Click to enlarge.

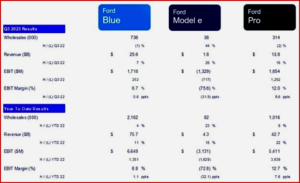

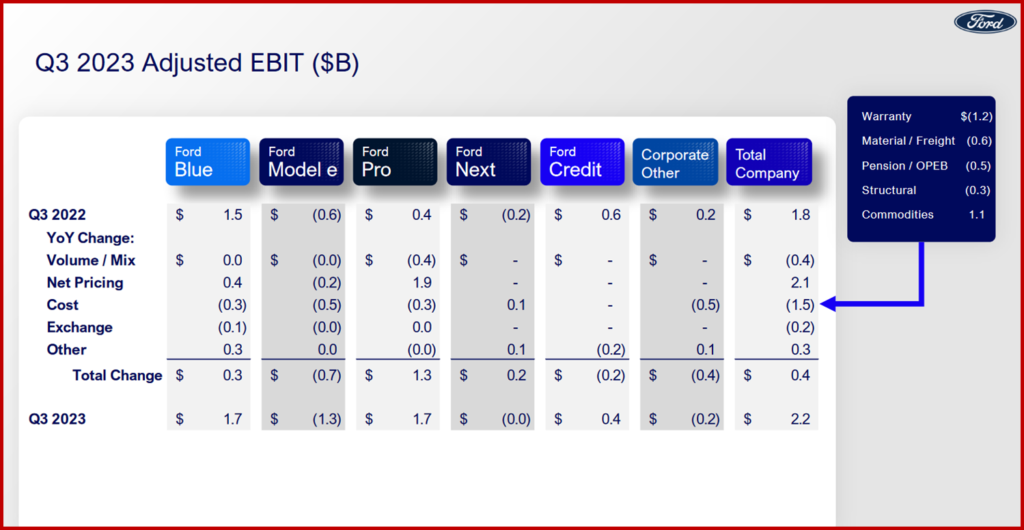

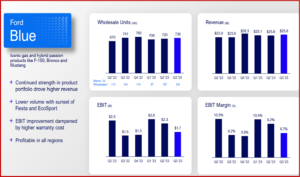

Ford Motor Company (NYSE: F) posted today Q3 revenue of $44 billion, up 11% from Q3 2022 on flat vehicle wholesales. Net income of $1.2 billion reversed a year-ago net loss of $827 million, which included a $2.7 billion non-cash, pretax impairment on Ford’s losing investment in Argo AI. Adjusted earnings before interest and taxes (EBIT), in Q3 increased to $2.2 billion.

“I’m very optimistic about the reality we’re creating with Ford+,” said President and CEO Jim Farley. “We’re building a more dynamic, highly talented and customer-focused company at the intersection of great vehicles, iconic brands, innovative software and high-value services.

Click for more data.

“We’re also radically changing how we work with a series of actions that put the right people with the right capabilities in the right places across the organization, so that our promise isn’t masked by cost and quality issues,” Farley claimed, echoing past CEOs going back three decades or more.

Ford revoked its 2023 earnings guidance with ratification of a tentative UAW labor contract pending.* Once again Ford Model e lost money – $1.3 billion on electric vehicles even though it reported 44% higher shipments of electric vehicles, and 26% revenue growth. This apparently ongoing operating loss was exacerbated by EV pricing pressure (Tesla price cuts), which AutoInformed thinks will continue.

Thus the traditional business goes…

Ford posted third-quarter U.S. sales increases in its gas, hybrid and electric vehicle lines; continued the lead of F-Series as America’s No. 1 truck, now in the 47th straight year; and was the top-selling brand in the United States through the first nine months of 2023.

Cash flow from operations was $4.6 billion in Q3 and $12.4 billion through the first nine months of 2023. Adjusted free cash flow for the same periods was $1.2 billion and $4.8 billion, respectively.

Ford’s balance sheet shows more than $29 billion in cash and $51 billion in liquidity at the end of Q3. That included a $4 billion contingent liquidity facility (credit line) that the company secured in August in anticipation of what it called business uncertainties.

