This ongoing EU crisis with the latest pending calamity is of more than passing interest to U.S. taxpayers.

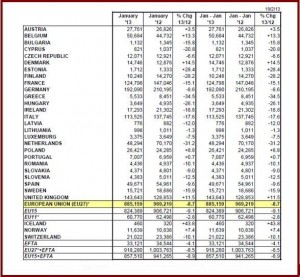

Passenger car registrations plummeted in the 27 markets of the EU during January of 2013 to 885,159 units. This is an historic low for January sales since the start of record keeping began in 1990 by ACEA, the automaker’s trade group.

Among the major markets, only the UK posted growth at 144,000 vehicles (+11.5%), while the former economic engine of Europe, Germany, posted a drop of -8.6% to 192,000 units. Spain, -9.6%, France, -15.1%, and Fiat’s home market of Italy, -17.6% all continue a freefall as unemployment rates grow, civil unrest increases and Eurocrats in Brussels fiddle.

The Italian elections this weekend pose the latest threat to the EU. If, as many observers predict, the new Parliament is split among warring factions, and/or perhaps worse, the disgraced Prime Minster Silvio Berlusconi is returned to power after resigning two years ago when he was facing criminal charges, then the Euro once again faces a run, possibly leading to a collapse with a deeper depression following in Western Europe.

A so -called common market with a “Balkanized” set of economies and warring leaders is a recipe for a collapse.

This pending calamity is of more than passing interest to U.S. taxpayers. The health of GM and Ford (both companies have accepted lavish U.S. government subsidies), as well as their shareholders is in harm’s way. Moreover, Chrysler employees via Fiat’s ownership – also U.S. government subsidized – are vulnerable to aftershocks of a deteriorating Europe, which could stop Chrysler’s resurgence if product programs are delayed or cancelled. (Chrysler Group Posts 2012 Net Income of $1.7 Billion)

Consider that GM’s 2012 earnings, while positive for the third straight year, were hurt by deepening losses in Europe. In January, GM’s sales there dropped -6% to 68,000 units. Europe has cost GM – zovirax billion since 1999, and -$1.8 billion in 2012 alone, in spite of GM’s best efforts to fix Opel Vauxhall. GM also wrote down more than $5 billion in assets in the Eurozone during the past year, and it also wrote off more than half of its new ownership of the PSA stock (-$220 million) it acquired last year in what it said was a collaboration that would save billions. Now the European Trade Commission is scrutinizing the French Government’s bailout of PSA Group, which could doom the company. GM is betting on PSA to help it recover in Europe by mid-decade, but PSA lost €5 billion in 2012. (GM Earns $4.9 Billion in 2012 down from $7.6 Billion in 2011)

Ford Motor is also bleeding oceans of cash in Europe, and its sales were clobbered in January, off -26% to 60,000, the largest drop among major automakers. While Ford’s 2012 earnings were $8 billion – virtually all derived from North America, it too lost a breathtaking $1.8 billion in Europe, with an operating margin of -6.6% on sales of 1.35 million vehicles. The loss was much higher than Ford had forecast, the result of the continuing deterioration of the European economy, which is outpacing Ford’s efforts to trim costs. Ford now expects full year 2013 results for Europe to be a loss of about $2 billion. (Ford Makes $8 Billion in 2012 – Almost all in North America)

In terms of absolute light vehicle sales, Germany remains the largest European market, followed by the UK, France (124,798) and Italy (113,525). Spain registered 49,671 new cars, slightly less than Belgium (50,684 units). Volkswagen Group remains by far the EU market leader with its 24% share. PSA Group is second with an 11.5% share, followed by Renault Group at 8.6%, GM at 7.7%, Ford Motor at 6.8% and Fiat Group at 6.7%.