Chrysler Group LLC today said that it had a total year net loss in 2010 of $652 million based on revenues of $42 billion, and a net loss of $199 million in Q4 2010, compared to a loss of $84 million in Q3 2010.

Debt increased by $400 million in 2010 to $5.8 billion from 2009, as the revision of 10 models significantly increased costs and decreased revenue during their Q4 launch. All told, last year Chrysler revised 16 models in an attempt to make its showrooms competitive with its much larger rivals.

Cash or equivalents as of 31 December 2010 were $7.3 billion compared to $8.3 billion on 30 September 2010. Free cash flow for 2010 was $1.4 billion.

Chrysler is now making an operating profit, and is ahead of many of the assumptions of the business plan announced by CEO Sergio Marchionne in November of 2009 after it emerged from bankruptcy. However, the progress is overshadowed on the balance sheet by liabilities of $13.1 billion, with $1.3 billion in 2010 interest costs.

“We will be bottom line profitable in 2011,” said Marchionne, who also confirmed that bonuses would be disclosed next week for UAW hourly employees even though they increased the 2010 loss.

Marchionne acknowledged the skepticism surrounding a return to its 2007 market share next year by some analysts, but held firm that new products can provide the momentum.

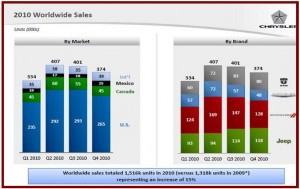

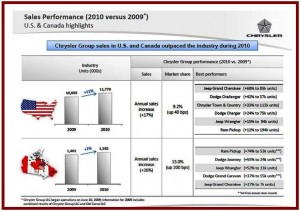

The Fiat and U.S. and Canadian taxpayer owned company sold 1,516,000 units during the year, an increase of 15%. U.S. market share for full year 2010 was 9.2%, versus 8.8% in 2009. Canadian market share increased to 13% for full-year 2010 compared to 11% in 2009.

Worldwide vehicle sales of 374,000 units for Q4 2010 represented a decrease of 7% (-27,000 units) compared to 401,000 units in Q3 2010, due mainly to reduced fleet volume associated with the new model changeovers in Q4.

Chrysler executives were guardedly optimistic about the outlook for 2011, even though more vehicle launches and large development costs for a Fiat-derived compact car to be launched by Dodge in 2012 are increasing fixed costs.

Sergio Marchionne predicted net revenues of more than $55 billion; modified operating profit of more than $2.0 billion; modified EBITDA of more than $4.8 billion; net income of $0.2 – $0.5 billion and a positive free cash flow of more than $1.0 billion.

Key to achieving this will be strong sales growth of Jeep internationally, and an increase of roughly 2% market share in the U.S. to 1.6 million. Chrysler’s estimates a U.S. Seasonally Adjusted Sales Rate of 12.7 million vehicles, the lowest of every “Ouija board” forecast, said Marchionne.

Still, Marchionne acknowledges the skepticism of returning to its 2007 market share.

“We can make $2 billion in operating profits if we sell 2 million cars,” said Marchionne. “Let us prove we can execute.