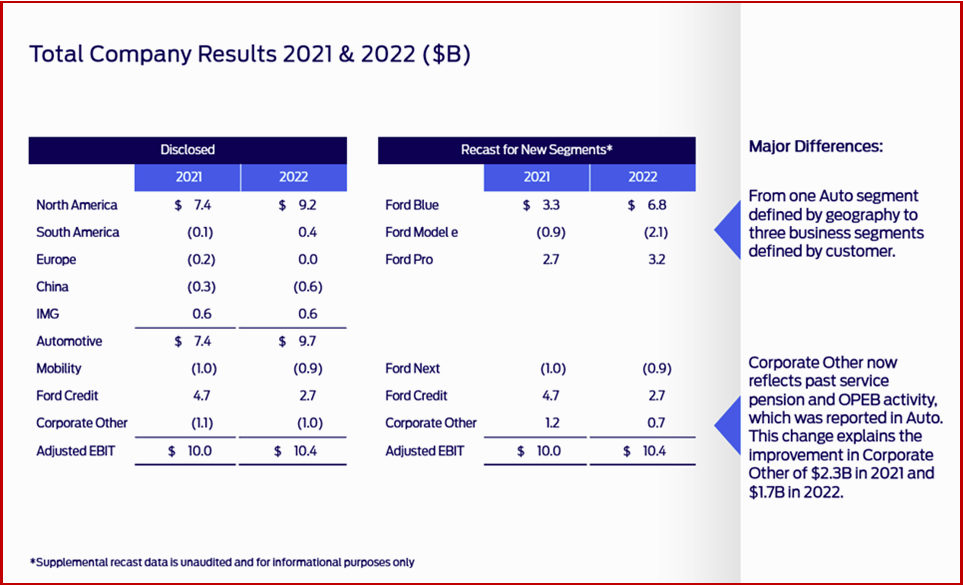

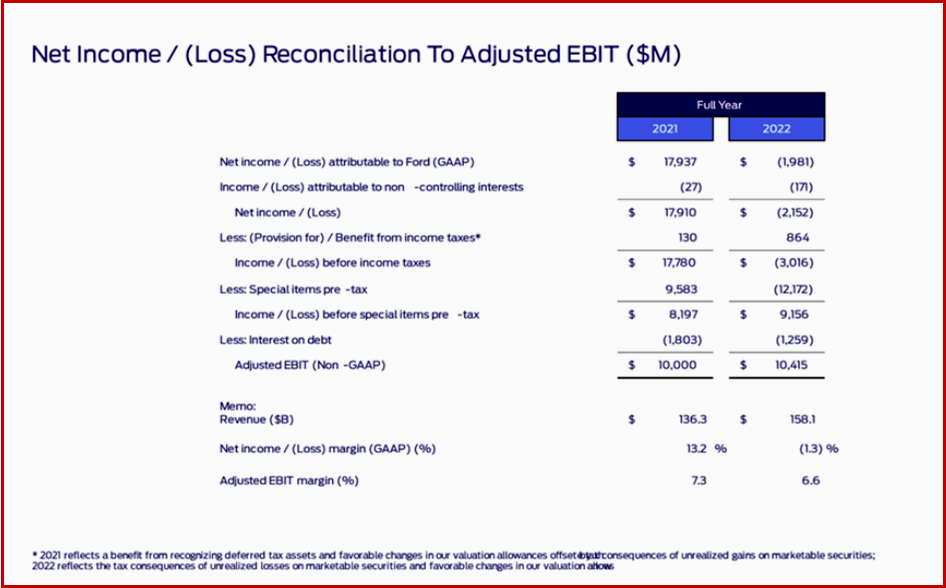

Ford Motor this morning told investors and analysts how the company is now organized and operating, adding that it will report financial results – based on three new global business segments that are focused on different automotive customers, rather than by geographic regions. Ford Motor reported a disappointing 2022 full-year net loss of $2.0 billion. During Q4 of 2022 Ford posted an adjusted EBIT $10.4 billion, and operating cash flow $1.2 billion for the quarter, $6.9 billion for the year. This was in stark contrast to GM, which reported a record $14.5 billion in earnings for 2022. (autoinformed.com on: Ford Misses Q4 and Full Year 2022 Forecasts. Loses $2B)

Click for more information.

Part of today’s presentation showed Ford’s nascent electric vehicle venture – Ford Model e – lost $3 billion before taxes during 2021 and 2022. More such losses are coming in the near term. Helping stem the tide of red ink, Ford Blue – its traditional internal combustion business – is forecast to post a $7 billion pretax profit in 2023, marginally better than last year. Ford Pro is forecast to earn $6 billion before taxes, almost double 2022 earnings. Other business units include corporate, Ford Credit and Ford Next, dubbed a new business incubator. (autoinformed.com on: John Dion to be Chief Transformation Officer at Struggling Ford; Ford Motor Structure Threatens Viability. Vast Reorg Coming)

Click for more information.

