Leading the way in terms of percentage increases, once again, was the Fiat-owned Chrysler Group with sales of 163,381 vehicles, up 34% compared to March of 2011. The industry was up roughly 13% for the month and for Q1. It was Chrysler’s best monthly sales performance since March of 2008, which was just before the economy collapsed and sent Chrysler into bankruptcy.

However, the strong results were not enough to regain the Number Three position in U.S. sales, once Chrysler’s seeming birthright. Last year Chrysler briefly retook Number Three after the Japan Earthquake and Tsunami last when the Japanese makers were out of the market for months. No more. A resurgent Toyota sold more than 203,000 vehicles in March, a 15% gain.

“The combination of credit availability, an improving economy, pent-up demand and even high fuel prices encouraging people to acquire newer more fuel-efficient vehicles are all helping to drive industry sales,” said Reid Bigland, President and CEO – Dodge Brand and Head of U.S. Sales.

The U.S. market leader, General Motors Company, reported sales 231,000 vehicles – a 12% year-over-year gain, slightly below industry trend. Total GM passenger car sales increased 22%, with small and compact car sales up a combined 62%. Compact crossover sales were up 47% and mid-size car sales were up 38%. Even full-size pickup sales were up 14%. The Chevrolet brand increased its sales 17% year over year, and every Chevrolet car line was up.

“Since the last time fuel prices spiked, both the economy and GM’s product portfolio are undeniably stronger. We’re now strong across the board in cars, crossovers and trucks,” said Don Johnson, vice president, of GM’s U.S. Sales Operations.

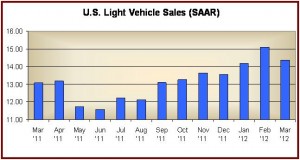

This statement of course applies to all of the Detroit Three, and the volatility of oil prices were cited by all sales executives today, and resulted in hedged statements about where the industry is headed. Johnson said he is optimistic the year will come in above 14 million units, a projection echoed at Toyota and Ford.

In second spot, Ford Motor Company posted its best March U.S. sales month since 2007 with 223,418 vehicles sold. The soon to be replaced Ford Fusion recorded its best month ever at 28,562 sedans. Overall, though, Ford only posted a 5% increase, which based on preliminary numbers of an industry increase of 13%, means it is under-performing the market as it has all year.

All of the Detroit Three continue to have weak spots – including the highest levels of incentives ranging from $2,500 to $3,300 a vehicle – as they face the resurgent Japanese and hard charging Korean automakers. However, all have critical car launches this year, which should keep the momentum going. One thing is becoming clearer as the year progresses – the offshore brands are coming back and the loyalty of their buyers remains as impressive as it remains a huge marketing challenge to the Detroit Three.