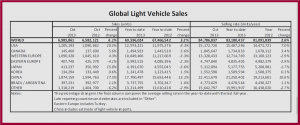

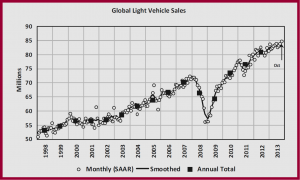

The global auto market during October is running at a record rate of close to 85 million light vehicles a year. China as usual is at the forefront of the increase with a historically strong selling rate of 22.4 million annually.

Sales are also increasing in other markets, with West European demand slowly moving upwards while Brazilian and Japanese sales were also strong, according to LMC.

North American markets remained solid even though the Republican shutdown of the U.S. federal government for the first two weeks of October spooked consumers, caused a temporary halt to vehicle sales and cost the economy an estimated $25 billion. In the U.S., auto sales recovered increasing 10% compared with the same month last year.

The corresponding SAAR of 15.2 million units matched September even though the model changeover was well underway and successfully completed by General Motors and Ford. Truck sales -up 9.4%- blew away car sales +3.2%, outpacing them for the tenth consecutive month.

West European light vehicle sales had a second month of improvements at 13.3 million units annually, the highest since the first half of 2012.

Light vehicle sales in Canada increased by 5.6% y-o-y in October translating into a SAAR of 1.8 million u nits/year, another strong result with the Canadian market now at record levels.

Europe

West European light vehicle sales posted a second month of improvements – at 13.3 million units annually, the highest since the first half of 2012. LMC once again claims that an upturn may finally be starting to emerge, perhaps sooner than expected.

“However, given the economic and political fragility in the region, it would be optimistic to expect a sustained period of increasing sales in the near future, though we do expect sales to start to steadily improve from 2014,” LMC said in a realse.

Sales in Russia fell to 2.74 million units/annually after a more encouraging result in September. Current loan incentives may not be having the desired positive effect. LMC thinks that negative risks for 2014 are growing.

Asia

Preliminary estimates indicate that the Chinese market has regained record-high sales. The holiday-adjusted October selling rate was 22.4 million light vehicles annually, slightly higher than September. On a year-on-year basis, sales were up 17.5% in October. Inventory at dealerships reportedly dropped to 1.19 months at the end of September, the lowest level since February 2013, which will boost deliveries to dealerships. Chinese consumers are encouraged by an improving economy, in particular rising property prices. Given low inventory, sales are expected to remain strong in the final months of 2013.

Japanese consumers are rushing to buy cars since the government announced that it would raise the consumption tax from the current 5% to 8% in April 2014. The selling rate surged to a five-month high of 5.3 million units annually in October and is expected to continue to rise before the tax hike.

In South Korea, the selling rate rebounded strongly to 1.6 million units/year in October after declining sharply due to holidays and labor strikes at Hyundai and Kia in September. Consumer confidence and spending are improving, as the government’s fiscal stimulus measures earlier this year are feeding through to the economy.

South America

The Brazilian market has shown surprising resilience in the face of rising interest rates and high inflation. The selling rate surged to 3.7 million vehicles annually during October, up nearly 12% from September, and reversing the downward trend evident since April. The expected end of the IPI tax cuts in December may have encouraged vehicle purchasing.

In Argentina, the selling rate is estimated to have surged to a record-high of 1 million units annually despite the rising risk of a financial crisis. Rampant inflation and the continuing sharp depreciation of the peso are encouraging consumers to spend on durable goods, such as new cars.