be encouraged, the April result was comfortably the most impressive outcome since 2021. As the market appears to be finally moving beyond supply chain woes, and pricing begins to become slightly more favorable to the consumer, thanks to higher incentives, we are now seeing sales comparable to pre-pandemic levels. There are some differences with the pre-COVID landscape – customers are waiting longer for vehicles, as OEMs learn the benefits of tighter inventories – but in some ways the market is returning to something approaching normal,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

Click chart for more information.

Average transaction prices are high by historical standards and continued to be up (by 3.6%) YoY in March. However, prices have declined month-on-month (MoM) in each month of 2023, and this trend is expected to have continued in April, with incentives also beginning to creep up. In March, incentives were up by 56.2% YoY, from an extremely low base.

General Motors was the bestselling automaker for the ninth consecutive month. Toyota Group was second at 42,000 units behind GM in April. Ford brand was once again the market leader, with a 12,000-unit lead over Toyota, which put Chevrolet into third place, flip-flop of positions compared to March. The Ford F- 150 had a good month as the bestselling Light Vehicle in the market, 12,000 units ahead of the Chevrolet Silverado. The Silverado only just held off a challenge from the Honda CR-V to remain in second place.

Compact Non-Premium SUV was once again the bestselling segment in April, with a 19.2% market share, up by 1.2 percentage points, YoY, but matching March’s result. Midsize Non- Premium SUV was the second-largest segment at 16.3%, a YoY decline of 1.5 pp. Large Pickups, the third largest segment, increased at tad from a weak March, accounting for 13.9% of the market in April, unchanged YoY, but up by almost 0.6 pp compared with March. For the second consecutive month, Cars outsold Pickups by a mere ~5000 units.

Global outlook

Global Light Vehicle sales ended Q1 at 20.6 million units, up by 4.3% YoY. March’s selling rate increased to 84 million units, from 81 million units in February. March volume was up by 10.5% YoY to 8.1 million, with growth in Brazil (+38.9%), Western Europe (+22.6%) and Korea (+21.3%). North America and China grew slightly less than the global market.

“As the recovery continues and production levels rise to fuel stronger demand, the 2023 forecast for global light vehicle sales is holding at 86.1 million units, a 6.3% increase from 2022. Supply disruption is projected to improve further, but will remain an issue throughout 2023. The overall effect on underlying demand is expected to be 4 million units of disruption, half of what it was in 2022,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s international clients include auto and truck makers, component manufacturers and suppliers, financial and logistics firms, as well as government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector.

The Global Light Vehicle Sales Forecast published in association with Jato Dynamics Ltd. builds on macro‐economic forecasts generated by LMC partner, the renowned Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve‐year forecasts at a global, regional and country levels for Light Vehicle demand in 137 countries. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

April US Light Vehicle Sales up 10%

US light vehicle sales grew by 10.2% year-on-year (YoY) in April to 1.36 million units, according to according to preliminary estimates just released by the LMC Automotive* consultancy. This means that April’s volumes were comparable with pre-pandemic levels as the Biden recovery continues. In month-on-month (MoM) terms, April is forecast to be up slightly (+0.2%), even though seasonality would normally suggest that March would be a significantly stronger month – and it had an additional selling day compared to April, LMC noted. (March Global Light Vehicles Sales Up 12%; US New Vehicle Sales Soar in April 2023 at 1.3 Million)

“While sales throughout 2023 to date had given us some reason to be encouraged, the April result was comfortably the most impressive outcome since 2021. As the market appears to be finally moving beyond supply chain woes, and pricing begins to become slightly more favorable to the consumer, thanks to higher incentives, we are now seeing sales comparable to pre-pandemic levels. There are some differences with the pre-COVID landscape – customers are waiting longer for vehicles, as OEMs learn the benefits of tighter inventories – but in some ways the market is returning to something approaching normal,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

Click chart for more information.

Average transaction prices are high by historical standards and continued to be up (by 3.6%) YoY in March. However, prices have declined month-on-month (MoM) in each month of 2023, and this trend is expected to have continued in April, with incentives also beginning to creep up. In March, incentives were up by 56.2% YoY, from an extremely low base.

General Motors was the bestselling automaker for the ninth consecutive month. Toyota Group was second at 42,000 units behind GM in April. Ford brand was once again the market leader, with a 12,000-unit lead over Toyota, which put Chevrolet into third place, flip-flop of positions compared to March. The Ford F- 150 had a good month as the bestselling Light Vehicle in the market, 12,000 units ahead of the Chevrolet Silverado. The Silverado only just held off a challenge from the Honda CR-V to remain in second place.

Compact Non-Premium SUV was once again the bestselling segment in April, with a 19.2% market share, up by 1.2 percentage points, YoY, but matching March’s result. Midsize Non- Premium SUV was the second-largest segment at 16.3%, a YoY decline of 1.5 pp. Large Pickups, the third largest segment, increased at tad from a weak March, accounting for 13.9% of the market in April, unchanged YoY, but up by almost 0.6 pp compared with March. For the second consecutive month, Cars outsold Pickups by a mere ~5000 units.

Global outlook

Global Light Vehicle sales ended Q1 at 20.6 million units, up by 4.3% YoY. March’s selling rate increased to 84 million units, from 81 million units in February. March volume was up by 10.5% YoY to 8.1 million, with growth in Brazil (+38.9%), Western Europe (+22.6%) and Korea (+21.3%). North America and China grew slightly less than the global market.

“As the recovery continues and production levels rise to fuel stronger demand, the 2023 forecast for global light vehicle sales is holding at 86.1 million units, a 6.3% increase from 2022. Supply disruption is projected to improve further, but will remain an issue throughout 2023. The overall effect on underlying demand is expected to be 4 million units of disruption, half of what it was in 2022,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s international clients include auto and truck makers, component manufacturers and suppliers, financial and logistics firms, as well as government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector.

The Global Light Vehicle Sales Forecast published in association with Jato Dynamics Ltd. builds on macro‐economic forecasts generated by LMC partner, the renowned Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve‐year forecasts at a global, regional and country levels for Light Vehicle demand in 137 countries. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.