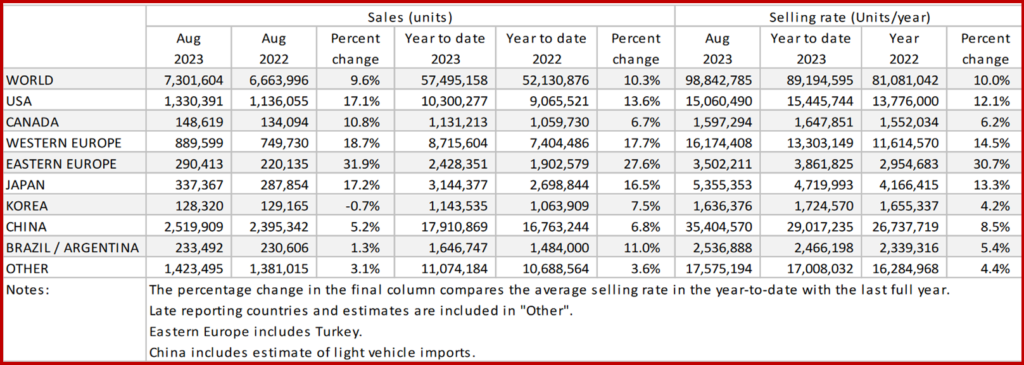

The Global Light Vehicle (LV) selling rate rose for the sixth consecutive month in August, reaching 99 million units/year, from a revised figure of 97 million units/year in July, according to statistics just made public by the GlobalData* consultancy. With 7.3 million units sold in August, the market has grown 9.6% year-over-year (YoY), with 57 million units sold year-to-date (YTD). The YTD figure has also exceeded the YTD Aug 2022 total by 10.3%.

“The USA, Western and Eastern European countries all registered double digit YoY growth, partly due to 2022 being a weak base and partly because of an alleviation in supply-side issues. Chinese sales grew 5.2%, driven by a booming export sector. However, the domestic PV market in China fell slightly because of subdued consumer confidence,” GlobalData said.

Click for more GlobalData.

GlobalData Observations

North America: The US LV market continued its strong sales in August, as vehicle sales increased by 17.1% YoY, reaching 1.3 million units. While sales increased MoM by 26,500 the selling rate declined significantly from July, as the rate dropped to 15.1 million units/year in August, down from 15.8 million units/year reported in July. “Consumers may have held off on purchases to see if better discounts would be available around the Labor Day holiday in early September. Transaction prices remain elevated, as prices increased by US$498 month-on-month (MoM) to US$45,935 in August, while incentives were virtually unchanged MoM at US$1,903,” GlobalData said.

Canadian LV sales reached 148,600, increasing by 10.8% YoY. As sales increased by 42,000 units over the previous month, the selling rate slightly increased in August to 1.6 million units/year, up from 1.5 million units/year in July.

LV sales in Mexico grew by 25.6% YoY to 113,900 in August. While sales have been exceeding expectations, the selling rate dropped slightly in August to 1.35 million units/year, down from 1.4 million units recorded in July.

Europe: The West European LV selling rate grew once again in August, to 16.2 million units/year, the highest level since December 2020, in what is seasonally a weak month (+18.7% YoY). “The strong performance was supported by YoY increases in all the big five countries, as the region continues to benefit from improved supply lines, allowing production to reduce lead times and fulfil backlogged orders. Year-to-date (YTD), the region has grown 17.7% YoY with total sales of 8.7 million units,” GlobalData said.

The East European LV selling rate fell to 3.5 million units/ year after a drop in the raw monthly registration figure of 290,000 units (+31.9% YoY). “The strong YoY growth was supported by Russia selling more than 70,000 units in August, which is 52% higher than the same period last year. While the YTD figure for the region (2.4 million units) is up 27.6% YoY, it is down 8% from pre-pandemic 2019 levels,” said GlobalData.

