Click to Enlarge.

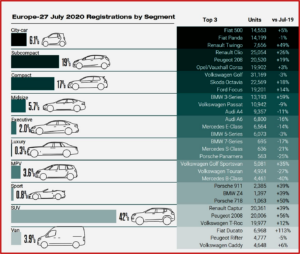

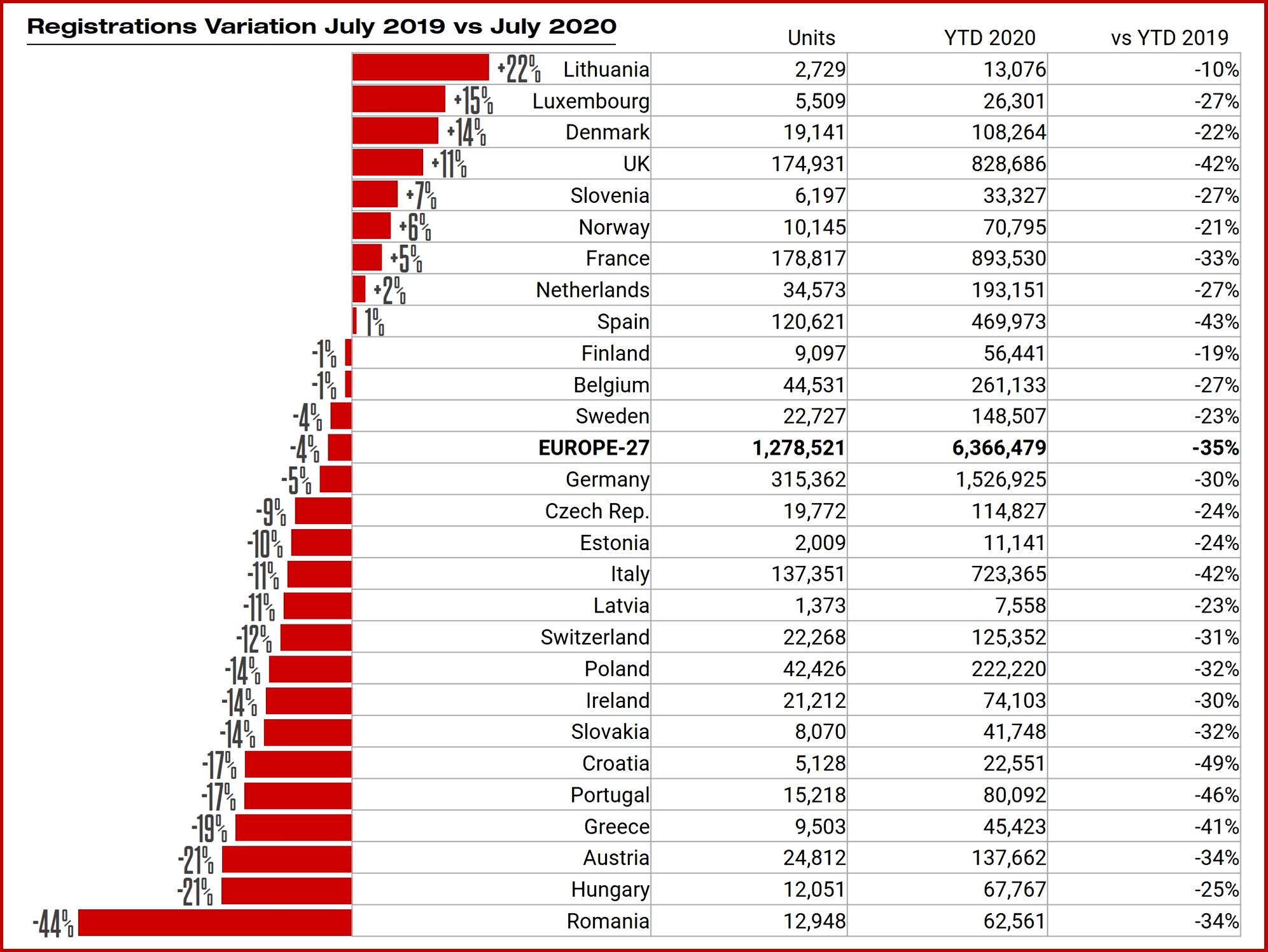

Data for 27 markets in Europe show that after several months of decline in registrations, July posted the highest monthly volume figures so far this year; and the highest since September last year. SUVs also set a record market share. The auto industry registered 1,278,521 new passenger vehicles, down by -4% month-on-month from 2019.

The global pandemic’s negative effect on the economy has not influenced consumer’s interest in electrified vehicles. July 2020 was a record-breaking month for EV registrations with volume up 131% year on year to 230,700. Though still small in relative terms, this is the first time that EVs were bought by more than 200,00 consumers in a single month.

How, when – or if – the pandemic will finally come to an end is unknown. Volumes since January fell by -35% to 6.37 million cars.

Consequently, EVs accounted for 18% of total registrations in July, far greater than their market share of 7.5% in July 2019, and 5.7% in July 2018. “The rise in demand for EVs is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices,” said Felipe Munoz, global analyst at JATO Dynamics.

- Half of these were powered by a hybrid engine (HEV), with demand increasing by 89%. The mild hybrid versions of the Ford Puma and Fiat 500 contributed to this result.

- Plug-in hybrids (PHEV) followed with 55,800 units, up by 365% from July 2019, and boosted by new models like the Ford-Kuga, Mercedes A class, BMW XC40 and BMW 3-Series.

- Finally, the pure electric cars (BEV) also showed positive results. Registrations jumped from 23,400 units in July 2019 to 53,200 just one year later, and the offer increased from 28 different models available to 38. New models like the Peugeot 209, Mini Electric, MG ZS, Porsche Taycan and Skoda Citigo buoyed the figures. Tesla posted a 76% decline to 1050 units following shipping delays to Europe, because of ongoing production problems in its Fremont, California plant.

