As they move towards the completion of a 50:50 merger in the Combination Agreement announced on 18 December 2019, Peugeot S.A. (“Groupe PSA”) and Fiat Chrysler Automobiles N.V. (“FCA”) (NYSE: FCAU / MTA: FCA) now say the corporate name of the new group will be Stellantis. The Latin verb “stello” meaning “to brighten with stars.” (Mobility Roll of the Die – FCA and PSA Merger, FCA-PSA Merger – Surviving Platforms and Powertrains)

The Stellantis name will be used exclusively at the Group level, as a Corporate brand. The next step in the process will be the unveiling of a logo that with the name will become the corporate brand identity. The names and the logos of the Stellantis Group’s basic brands will remain unchanged. What actually happens to the brands is an entirely different matter.

AutoInformed readers likely realized that such mergers are difficult, and the road – looking backward – is littered with abandoned or failed promises of synergies and sales from such ventures. (FCA + PSA = Massive Job Losses, FCA-PSA Merger – Surviving Platforms and Powertrains)

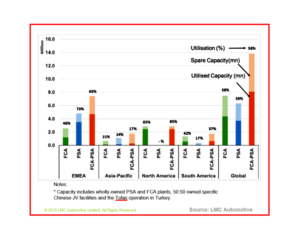

For enthusiasts as well as workers there are other threats. How about a spin-off FCA’s expensive low-return Alfa Romeo/Maserati operations? Simple math here: It would provide funds for the new FCA-PSA group while improving its utilization rate.

The proposed combination has the capability to be an industry leader with “the management, capabilities, resources and scale to successfully capitalize on the opportunities presented by the new era in sustainable mobility.” More than two-thirds of run rate volumes will be concentrated on 2 platforms, with approximately 3 million cars per year on each of the small platform and the compact/mid-size platform.

The exorbitantly expensive world of developing clean vehicles is on view at FCA-PSA. The business case is simply put as a way to spread costs as a consolidation would result in FCA-PSA group emerging as the fourth-largest Global Automaker. It could compete with the current Global Big Three – Volkswagen Group, Toyota, and Renault-Nissan-Mitsubishi.

The completion of the merger is expected to occur in the first quarter of 2021, subject to customary closing conditions, including approval by both companies’ shareholders at their respective Extraordinary General Meetings and the satisfaction of antitrust and other regulatory requirements.

Pingback: Maserati Notes Tipo 300s Win at Venezuela Grand Prix | AutoInformed