In its latest attempt to address dreadful quality and cost issues, Ford last week completed a sequence of organizational changes in support of Ford+, creating an end-to-end global industrial system under, Kumar Galhotra (previously head of Ford Blue, the old internal combustion engine business) who was named chief operating officer.

Ford Credit Q3 earnings before taxes were $358 million, down from a year ago because of lower lease residuals and financing margin, along with a non-recurrence of gains in derivative market valuations.

*Full-Year 2023 Guidance

Through the third quarter, Ford earned $9.4 billion in adjusted EBIT toward the full-year range of $11 billion to $12 billion it affirmed in late July. Based on that and strong demand for Ford’s products, CFO John Lawler said that the company had been poised to deliver profitability within that range. However, given effects of the UAW strike and with ratification of the tentative agreement with the union that was announced Wednesday night pending, Ford withdrew its guidance for full-year 2023 operating results. Ford plans to report fourth-quarter and full-year 2023 financial results on Thursday 1 February 2024.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor 2023 Q3 Net income $1.2 Billion

Click to enlarge.

Ford Motor Company (NYSE: F) posted today Q3 revenue of $44 billion, up 11% from Q3 2022 on flat vehicle wholesales. Net income of $1.2 billion reversed a year-ago net loss of $827 million, which included a $2.7 billion non-cash, pretax impairment on Ford’s losing investment in Argo AI. Adjusted earnings before interest and taxes (EBIT), in Q3 increased to $2.2 billion.

“I’m very optimistic about the reality we’re creating with Ford+,” said President and CEO Jim Farley. “We’re building a more dynamic, highly talented and customer-focused company at the intersection of great vehicles, iconic brands, innovative software and high-value services.

Click for more data.

“We’re also radically changing how we work with a series of actions that put the right people with the right capabilities in the right places across the organization, so that our promise isn’t masked by cost and quality issues,” Farley claimed, echoing past CEOs going back three decades or more.

Ford revoked its 2023 earnings guidance with ratification of a tentative UAW labor contract pending.* Once again Ford Model e lost money – $1.3 billion on electric vehicles even though it reported 44% higher shipments of electric vehicles, and 26% revenue growth. This apparently ongoing operating loss was exacerbated by EV pricing pressure (Tesla price cuts), which AutoInformed thinks will continue.

Thus the traditional business goes…

Ford posted third-quarter U.S. sales increases in its gas, hybrid and electric vehicle lines; continued the lead of F-Series as America’s No. 1 truck, now in the 47th straight year; and was the top-selling brand in the United States through the first nine months of 2023.

Cash flow from operations was $4.6 billion in Q3 and $12.4 billion through the first nine months of 2023. Adjusted free cash flow for the same periods was $1.2 billion and $4.8 billion, respectively.

Ford’s balance sheet shows more than $29 billion in cash and $51 billion in liquidity at the end of Q3. That included a $4 billion contingent liquidity facility (credit line) that the company secured in August in anticipation of what it called business uncertainties.

In its latest attempt to address dreadful quality and cost issues, Ford last week completed a sequence of organizational changes in support of Ford+, creating an end-to-end global industrial system under, Kumar Galhotra (previously head of Ford Blue, the old internal combustion engine business) who was named chief operating officer.

Ford Credit Q3 earnings before taxes were $358 million, down from a year ago because of lower lease residuals and financing margin, along with a non-recurrence of gains in derivative market valuations.

*Full-Year 2023 Guidance

Through the third quarter, Ford earned $9.4 billion in adjusted EBIT toward the full-year range of $11 billion to $12 billion it affirmed in late July. Based on that and strong demand for Ford’s products, CFO John Lawler said that the company had been poised to deliver profitability within that range. However, given effects of the UAW strike and with ratification of the tentative agreement with the union that was announced Wednesday night pending, Ford withdrew its guidance for full-year 2023 operating results. Ford plans to report fourth-quarter and full-year 2023 financial results on Thursday 1 February 2024.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.