Vote Democratic to decrease working people suffering and end welfare for the rich?

By now the unnecessarily severe negative effects are well-documented from the previous Administration’s denials that Covid was a threat to public health and the American economy. Americans are about to receive a third round of stimulus checks through the new American Rescue Plan Act that the Biden Administration pushed past the do-nothing Republican congressional non-representatives of the people – none of them voted for it – in spite of overwhelming public approval polling ranging from 60% to 85% of the items therein.

Data from the US Census Bureau clearly support the need and positive effects of stimulus payments, unlike the failed Republican tax cuts for the rich that did not result in increased investments in the US economy because the off-shore holdings were largely fictional tax dodges not real investments in overseas businesses. There were no large amounts of capital that would return home and be invested in the US economy, although plenty of rich people including foreigners supped at the welfare for the rich GOP table.

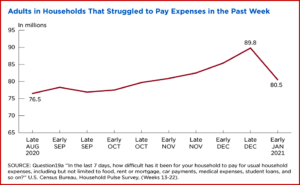

The first COVID stimulus payments of up to $1,200 per adult and $500 per child began reaching households in April and May 2020. By late summer, 76.5 million adults reported that it was somewhat or very difficult to pay their usual expenses. This rose to 89.7 million adults in December 2020 after a clear majority of Americans voted the failed Republicans out of office in November.

Household Pulse data also indicates to AutoInformed that many households – unlike the rich – have accumulated debt to make ends meet. Credit card use is common, but recent research has found the pandemic changed Americans’ credit card habits and reduced discretionary spending. Roughly 30% of adults reported using credit cards, taking out loans or borrowing from family and friends between June and December to pay for food, housing and gas. As the pandemic continued unfettered – aided by Republican non-leaders who still refuse to wear masks – see Senator Ted Cruz yesterday violating CDC guidelines and lying about it at a press conference. (Winter Storms Clobber Texas Small Businesses Unduly)

The fact remains that the number of people who reported using borrowed money and not regular income to pay their weekly expenses increased. In June 2020, 33.7 million adults were using debt but not income to pay their expenses. By late December, that number had jumped to 43.7 million adults, including 34.0 million living in households that suffered a loss of employment income since the start of the pandemic.

Consider: Only 15.7% of stimulus recipients reported using their first check to reduce debt, but about half of all recipient adults used their second one to do that. About 60% of adults in households that experienced a loss in employment income during the pandemic used their second stimulus check to pay down debt.

The new coronavirus relief package will provide much better benefits for people who were hurt by failed Republican policies – as much as $1,400 per person – in coming weeks.

Americans are about to receive stimulus checks through the American Rescue Plan Act that the Biden Administration pushed past the do-nothing Republicans.

“Pulse survey data show that households are struggling financially, with roughly 13 million adults reporting no confidence in their ability to pay their next month’s rent or mortgage.

“In this context, the data also show that stimulus checks are being widely used to pay basic expenses and to cut debt,” said Daniel J. Perez-Lopez and Lindsay M. Monte of the US Census yesterday in a review of Pulse Data.

The Household Pulse Survey is ongoing with close to real-time data about the well-being of American households during the pandemic. Future analyses of these data should provide important insights into the impact of the newest round of stimulus payments.

We need policies based on data, not politics based on demonstrably failed ideologies.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Census Survey – Stimulus Payments Eased Financial Suffering

Vote Democratic to decrease working people suffering and end welfare for the rich?

By now the unnecessarily severe negative effects are well-documented from the previous Administration’s denials that Covid was a threat to public health and the American economy. Americans are about to receive a third round of stimulus checks through the new American Rescue Plan Act that the Biden Administration pushed past the do-nothing Republican congressional non-representatives of the people – none of them voted for it – in spite of overwhelming public approval polling ranging from 60% to 85% of the items therein.

Data from the US Census Bureau clearly support the need and positive effects of stimulus payments, unlike the failed Republican tax cuts for the rich that did not result in increased investments in the US economy because the off-shore holdings were largely fictional tax dodges not real investments in overseas businesses. There were no large amounts of capital that would return home and be invested in the US economy, although plenty of rich people including foreigners supped at the welfare for the rich GOP table.

The first COVID stimulus payments of up to $1,200 per adult and $500 per child began reaching households in April and May 2020. By late summer, 76.5 million adults reported that it was somewhat or very difficult to pay their usual expenses. This rose to 89.7 million adults in December 2020 after a clear majority of Americans voted the failed Republicans out of office in November.

Household Pulse data also indicates to AutoInformed that many households – unlike the rich – have accumulated debt to make ends meet. Credit card use is common, but recent research has found the pandemic changed Americans’ credit card habits and reduced discretionary spending. Roughly 30% of adults reported using credit cards, taking out loans or borrowing from family and friends between June and December to pay for food, housing and gas. As the pandemic continued unfettered – aided by Republican non-leaders who still refuse to wear masks – see Senator Ted Cruz yesterday violating CDC guidelines and lying about it at a press conference. (Winter Storms Clobber Texas Small Businesses Unduly)

The fact remains that the number of people who reported using borrowed money and not regular income to pay their weekly expenses increased. In June 2020, 33.7 million adults were using debt but not income to pay their expenses. By late December, that number had jumped to 43.7 million adults, including 34.0 million living in households that suffered a loss of employment income since the start of the pandemic.

Consider: Only 15.7% of stimulus recipients reported using their first check to reduce debt, but about half of all recipient adults used their second one to do that. About 60% of adults in households that experienced a loss in employment income during the pandemic used their second stimulus check to pay down debt.

The new coronavirus relief package will provide much better benefits for people who were hurt by failed Republican policies – as much as $1,400 per person – in coming weeks.

Americans are about to receive stimulus checks through the American Rescue Plan Act that the Biden Administration pushed past the do-nothing Republicans.

“Pulse survey data show that households are struggling financially, with roughly 13 million adults reporting no confidence in their ability to pay their next month’s rent or mortgage.

“In this context, the data also show that stimulus checks are being widely used to pay basic expenses and to cut debt,” said Daniel J. Perez-Lopez and Lindsay M. Monte of the US Census yesterday in a review of Pulse Data.

The Household Pulse Survey is ongoing with close to real-time data about the well-being of American households during the pandemic. Future analyses of these data should provide important insights into the impact of the newest round of stimulus payments.

We need policies based on data, not politics based on demonstrably failed ideologies.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.