China

Advance data indicates that China’s wholesales, which include exports, “continued to surprise on the upside.” The August selling rate was 35.4 million units/year, not so different from July’s exceptionally strong (and upwardly revised) 36 million units/year. That brought the YTD average selling rate to 29 million units/year. In YoY terms, sales increased by 5.2% in August and 6.8% YTD.

“Behind such stellar performances in recent months are booming exports. Exports of Passenger Vehicles (PV) expanded by 43% YoY in August, boosted by increased shipments to Russia and buoyant global demand for China’s NEVs. In contrast, domestic PV sales declined marginally (-0.5%) YoY, reflecting depressed consumer confidence. As the domestic market continues to stagnate, OEMs are ramping up their efforts to increase exports; meanwhile, the government has announced stimulus measures to bolster consumption,” GlobalData said

Elsewhere in Asia

The Japanese market accelerated strongly in August after weakening for three straight months, due to supply constraints and a severe heatwave across the country. The August selling rate reached a robust 5.4 million units/year, up 28% from a weak July. With supply catching up, the delivery periods have shortened for many models – although there are still significant volumes of backlogged orders. “On the other hand, demand appears to be losing some steam, in the face of sticky inflation, a weak yen, and global uncertainty,” GlobalData said.

Sales in Korea were up slightly in August, after slowing sharply in July due to the expiration of the temporary tax cut and a long period of heavy rains. The August selling rate was 1.6 million units/year, up 4.4% from a weak July. In YoY terms, sales declined by 0.7% in August, with the entire loss coming from Light Commercial Vehicles (LCVs). “LCV sales fell by 24% YoY, owing to a combination of factors, such as the ageing of local truck models, rising diesel prices and financing costs, and weakening economic activities in Korea,” GlobalData said.

South America

Preliminary estimates indicate that Brazilian Light Vehicle sales increased by 1.0% YoY in August to 196.9k units. With the reduction in sales from July, the selling rate in August dropped to 2.1 million units/year, down from the 2.5 million units/year reported in July. The temporary boost that the government incentive scheme provided to the market in June and July faded in August. As demand settled down, this likely also explains the increase in inventory levels, which reached 244,600 units in August, up from 198,800 units in July.

In Argentina, Light Vehicle sales are estimated to have grown to 36,600 units in August, up by 2.4% YoY. LV sales saw a reduction on a MoM basis, and the selling rate also dropped in August to 394,600 units/year, down from the 479,000 units/year recorded in July. “The market appears to have returned to pre-pandemic sales levels, but a slowdown towards the end of the year is still likely given economic and political conditions. August broke the trend of five consecutive months with selling rates of over 400,000 units/year,” GlobalData said

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

August Global Light Vehicle Sales Up Again

The Global Light Vehicle (LV) selling rate rose for the sixth consecutive month in August, reaching 99 million units/year, from a revised figure of 97 million units/year in July, according to statistics just made public by the GlobalData* consultancy. With 7.3 million units sold in August, the market has grown 9.6% year-over-year (YoY), with 57 million units sold year-to-date (YTD). The YTD figure has also exceeded the YTD Aug 2022 total by 10.3%.

“The USA, Western and Eastern European countries all registered double digit YoY growth, partly due to 2022 being a weak base and partly because of an alleviation in supply-side issues. Chinese sales grew 5.2%, driven by a booming export sector. However, the domestic PV market in China fell slightly because of subdued consumer confidence,” GlobalData said.

Click for more GlobalData.

GlobalData Observations

North America: The US LV market continued its strong sales in August, as vehicle sales increased by 17.1% YoY, reaching 1.3 million units. While sales increased MoM by 26,500 the selling rate declined significantly from July, as the rate dropped to 15.1 million units/year in August, down from 15.8 million units/year reported in July. “Consumers may have held off on purchases to see if better discounts would be available around the Labor Day holiday in early September. Transaction prices remain elevated, as prices increased by US$498 month-on-month (MoM) to US$45,935 in August, while incentives were virtually unchanged MoM at US$1,903,” GlobalData said.

