The negative local effects of a Global crisis: The auto industry is a key part of the UK economy at £78.9 billion in annual sales. Click to Enlarge.

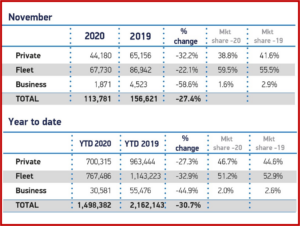

The UK new car market saw a decline last month again as registrations in November fell -27.4% year-on-year, or 42,840 units, according to the Society of Motor Manufacturers and Traders (SMMT). This means a – gasp- -£1.3 billion revenue drop in November as 42,840 fewer new cars than November of 2019 joined British roads at an average price of £30,000. The market is now down -30.7% year to date or 663,761 units.

During November when showrooms across England had to close due to new lockdown restrictions, the industry recorded 113,781 new registrations, taking trade back to levels last seen during the 2008 Great Recession.

SMMT observes the decline was less severe than that seen during the first lockdown – when registrations fell by a record -97.3% in April alone – largely because this time around, retailers and manufacturers were able to dispense vehicles via delivery or click and collect. Despite these innovations, private demand still fell by -32.2% while registrations by large fleets saw a decline of -22.1%.

Market share for battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) continued to grow significantly, up 122.4% and 76.9% respectively from an admittedly small base. BEVs recorded their third highest ever monthly share of registrations at 9.1%, while PHEV share increased to 6.8% – a combined total of more than 18,000 new zero-emission capable cars joining Britain’s roads. It just seems like they are all in front of you when you are on the road.

The automotive industry is a key part of the UK economy accounting for £78.9 billion in sales and £15.3 billion value added. With some 180,000 people employed directly in manufacturing and 864,000 across the wider automotive industry, it accounts for 13% of total UK export of goods and invests more than £3 billion each year in automotive R&D. More than 30 manufacturers build some 70 models in the UK supported by 2,500 component providers and skilled tradespeople and engineers.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

English Covid Crisis Reigns. November Auto Sales Drop 27.4%

The negative local effects of a Global crisis: The auto industry is a key part of the UK economy at £78.9 billion in annual sales. Click to Enlarge.

The UK new car market saw a decline last month again as registrations in November fell -27.4% year-on-year, or 42,840 units, according to the Society of Motor Manufacturers and Traders (SMMT). This means a – gasp- -£1.3 billion revenue drop in November as 42,840 fewer new cars than November of 2019 joined British roads at an average price of £30,000. The market is now down -30.7% year to date or 663,761 units.

During November when showrooms across England had to close due to new lockdown restrictions, the industry recorded 113,781 new registrations, taking trade back to levels last seen during the 2008 Great Recession.

SMMT observes the decline was less severe than that seen during the first lockdown – when registrations fell by a record -97.3% in April alone – largely because this time around, retailers and manufacturers were able to dispense vehicles via delivery or click and collect. Despite these innovations, private demand still fell by -32.2% while registrations by large fleets saw a decline of -22.1%.

Market share for battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) continued to grow significantly, up 122.4% and 76.9% respectively from an admittedly small base. BEVs recorded their third highest ever monthly share of registrations at 9.1%, while PHEV share increased to 6.8% – a combined total of more than 18,000 new zero-emission capable cars joining Britain’s roads. It just seems like they are all in front of you when you are on the road.

The automotive industry is a key part of the UK economy accounting for £78.9 billion in sales and £15.3 billion value added. With some 180,000 people employed directly in manufacturing and 864,000 across the wider automotive industry, it accounts for 13% of total UK export of goods and invests more than £3 billion each year in automotive R&D. More than 30 manufacturers build some 70 models in the UK supported by 2,500 component providers and skilled tradespeople and engineers.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.