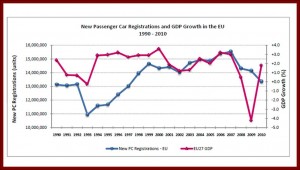

The European passenger car market shrank for the third straight year in 2010, with registrations declining by 5.5%, from 2009, according to the latest data just released from ACEA, the automakers’ trade group in the EU.

With a total of 13,360,599 new units registered throughout the year, manufacturing remains well below the peak of more than 16 million recorded in 2007 before the collapse of the global financial markets caused the ongoing Great Recession.

Relatively speaking, with the market off 5.5%, Renault Group stood out for its 4.4% improvement, as did BMW and Nissan, albeit on much smaller sales bases (725,000 and 390,000) that make percentage gains of 5.7% and 9.9% sound much more significant than they were in actual numbers.

As to the losers in 2010, Fiat Group and Ford stand out for large drops of 17% and 14% respectively. Each lost the equivalent in sales of the output of a final assembly plant. GM group also dropped 8% with all brands declining – Opel/Vauxhall, Chevrolet and of course the now sold Saab.

Volkswagen Group retained its dominant market share at 21.2%, 2.8m. VW was followed by these shares:

2. PSA Group with a 13.5%, 1.8m

3. Renault Group at 10.4%, 1.4m

4. GM at 8.7%, 1.2m

5. Ford at 8.1%, 1.1m

6. Fiat at 7.7%, 1m

7. BMW Group at 5.4%, 0.73m

8. Daimler at 4.9%, 0.7m

9. Toyota Group at 4.2%, 0.6m

10. Nissan at 2.9%, 0.4m

Unlike the U.S. a strong national component among buyers remains in play in Europe with cars from makers headquartered in the largest markets – Germany, France, United Kingdom, Italy and Spain , respectively – selling in large numbers.

Combined with government encouraged export activity, this makes the German automakers the automotive economic powers they are, even though German automakers pay the highest wages by far to autoworkers. German industrial policy also makes it very difficult to close plants and move jobs out out of Germany.

The surprise that occurred in 2009 when Toyota Group surpassed BMW and Daimler in European sales for the first time in history – has now been righted, at least from the German point of view. Toyota Group dropped 17%. This BMW and Daimler comeback occurred even though their home German market was off a staggering 23% to 2.9 million units after the end of lavish government scrappage subsidies.

Going forward we will see if The Germans can hold position as Toyota and Lexus recover from global recall and quality problems and introduce 11 Prius hybrid models to its global lineup in the next 23 months. Hybrids are Toyota’s strongest product line form a positive image point of view, and seven of them are all-new, not freshenings.

With the Euro common currency preventing depreciation and appreciation adjustments when trading occurs, and ongoing huge government deficits in many European countries, it’s not clear how the crisis will resolve itself.

Relatively speaking, with the market off 5.5%, Renault Group stood out for its 4.4% improvement, as did BMW and Nissan, albeit on much smaller sales bases ( 725,000 and 390,000) that make percentage gains of 5.7% and 9.9% sound much more significant than they were in actual numbers.

As to the losers in 2010, Fiat and Ford stand out for large drops of 17% and 14% respectively. Each lost the equivalent in sales of the output of a final assembly plant. GM group also dropped 8% with all brands declining – Opel/Vauxhall, Chevrolet and of course the now sold Saab.

Prospects for 2011 are troubled. Several effectively bankrupt countries – Portugal, Ireland, Greece, Spain and Belgium have triggered an ongoing financial crisis that has prompted austerity measures and a $1 trillion dollar bailout with as yet unknown results.