Canadian LV sales reached 148,600, increasing by 10.8% YoY. As sales increased by 42,000 units over the previous month, the selling rate slightly increased in August to 1.6 million units/year, up from 1.5 million units/year in July.

LV sales in Mexico grew by 25.6% YoY to 113,900 in August. While sales have been exceeding expectations, the selling rate dropped slightly in August to 1.35 million units/year, down from 1.4 million units recorded in July.

Europe: The West European LV selling rate grew once again in August, to 16.2 million units/year, the highest level since December 2020, in what is seasonally a weak month (+18.7% YoY). “The strong performance was supported by YoY increases in all the big five countries, as the region continues to benefit from improved supply lines, allowing production to reduce lead times and fulfil backlogged orders. Year-to-date (YTD), the region has grown 17.7% YoY with total sales of 8.7 million units,” GlobalData said.

The East European LV selling rate fell to 3.5 million units/ year after a drop in the raw monthly registration figure of 290,000 units (+31.9% YoY). “The strong YoY growth was supported by Russia selling more than 70,000 units in August, which is 52% higher than the same period last year. While the YTD figure for the region (2.4 million units) is up 27.6% YoY, it is down 8% from pre-pandemic 2019 levels,” said GlobalData.

China

Advance data indicates that China’s wholesales, which include exports, “continued to surprise on the upside.” The August selling rate was 35.4 million units/year, not so different from July’s exceptionally strong (and upwardly revised) 36 million units/year. That brought the YTD average selling rate to 29 million units/year. In YoY terms, sales increased by 5.2% in August and 6.8% YTD.

“Behind such stellar performances in recent months are booming exports. Exports of Passenger Vehicles (PV) expanded by 43% YoY in August, boosted by increased shipments to Russia and buoyant global demand for China’s NEVs. In contrast, domestic PV sales declined marginally (-0.5%) YoY, reflecting depressed consumer confidence. As the domestic market continues to stagnate, OEMs are ramping up their efforts to increase exports; meanwhile, the government has announced stimulus measures to bolster consumption,” GlobalData said

Elsewhere in Asia

The Japanese market accelerated strongly in August after weakening for three straight months, due to supply constraints and a severe heatwave across the country. The August selling rate reached a robust 5.4 million units/year, up 28% from a weak July. With supply catching up, the delivery periods have shortened for many models – although there are still significant volumes of backlogged orders. “On the other hand, demand appears to be losing some steam, in the face of sticky inflation, a weak yen, and global uncertainty,” GlobalData said.

Sales in Korea were up slightly in August, after slowing sharply in July due to the expiration of the temporary tax cut and a long period of heavy rains. The August selling rate was 1.6 million units/year, up 4.4% from a weak July. In YoY terms, sales declined by 0.7% in August, with the entire loss coming from Light Commercial Vehicles (LCVs). “LCV sales fell by 24% YoY, owing to a combination of factors, such as the ageing of local truck models, rising diesel prices and financing costs, and weakening economic activities in Korea,” GlobalData said.

South America

Preliminary estimates indicate that Brazilian Light Vehicle sales increased by 1.0% YoY in August to 196.9k units. With the reduction in sales from July, the selling rate in August dropped to 2.1 million units/year, down from the 2.5 million units/year reported in July. The temporary boost that the government incentive scheme provided to the market in June and July faded in August. As demand settled down, this likely also explains the increase in inventory levels, which reached 244,600 units in August, up from 198,800 units in July.

In Argentina, Light Vehicle sales are estimated to have grown to 36,600 units in August, up by 2.4% YoY. LV sales saw a reduction on a MoM basis, and the selling rate also dropped in August to 394,600 units/year, down from the 479,000 units/year recorded in July. “The market appears to have returned to pre-pandemic sales levels, but a slowdown towards the end of the year is still likely given economic and political conditions. August broke the trend of five consecutive months with selling rates of over 400,000 units/year,” GlobalData said

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.