Ford’s goal is an 8% EBIT margin for its so-called Model e electrification by 2026. It is being pushed hard here by General Motors, Toyota and other global automakers as they compete in the capital markets. (autoinformed.com on: GM’s Dual Platform Strategy – Doubling Revenues by 2030?; GM Raises 2022 Earnings, Offers 2023-25 Performance Goals; New Toyota Motor President Koji Sato on Evolution)

Ford Changes in Financial Reporting

- Results will now be reported by Ford Blue (gasoline, diesel and hybrid vehicles), Ford Model e (EVs) and Ford Pro (commercial products, services), not by regional markets

- It was claimed, Ford+ will produce solid growth and sustained, healthy profitability and returns by deploying new technologies, achieving higher quality, lowering costs and complexity

- Ford Reconfirmed late-2026 margin targets of 10% for company adjusted EBIT and 8% for Ford Model e – the latter driven by increased EV production run rates

- Claims Ford Pro shows that software-enabled vehicles and services will generate value across all three segments

- Reaffirms full-year 2023 adjusted EBIT guidance of $9 billion to $11 billion; provides segment-level outlooks; plans to share more information at Capital Markets Day on May 22.

Click for more information.

“We’ve essentially ‘refounded’ Ford, with business segments that provide new degrees of strategic clarity, insight and accountability to the Ford+ plan for growth and value,” said CFO John Lawler. “It’s not only about changing how we report financial results; we’re transforming how we think, make decisions and run the company, and allocate capital for highest returns.”

Lawler claimed the new financial reporting will allow investors and analysts develop new models for projecting, tracking and valuing the individual and collective performances of Ford’s new segments, after decades of the business being managed and reporting financial results by regional markets.

Ford Controller Cathy O’Callaghan explained the three principles guiding the latest segmentation:

- Fairly representing the business models of each segment.

- Giving the Ford Blue, Ford Model e and Ford Pro teams the latitude and accountability for their success, and

- Being easy to understand and simple to execute, so that everyone can see how Ford is generating value for customers and other stakeholders

Ford plans to announce Q1 results on Tuesday, 2 May 2023. On 22 May 2023, Ford will host its next Capital Markets Day in Dearborn. Executives will provide “extensive updates on the strategic potential and progress of Ford+ and the company’s rapidly expanding capabilities in software and services, along with deep dives into plans and key performance indicators for each of the business segments.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor New Financial Reporting – Billions in EV Losses

Ford Motor this morning told investors and analysts how the company is now organized and operating, adding that it will report financial results – based on three new global business segments that are focused on different automotive customers, rather than by geographic regions. Ford Motor reported a disappointing 2022 full-year net loss of $2.0 billion. During Q4 of 2022 Ford posted an adjusted EBIT $10.4 billion, and operating cash flow $1.2 billion for the quarter, $6.9 billion for the year. This was in stark contrast to GM, which reported a record $14.5 billion in earnings for 2022. (autoinformed.com on: Ford Misses Q4 and Full Year 2022 Forecasts. Loses $2B)

Click for more information.

Part of today’s presentation showed Ford’s nascent electric vehicle venture – Ford Model e – lost $3 billion before taxes during 2021 and 2022. More such losses are coming in the near term. Helping stem the tide of red ink, Ford Blue – its traditional internal combustion business – is forecast to post a $7 billion pretax profit in 2023, marginally better than last year. Ford Pro is forecast to earn $6 billion before taxes, almost double 2022 earnings. Other business units include corporate, Ford Credit and Ford Next, dubbed a new business incubator. (autoinformed.com on: John Dion to be Chief Transformation Officer at Struggling Ford; Ford Motor Structure Threatens Viability. Vast Reorg Coming)

Click for more information.

Ford’s goal is an 8% EBIT margin for its so-called Model e electrification by 2026. It is being pushed hard here by General Motors, Toyota and other global automakers as they compete in the capital markets. (autoinformed.com on: GM’s Dual Platform Strategy – Doubling Revenues by 2030?; GM Raises 2022 Earnings, Offers 2023-25 Performance Goals; New Toyota Motor President Koji Sato on Evolution)

Ford Changes in Financial Reporting

Click for more information.

“We’ve essentially ‘refounded’ Ford, with business segments that provide new degrees of strategic clarity, insight and accountability to the Ford+ plan for growth and value,” said CFO John Lawler. “It’s not only about changing how we report financial results; we’re transforming how we think, make decisions and run the company, and allocate capital for highest returns.”

Lawler claimed the new financial reporting will allow investors and analysts develop new models for projecting, tracking and valuing the individual and collective performances of Ford’s new segments, after decades of the business being managed and reporting financial results by regional markets.

Ford Controller Cathy O’Callaghan explained the three principles guiding the latest segmentation:

Ford plans to announce Q1 results on Tuesday, 2 May 2023. On 22 May 2023, Ford will host its next Capital Markets Day in Dearborn. Executives will provide “extensive updates on the strategic potential and progress of Ford+ and the company’s rapidly expanding capabilities in software and services, along with deep dives into plans and key performance indicators for each of the business segments.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.