Marchionne lowered his previous goal for Fiat and Chrysler to produce 6 million vehicles by 2014 to 14.6-14.8 million a year, up from a projected 4.2 million in 2012.

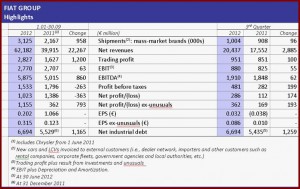

The Fiat Group in Turin today recorded a Q3 profit of €286 million or $371 million (2011 €112 m) as Chrysler earnings in North America offset losses in Europe. Without Chrysler, Fiat would have lost -€281 million in the quarter. Group revenues increased 16% to €20.4 billion as strong year-over-year volume growth in NAFTA, LATAM and APAC more than offset declines in Europe, which were particularly severe in Italy. Globally, the company shipped more than 1 million vehicles during the quarter.

CEO Sergio Marchionne said that to recover in Europe the Group would fill the existing five plants in Italy with upscale Alfa Romeo, Maserati and Jeep models by 2016 rather than closing some of them. Roughly 15% of Fiat’s capacity would be used for exports. “We have to stop chasing our own tail in Europe,” Marchionne said during a conference call with surprised to frankly skeptical analysts and media. “This plan is not for the faint hearted,” he said.

Marchionne explained that he had run the numbers both ways, and it makes no sense to him to close a plant in Italy when the Group is running at more than 100% of assembly capacity elsewhere in the world. “If I close a plant in Italy, I have to build another one somewhere else,” Marchionne said.

Trading profit for Q3 totaled €951 million (€851 million for Q3 2011) with strong performance in NAFTA, LATAM and APAC, while EMEA (Europe) reported a trading loss of -€238 million. Luxury and performance brands Maserati and Ferrari improved on their prior year’s strong performance with trading profit increasing 10% to €264 million. Year-to-date the two premium names have generated more than €2.1 billion in revenue. Measured the traditional Harbour way, named after consultant James Harbour who is famous for ranking plant productivity by the lowest number of hours it takes to build a car, the Ferrari plant is only running at 10% or so of capacity, but the margins and therefore the profits are excellent, as Marchionne likes to remind anyone listening.

Debt increased to €6.7 billion (€5.4 billion at the end Q2) due to “seasonal cash absorption” related to Fiat excluding Chrysler, and also hurt by market conditions in Europe and “significant” capital expenditure at Chrysler because of the launch of new and revised models. Total liquidity, including €3.0 billion in undrawn credit lines, was €20.0 billion down from €22.7 billion at end Q2, as Europe continues to bleed cash. Marchionne claimed that cash would not be a problem weathering the ongoing storm as he continues to try to fix Europe, where Fiat seems permanently mired in the low profit volume small car segments and sells 25% of its vehicles.

Given the economic uncertainty, Fiat Group confirmed 2012 guidance at the lower end of the range with revenues of about €83 billion and trading profit in excess of €3.8 billion. Net debt expected to decrease to approximately €6.5 billion from Q3 levels.

Marchionne also lowered his previous goal for Fiat and Chrysler to produce 6 million vehicles by 2014 to 14.6-14.8 million a year. Fiat expects to make 4.2 million cars this year.

|

Fiat Group Q3 2012 Income Statement |

|||||

| Q3 2012 | Q3 2011 | ||||

| € million | Fiat (a) | Fiat ex Chrysler | Fiat (b) | Fiat ex Chrysler | Change (a vs b) |

| Net Revenue | 20,437 | 8,490 | 17,552 | 8,813 | 16% |

| Trading Profit | 951 | 105 | 851 | 295 | 100 |

| EBIT (1) | 880 | 61 | 825 | 260 | 55 |

| EBITDA (2) | 1,910 | 596 | 1,848 | 823 | 62 |

| Profit (loss) before taxes | 481 | (129) | 282 | (74) | 199 |

| Profit (loss) | 286 | (281) | 112 | (210) | 174 |

| Profit (loss) ex unusuals | 362 | (231) | 169 | (150) | 193 |

| (1)Trading profit plus result from investments and unusual items(2) EBIT plus Depreciation and Amortization | |||||

Chrysler Group’s production plans for the Jeep brand have become the focus of public debate.

