Click to Enlarge.

New US light-vehicle sales in June 2022 were down year-over-year and barely up from last month. June 2022’s SAAR of 13 million units was down 16% compared with June 2021, but up 2.3% compared with May 2022. June’s sales brought the second-quarter SAAR to a total of 13.4 million units, a decrease from the first quarter’s 14.1 million. According to Wards Intelligence, inventory at the start of June 2022 was down 25% year-over-year and was less than a third of the pre-pandemic level.

“The shortage of microchips continues to limit vehicle production, but it’s not the only hurdle. Numerous other supply chain disruptions have limited OEM production, and many OEMs continue to nearly complete their vehicles and park them while they await chips. Unfortunately, these supply chain issues will continue to limit new-vehicle production, inventory and sales levels for the rest of the year,” said Patrick Manzi, chief economist of the National Automobile Dealers Association.

“Additionally, the low interest rate environment of the past few years will shift from a tailwind to a headwind as the Federal Reserve continues to boost interest rates in an effort to rein in inflation. So far this year, the Fed has increased the federal funds rate three times, to a target range of 1.5 – 1.75%. More rate increases are a near certainty throughout the remainder of 2022. This means that average interest rates for new- and used-vehicle finance contracts should be back at or above their pre-pandemic levels before the end of the summer. Despite these challenges, demand for new vehicles remains strong, and we expect another great year for America’s franchised dealers,” said Manzi.

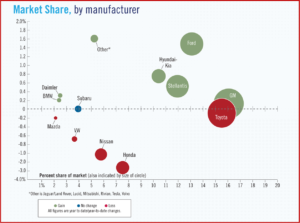

“While June tends to gain momentum as part of the robust summer selling season, that clearly has not happened this year, and we remain well below normal levels. General Motors led the market, ahead of Toyota by 26,000 units. Yet, the Toyota brand remained the market leader, outselling Ford by 8,000 units. At a model level, the F-150 was ahead of the RAV4 by just 200 units to reclaim the title of bestselling Light Vehicle. Tesla once again had the best YoY growth, helping the Premium segment account for 16.5% of sales, a record for June – and the third consecutive month above 16%,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

“However, key players returning to their normal spots in the sales ranking are not an indication that disruptions are over. Supply chain disruptions in Asia continue to impact volumes dis-proportionally. Acura, Mazda, Honda, Buick and Infiniti sold at least 45% fewer vehicles this June from last June, while base effect and fleet deliveries helped sales of 12 brands to grow this year,” said Amorim.

Average incentive spending per unit is projected to total $930, down 59.4% from June 2021, according to JD Power. With OEMs still prioritizing the production of higher-trimmed, more-expensive vehicles and further reducing incentives, the average transaction price is expected to set an all-time record in June. June 2022’s average transaction price, says J.D. Power, will likely total $45,844,an increase of 14.5% from the previous June.

Robust demand for used vehicles has helped keep prices for buyers’ trade-ins high all year. J.D. Power projects that consumers’ average trade-in equity will total a record-high $10,381. This represents an increase of 49.2% compared with a year ago and the first-time average trade-in equity has topped $10,000.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Demand Greater than Supply during June in US

Click to Enlarge.

New US light-vehicle sales in June 2022 were down year-over-year and barely up from last month. June 2022’s SAAR of 13 million units was down 16% compared with June 2021, but up 2.3% compared with May 2022. June’s sales brought the second-quarter SAAR to a total of 13.4 million units, a decrease from the first quarter’s 14.1 million. According to Wards Intelligence, inventory at the start of June 2022 was down 25% year-over-year and was less than a third of the pre-pandemic level.

“The shortage of microchips continues to limit vehicle production, but it’s not the only hurdle. Numerous other supply chain disruptions have limited OEM production, and many OEMs continue to nearly complete their vehicles and park them while they await chips. Unfortunately, these supply chain issues will continue to limit new-vehicle production, inventory and sales levels for the rest of the year,” said Patrick Manzi, chief economist of the National Automobile Dealers Association.

“Additionally, the low interest rate environment of the past few years will shift from a tailwind to a headwind as the Federal Reserve continues to boost interest rates in an effort to rein in inflation. So far this year, the Fed has increased the federal funds rate three times, to a target range of 1.5 – 1.75%. More rate increases are a near certainty throughout the remainder of 2022. This means that average interest rates for new- and used-vehicle finance contracts should be back at or above their pre-pandemic levels before the end of the summer. Despite these challenges, demand for new vehicles remains strong, and we expect another great year for America’s franchised dealers,” said Manzi.

“While June tends to gain momentum as part of the robust summer selling season, that clearly has not happened this year, and we remain well below normal levels. General Motors led the market, ahead of Toyota by 26,000 units. Yet, the Toyota brand remained the market leader, outselling Ford by 8,000 units. At a model level, the F-150 was ahead of the RAV4 by just 200 units to reclaim the title of bestselling Light Vehicle. Tesla once again had the best YoY growth, helping the Premium segment account for 16.5% of sales, a record for June – and the third consecutive month above 16%,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

“However, key players returning to their normal spots in the sales ranking are not an indication that disruptions are over. Supply chain disruptions in Asia continue to impact volumes dis-proportionally. Acura, Mazda, Honda, Buick and Infiniti sold at least 45% fewer vehicles this June from last June, while base effect and fleet deliveries helped sales of 12 brands to grow this year,” said Amorim.

Average incentive spending per unit is projected to total $930, down 59.4% from June 2021, according to JD Power. With OEMs still prioritizing the production of higher-trimmed, more-expensive vehicles and further reducing incentives, the average transaction price is expected to set an all-time record in June. June 2022’s average transaction price, says J.D. Power, will likely total $45,844,an increase of 14.5% from the previous June.

Robust demand for used vehicles has helped keep prices for buyers’ trade-ins high all year. J.D. Power projects that consumers’ average trade-in equity will total a record-high $10,381. This represents an increase of 49.2% compared with a year ago and the first-time average trade-in equity has topped $10,000.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.