Munoz said: “In contrast to the general trend of increasing demand for electric cars, Tesla is losing ground this year in Europe. Some of this can be explain by issues relating to the production continuity in California, but also by high competition from brands that play as locals in Europe.”

“Both private and business consumers are responding to the better market conditions,” Munoz commented. “If the current situation continues to improve, we could start to talk about a ‘V’ shaped recovery in the European car industry.”

Whether this is typical sales and marketing blather, or wishful thinking remains to be seen. How, when or if the pandemic will finally come to an end is unknown. Volumes since January fell by -35% to 6.37 million cars.

Still, demand recorded healthy figures in countries such as the United Kingdom, Denmark and France, alongside other small and mid-size markets. Much of this boost can be explained by an increased demand for green cars, and more discounting.

The increasing demand predominantly favors SUVs, with a wider offering, including more electrified versions. Like EVS, SUVs showed record results. Last month, they accounted for almost 42% of total registrations to 530,800 units, posting the highest monthly volume since July 2019.

Mid-size SUVs were the only segment to record a decrease of -6%, a contrast to the positive results seen from small (+9%), compact (+4%) and large/luxury SUVs (+14%). Overall SUV demand has grown fast due to the electrification of many of the models available. In July, 48% of the electrified vehicles registered were SUVs.

The greater availability of the 8th generation Volkswagen Golf helped this model to regain first place in the rankings, that was previously lost in June. However, it was not enough to offset the large drop posted by the outgoing 7th generation. In contrast, the Renault Clio was able to record a 26% increase, as 89% of its volume corresponded to the latest generation.

The Skoda Octavia, Peugeot 208, Renault Captur and Peugeot 2008 also posted double-digit growth due to recently launched new generations. Other big improvers include the Hyundai Kona (+56%), BMW 3-Series (+59%), Mini Hatch (+26%), Volvo XC40 (+66%), BMW X1 (+49%) and BMW 1-Series (+52%). The Renault Zoe and Kia Niro increased their registrations by 146% and 111% respectively.

Among the latest launches: Ford Puma (13,157 units at 24th position); Skoda Kamiq (8,736 units); Mazda CX-30 (5,494); Kia Xceed (5,201); Audi Q3 Sportback (4,183); Mercedes GLB (2,469); and Porsche Taycan (1,498).

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Electric Vehicles Set Record 18% EU Market Share in July

Click to Enlarge.

Data for 27 markets in Europe show that after several months of decline in registrations, July posted the highest monthly volume figures so far this year; and the highest since September last year. SUVs also set a record market share. The auto industry registered 1,278,521 new passenger vehicles, down by -4% month-on-month from 2019.

The global pandemic’s negative effect on the economy has not influenced consumer’s interest in electrified vehicles. July 2020 was a record-breaking month for EV registrations with volume up 131% year on year to 230,700. Though still small in relative terms, this is the first time that EVs were bought by more than 200,00 consumers in a single month.

How, when – or if – the pandemic will finally come to an end is unknown. Volumes since January fell by -35% to 6.37 million cars.

Consequently, EVs accounted for 18% of total registrations in July, far greater than their market share of 7.5% in July 2019, and 5.7% in July 2018. “The rise in demand for EVs is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices,” said Felipe Munoz, global analyst at JATO Dynamics.

Munoz said: “In contrast to the general trend of increasing demand for electric cars, Tesla is losing ground this year in Europe. Some of this can be explain by issues relating to the production continuity in California, but also by high competition from brands that play as locals in Europe.”

“Both private and business consumers are responding to the better market conditions,” Munoz commented. “If the current situation continues to improve, we could start to talk about a ‘V’ shaped recovery in the European car industry.”

Whether this is typical sales and marketing blather, or wishful thinking remains to be seen. How, when or if the pandemic will finally come to an end is unknown. Volumes since January fell by -35% to 6.37 million cars.

Still, demand recorded healthy figures in countries such as the United Kingdom, Denmark and France, alongside other small and mid-size markets. Much of this boost can be explained by an increased demand for green cars, and more discounting.

The increasing demand predominantly favors SUVs, with a wider offering, including more electrified versions. Like EVS, SUVs showed record results. Last month, they accounted for almost 42% of total registrations to 530,800 units, posting the highest monthly volume since July 2019.

Mid-size SUVs were the only segment to record a decrease of -6%, a contrast to the positive results seen from small (+9%), compact (+4%) and large/luxury SUVs (+14%). Overall SUV demand has grown fast due to the electrification of many of the models available. In July, 48% of the electrified vehicles registered were SUVs.

The greater availability of the 8th generation Volkswagen Golf helped this model to regain first place in the rankings, that was previously lost in June. However, it was not enough to offset the large drop posted by the outgoing 7th generation. In contrast, the Renault Clio was able to record a 26% increase, as 89% of its volume corresponded to the latest generation.

The Skoda Octavia, Peugeot 208, Renault Captur and Peugeot 2008 also posted double-digit growth due to recently launched new generations. Other big improvers include the Hyundai Kona (+56%), BMW 3-Series (+59%), Mini Hatch (+26%), Volvo XC40 (+66%), BMW X1 (+49%) and BMW 1-Series (+52%). The Renault Zoe and Kia Niro increased their registrations by 146% and 111% respectively.

Among the latest launches: Ford Puma (13,157 units at 24th position); Skoda Kamiq (8,736 units); Mazda CX-30 (5,494); Kia Xceed (5,201); Audi Q3 Sportback (4,183); Mercedes GLB (2,469); and Porsche Taycan (1,498).

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.