I feel obliged to unambiguously restate our position: Jeep production will not be moved from the United States to China.

North American production is critical to achieving our goal of selling 800,000 Jeep vehicles by 2014. In fact, U.S. production of our Jeep models has nearly tripled (it is expected to be up 185%) since 2009 in order to keep up with global demand.

We also are investing to improve and expand our entire U.S. operations, including our Jeep facilities. The numbers tell the story:

– We will invest more than $1.7 billion to develop and produce the next generation Jeep SUV, the successor of the Jeep Liberty — including $500 million directly to tool and expand our Toledo Assembly Complex and will be adding about 1,100 jobs on a second shift by 2013.

– At our Jefferson North Assembly Plant, where we build the Jeep Grand Cherokee, we have created 2,000 jobs since June 2009 and have invested more than $1.8 billion.

– In Belvidere, where we build two Jeep models, we have added two shifts since 2009 resulting in an additional 2,600 jobs.

With the increase in demand for our vehicles, especially Jeep branded vehicles, we have added more than 11,200 U.S. jobs since 2009. Plants producing Jeep branded vehicles alone have seen the number of people invested in the success of the Jeep brand grow to more than 9,300 hourly jobs from 4,700. This will increase by an additional 1,100 as the Liberty successor, which will be produced in Toledo, is introduced for global distribution in the second quarter of 2013.

Together, we are working to establish a global enterprise and previously announced our intent to return Jeep production to China, the world’s largest auto market, in order to satisfy local market demand, which would not otherwise be accessible. Chrysler Group is interested in expanding the customer base for our award-winning Jeep vehicles, which can only be done by establishing local production. This will ultimately help bolster the Jeep brand, and solidify the resilience of U.S. jobs.

Jeep is one of our truly global brands with uniquely American roots. This will never change. So much so that we committed that the iconic Wrangler nameplate, currently produced in our Toledo, Ohio plant, will never see full production outside the United States.

Jeep assembly lines will remain in operation in the United States and will constitute the backbone of the brand.

It is inaccurate to suggest anything different.- Sergio Marchionne 30 October 2012 11:55 AM

Fiat statement about meeting with trade unions to present 2012 third quarter results:

During today’s meeting with the trade union delegations, Fiat CEO Sergio Marchionne presented the Group’s third quarter results and outlook for the full year.

In the EMEA (Europe) region, there is no sign of improvement in economic conditions and it is expected that European and Italian auto markets will continue to face significant difficulties. Several automakers have announced plant closures and in France the government has intervened to save PSA.

Even in these circumstances, however, Fiat gave unions confirmation of its commitment to maintain existing production capacity in Italy and its intention not to reduce headcount, as long as there is continued availability of temporary layoff benefits provided under law.

The Company confirmed that investment will resume at all Italian plants where production based on the Group’s global platforms is to be allocated. This will enable full utilization of the existing workforce and significant expansion of the product offer. For manufacturing activities based in Turin, in addition to plans already announced for the Grugliasco plant and for production of the Alfa Romeo MiTo at Mirafiori, a family of upper segment passenger cars will also be produced for export to Europe and other international markets.

For the Melfi plant, the existing platform will also be used for production of SUV and crossover models. For Cassino, finally, a platform established with Chrysler will be used as the basis for development of new models, including for the export market.

These strategic choices, which represent a particularly significant commitment in the current economic environment, require full implementation of conditions for competitiveness agreed with the unions that signed the collective labor agreement with Fiat Group. All partners in this project need to actively defend it from those minority elements that are determined to block it against the interests of the nation and, even more importantly, the interests of workers.