With more than 2 million sales added on an annual basis compared to last year, only Chrysler Group is outpacing industry growth as GM and Ford lag.

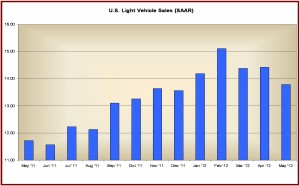

Chrysler, Ford and GM today posted the best May sales in years as the U.S. auto market continued its slow recovery to what looks to be shaping up as a 14 million unit year – the best since the collapse of the economy under the waning years of the Bush Administration. In terms of numbers, GM once again led with sales of 245,000 light cars and trucks – its highest in 33 months, followed by Ford Motor (209,000) and Chrysler Group (150,000).

The market appears to be slipping away from Ford and General Motors, though. Only Chrysler Group at 689,000 year-to-date for a 33% increase outraced industry growth of 13.4%. Ford Motor up 6.5% (933,000) and GM up a mere 2% at 1,067,000 badly lagged the auto sale expansion.

As is traditional from the Detroit Three, May sales volumes were heavily influenced by trucks, with the Ford F-Series leading at 55,000 units, followed by Chevy Silverado (35,000), Dodge Ram (26,000) and GMC Sierra (13,000). However, car sales are strong as well. The Chevrolet Malibu (30,000) and Cruze (20,000) at GM, followed by the Ford Fusion (27,000) and Focus (25,000) were testament to GM’s and Ford’s growing strengths at the heart of the car market where the Japanese Three are formidable competition.

Chrysler, the weakest member of the Detroit Three, has just started production of the Dodge Dart in the compact segment where it hasn’t been present since the Neon in the 1990s. The Group’s strongest selling car is the Chrysler 200 midsize sedan (13,000) and the large Dodge Avenger (11,000). Chrysler in compensation for its neglect of cars – is alone among the Detroit Three with minvans as Frod and GM were driven from the field in a rout by the Japanese. Chrysler continues to have strong sales of minivans, split between the Town & Country (10,000) and the Dodge Caravan (12,000).

All told, it was the Chrysler Group’s best sales in the month of May since 2007. Moreover, it should be noted that the Fiat 500, written off by many pundits after its slow sales start last year, posted sales of more than 4,000 units.

On a conference call with media, Ford also announced its third-quarter North American production plan. The company plans to build 690,000 vehicles in the third quarter, up 5% (34,000 vehicles) from the third quarter 2011, mainly accomplished by cancelling one week of the traditional two-week summer shutdown. Second quarter production of 730,000 vehicles is unchanged from the previous predictions.

Ford is scrambling to keep up with market growth, and by end of 2102 Ford will have added 400,000 units of additional capacity in North America, and it looks like it will still lose share, and maybe the Number Two U.S. sales spot to Toyota Motor Sales if the market keeps expanding.

Ford is in the process of converting plants to build the new 2013 Fusion and Escape as well as the Lincoln MKZ. Ford is capacity restrained and during May it could have sold more of ‘high demand” vehicles such as the Ford Fusion.