Self-interest caveat: Pied Piper Management Company was founded in 2003 to help brands and manufacturers improve the performance of retail networks. Click to Enlarge.

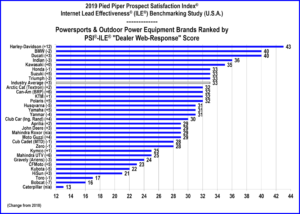

Harley-Davidson dealerships ranked highest in the 2019 Pied Piper PSI Internet Lead Effectiveness Industry Study*, which asks, “What happens when UTV or motorcycle customers visit a dealer website and inquire about a vehicle?”

Scores ranged from zero to 100, with 21% of dealerships nationwide scoring above 60%; 58% of scored below 40. Whether this means anything is debatable. Customers nationally received a personal reply* to their website inquiry within 24 hours 47% of the time on average. There was no correlation provided between survey results and whether the brands were Pied Piper customers.

Dealerships selling BMW or Ducati motorcycles were tied for second, followed by Indian and Kawasaki. Brands which improved the most from year-to-year were Harley-Davidson, BRP’s Can-Am brand, and Mahindra tractor dealers. Brands with the greatest decline from year to year were Bobcat, Kubota and Husqvarna.

Pied Piper sent customer inquiries through the individual websites of 4,208 dealerships, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email and telephone over the next 24 hours. Twenty different measurements generated a dealership’s PSI-ILE score.

The basic measurement is whether a customer buy viagra online received an email response of any type, even an automated reply, within 24 hours. Industry-wide, on average 18% of customers received no email reply of any type.

Pied Piper claims a more meaningful measurement is whether the customer received a personal email response within 24 hours. Ducati and BMW dealerships were the most likely to provide a personal email response within 24 hours, more than 60% of the time on average. Bobcat, Toro, Zero, Kubota and HiSun dealerships provided a personal email response within 24 hours less than 35% of the time on average.

“Consider how dramatically retailing has changed over the past 15 years,” said Pied Piper Management Company President and CEO Fran O’Hagan. “If you wonder where all the traditional customers have gone, look instead for customers attempting to interact through dealer websites. Today customers visit dealer websites before visiting in person, and today the opportunity for dealers to ‘meet’ first-time customers often happens on-line.”

*The 2019 Pied Piper Powersports & Outdoor Power Equipment Industry Study (U.S.A.) was conducted between September 2018 and March 2019 by submitting customer inquiries directly to the websites of 4,208 dealerships nationwide representing all major brands. Examples of other recent Pied Piper PSI studies are the 2018 Pied Piper PSI (In-Person) U.S. UTV Industry Study, in which BRP’s Can-Am brand was ranked first, the 2018 Pied Piper PSI-ILE (Internet) U.S. Auto Industry Study in which Mercedes-Benz was ranked first, and the 2019 Pied Piper PSI for EVs (In-Person) U.S. Auto Industry Study in which Tesla was ranked first.

Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI “mystery shop” evaluations—internet, telephone, or in-person—as tools to improve the sales effectiveness of their dealerships.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

For What It’s Worth – Harley-Davidson Tops Response Ratings

Self-interest caveat: Pied Piper Management Company was founded in 2003 to help brands and manufacturers improve the performance of retail networks. Click to Enlarge.

Harley-Davidson dealerships ranked highest in the 2019 Pied Piper PSI Internet Lead Effectiveness Industry Study*, which asks, “What happens when UTV or motorcycle customers visit a dealer website and inquire about a vehicle?”

Scores ranged from zero to 100, with 21% of dealerships nationwide scoring above 60%; 58% of scored below 40. Whether this means anything is debatable. Customers nationally received a personal reply* to their website inquiry within 24 hours 47% of the time on average. There was no correlation provided between survey results and whether the brands were Pied Piper customers.

Dealerships selling BMW or Ducati motorcycles were tied for second, followed by Indian and Kawasaki. Brands which improved the most from year-to-year were Harley-Davidson, BRP’s Can-Am brand, and Mahindra tractor dealers. Brands with the greatest decline from year to year were Bobcat, Kubota and Husqvarna.

Pied Piper sent customer inquiries through the individual websites of 4,208 dealerships, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email and telephone over the next 24 hours. Twenty different measurements generated a dealership’s PSI-ILE score.

The basic measurement is whether a customer buy viagra online received an email response of any type, even an automated reply, within 24 hours. Industry-wide, on average 18% of customers received no email reply of any type.

Pied Piper claims a more meaningful measurement is whether the customer received a personal email response within 24 hours. Ducati and BMW dealerships were the most likely to provide a personal email response within 24 hours, more than 60% of the time on average. Bobcat, Toro, Zero, Kubota and HiSun dealerships provided a personal email response within 24 hours less than 35% of the time on average.

“Consider how dramatically retailing has changed over the past 15 years,” said Pied Piper Management Company President and CEO Fran O’Hagan. “If you wonder where all the traditional customers have gone, look instead for customers attempting to interact through dealer websites. Today customers visit dealer websites before visiting in person, and today the opportunity for dealers to ‘meet’ first-time customers often happens on-line.”

*The 2019 Pied Piper Powersports & Outdoor Power Equipment Industry Study (U.S.A.) was conducted between September 2018 and March 2019 by submitting customer inquiries directly to the websites of 4,208 dealerships nationwide representing all major brands. Examples of other recent Pied Piper PSI studies are the 2018 Pied Piper PSI (In-Person) U.S. UTV Industry Study, in which BRP’s Can-Am brand was ranked first, the 2018 Pied Piper PSI-ILE (Internet) U.S. Auto Industry Study in which Mercedes-Benz was ranked first, and the 2019 Pied Piper PSI for EVs (In-Person) U.S. Auto Industry Study in which Tesla was ranked first.

Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI “mystery shop” evaluations—internet, telephone, or in-person—as tools to improve the sales effectiveness of their dealerships.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.