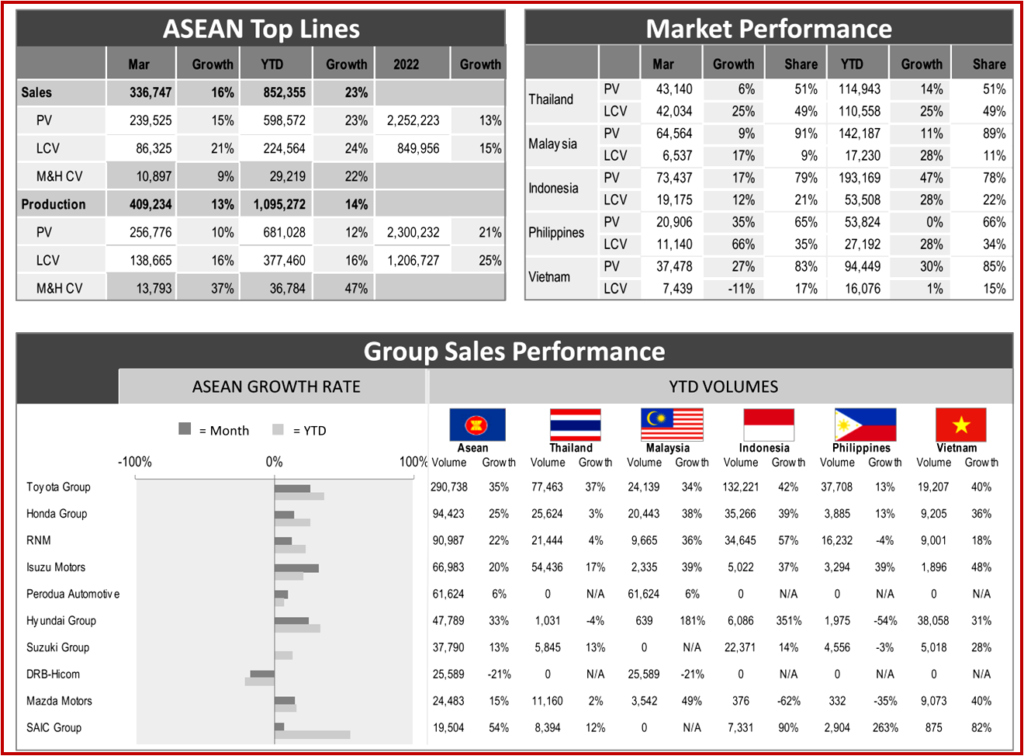

ASEAN LV sales continued to grow in March (+17% YoY +32% MoM), improving Q1 2021 sales by 23% YoY, according to the LMC Automotive consultancy. LMC attributed this to falling COVID-19 cases normalizing economic activity and mobility in the region. “As a result, overall ASEAN LV sales are now increased to 3.10 mn units, or a 13% YoY increase, this year,” said LMC. Toyota Group remains the dominant force in the market.

Click to Enlarge.

Indonesia’s LV sales increased by 16% YoY and 22% MoM in March. This was due to consumers rushing to buy new vehicles “to avoid April prices hikes.” The April price adjustments stemmed from A: LCGC (Low-Cost Green Car) tax cuts rising from 0% in January- March 2022 to 1% for April-June. B: non-LCGC tax cuts to 7.5% expiring at the end of March and returning to 15% in April. C: VAT increasing from 10% to 11% in April. D: the EURO4 standards for diesel vehicles coming into effect in April as well. “Despite stronger-than-expected March sales, Indonesia’s 2022 LV sales outlook was slightly adjusted from 855k units in our previous report to 856k units in this report because the country’s economic outlook is unclear, due to the war in Ukraine, global supply disruptions, soaring commodity prices, and higher inflation. Reportedly, the consumer price index (CPI) increased by 3.47% YoY in April, the highest rate since December 2017.”

Thailand’s LV market in March saw sales rise by 14% YoY, marking double-digit growth for three consecutive months. LMC’s advance data show that April sales fell by 27% from March, but still increased by 6% YoY. The slowdown in April was likely from the auto component shortage and the long Songkran holiday. Thailand LV sales are projected to grew by 18% to 868k units this year after two years of deep slump. Also, the 2022 sales outlook is on upside risks since the services sector is now recovering thanks to falling COVID-19 cases and the country’s policy to live with the virus. The sector will play a larger role in driving the economy this year to boost job and income growth.

Malaysia’s LV market rose by 10% YoY and 55% MoM in March. “The robust March sales reflected a catch-up from weak production in January and February when floods disrupted vehicle deliveries. We increased the Malaysia sales outlook to 608k units sold this year since many OEMs have a large backlog of orders and strong bookings for new models and the automotive industry asked the government to extend tax cuts until December 2022, which we expect will be granted,” said LMC

The Vietnamese market continued to accelerate in March (+18% YoY and +70% MoM) thanks to the temporary 50% cut in registration fees for locally assembled vehicles and to some easing in supply constraints. However, LV sales are expected to lose momentum after the temporary registration fee cut expires at the end of May. As such, the Vietnam LV market is forecast at 435k units, or a 14% YoY increase, for the whole year 2022, slowing down from the 25% YoY increase in Q1 2022.

After Philippines LV sales saw a decline in January-February, demand picked up in March (+21.5% MoM and +44.6% YoY). With this, Q1 2022 sales turned from negative (-7.6% YoY) to positive growth (+7.8% YoY). “Despite rising inflation, growing global uncertainty, and rising vehicle prices, Philippines LV sales remained robust in March, stronger than we expected. This led us to a minor adjustment of the 2022 outlook, to 334k units this year. Note that March sales exceeded 30k units, marking the highest monthly sales in 25 months.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

ASEAN Light Vehicle Sales Still Soaring in March

ASEAN LV sales continued to grow in March (+17% YoY +32% MoM), improving Q1 2021 sales by 23% YoY, according to the LMC Automotive consultancy. LMC attributed this to falling COVID-19 cases normalizing economic activity and mobility in the region. “As a result, overall ASEAN LV sales are now increased to 3.10 mn units, or a 13% YoY increase, this year,” said LMC. Toyota Group remains the dominant force in the market.

Click to Enlarge.

Indonesia’s LV sales increased by 16% YoY and 22% MoM in March. This was due to consumers rushing to buy new vehicles “to avoid April prices hikes.” The April price adjustments stemmed from A: LCGC (Low-Cost Green Car) tax cuts rising from 0% in January- March 2022 to 1% for April-June. B: non-LCGC tax cuts to 7.5% expiring at the end of March and returning to 15% in April. C: VAT increasing from 10% to 11% in April. D: the EURO4 standards for diesel vehicles coming into effect in April as well. “Despite stronger-than-expected March sales, Indonesia’s 2022 LV sales outlook was slightly adjusted from 855k units in our previous report to 856k units in this report because the country’s economic outlook is unclear, due to the war in Ukraine, global supply disruptions, soaring commodity prices, and higher inflation. Reportedly, the consumer price index (CPI) increased by 3.47% YoY in April, the highest rate since December 2017.”

Thailand’s LV market in March saw sales rise by 14% YoY, marking double-digit growth for three consecutive months. LMC’s advance data show that April sales fell by 27% from March, but still increased by 6% YoY. The slowdown in April was likely from the auto component shortage and the long Songkran holiday. Thailand LV sales are projected to grew by 18% to 868k units this year after two years of deep slump. Also, the 2022 sales outlook is on upside risks since the services sector is now recovering thanks to falling COVID-19 cases and the country’s policy to live with the virus. The sector will play a larger role in driving the economy this year to boost job and income growth.

Malaysia’s LV market rose by 10% YoY and 55% MoM in March. “The robust March sales reflected a catch-up from weak production in January and February when floods disrupted vehicle deliveries. We increased the Malaysia sales outlook to 608k units sold this year since many OEMs have a large backlog of orders and strong bookings for new models and the automotive industry asked the government to extend tax cuts until December 2022, which we expect will be granted,” said LMC

The Vietnamese market continued to accelerate in March (+18% YoY and +70% MoM) thanks to the temporary 50% cut in registration fees for locally assembled vehicles and to some easing in supply constraints. However, LV sales are expected to lose momentum after the temporary registration fee cut expires at the end of May. As such, the Vietnam LV market is forecast at 435k units, or a 14% YoY increase, for the whole year 2022, slowing down from the 25% YoY increase in Q1 2022.

After Philippines LV sales saw a decline in January-February, demand picked up in March (+21.5% MoM and +44.6% YoY). With this, Q1 2022 sales turned from negative (-7.6% YoY) to positive growth (+7.8% YoY). “Despite rising inflation, growing global uncertainty, and rising vehicle prices, Philippines LV sales remained robust in March, stronger than we expected. This led us to a minor adjustment of the 2022 outlook, to 334k units this year. Note that March sales exceeded 30k units, marking the highest monthly sales in 25 months.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.