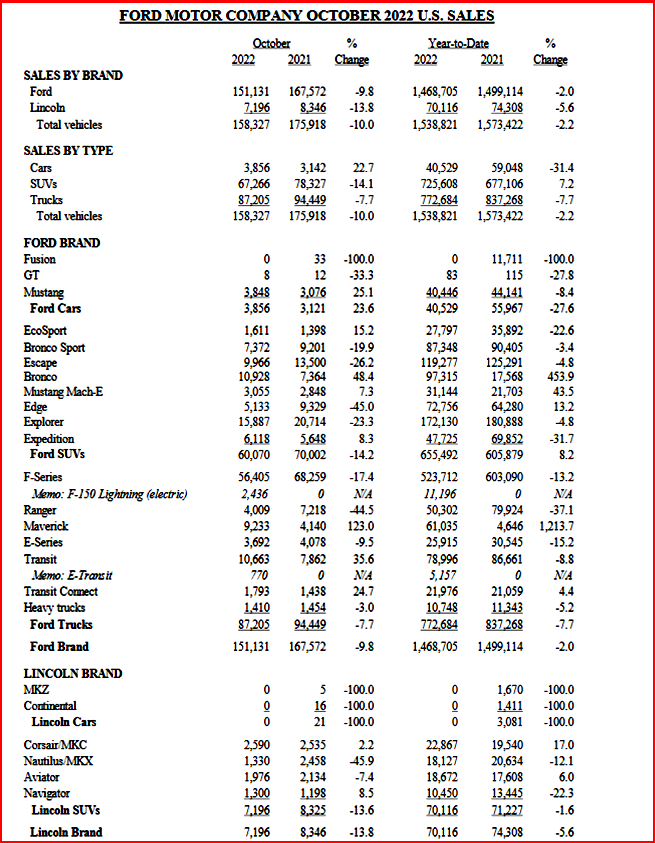

Ford Motor Company said today that its US vehicles sales at 158,327 during October of 2022 dropped 10% compared to the prior year, which was plagued by low inventory problems. Ford also claimed it remains the No. 2 EV brand behind Tesla in the US, although other automaker results for the month are not yet available. Preliminary data indicate the market grew by ~10%. GM sales were up ~50%. Ford said that Super Duty orders were ~50,000 in five days. (AutoInformed on: Ford – $700M to Louisville Plant for 2023 Super Duty Pickup; Ford Motor Posts Q3 Net Loss of $827 Million)

A look at the sales by model reveals that Ford is now essentially a truck and SUV maker with dwindling car sales of ~41,000 year-to-date. Lincoln sold no cars at all ytd. Mercedes Benz posted a huge increase in sales of more than 50%. The difficulty in analyzing what the data mean comes from what sales were from previously placed orders, and when the US will return to a normal sales environment, which might be undefinable at this time. Ford no longer holds sales calls for media and analysts.

Click for more informative.

In one case where Ford provided clarification, Bronco sales totaled 10,928 and were up 48.4%. Bronco is turning on dealer lots in just 9 days, with 91% of Bronco’s retail sales coming from previously placed orders. Combined, Bronco and Bronco Sport sales totaled 18,300 for the month, an increase of 10.5% compared to last year. Retail sales are comprised of ~50% of previously ordered vehicles with the wait time unspecified.

“Ford continues to see strong demand for its vehicles, with orders for ’23MY vehicles up 134% over this time last year. The all-new Super Duty saw a record 52,000 orders in just five days. The F-Series continued as America’s No. 1 truck, expanding its lead over our second-place competitor to more than 100,000 trucks this year. We doubled our electric vehicle sales. F-150 Lightning had its best monthly sales performance since launch,” said Andrew Frick, vice president, Sales, Distribution & Trucks, Ford Blue.

Ford Data Points

- Electric vehicle momentum continued in October with sales of its EV lineup up 120% over last year, about two times the rate of growth of the overall EV segment, claimed Ford.

- F-150 Lightning continues as America’s best-selling electric truck with sales of 2,436 – its best monthly sales performance since its introduction this year.

- America’s best-selling electric van, E-Transit, climbed 71.5% compared to September on sales of 770 vans.

- Mustang Mach-E sales grew 7.3% over last year on sales of 3,055

- Record demand for 2023 model-year vehicles continues with retail orders up 134% over 2022MY vehicles at this time last year. Orders for ’23MY vehicles totaled 255,000. For the seventh straight month, about 50% of retail sales came from previously placed orders. Year to date, retail share is up 1.2 percentage points.

- Order banks opened for the ’23MY Super Duty on Oct. 27th with over 52,000 total new orders placed in five days – averaging more than 10,000 orders per day.

- Bronco SUV sales continue to expand – up 48.4% in October on sales of 10,928 vehicles; 91% of Bronco’s retail sales are coming from previously placed orders.

- F-Series expands its lead through October as America’s best-selling truck on total sales of 523,712 vehicles. This extends F-Series’ lead over its second-place competitor to 105,427 trucks this year.

- Ford’s Maverick truck turned on dealer lots in just 6 days last month with sales up 123%. Maverick’s conquest rate is over 60%, with its top competitive conquests outside of pickups coming from Civic, Honda CR-V and Toyota’s RAV4.

- Ford’s BlueCruise and Lincoln ActiveGlide technology now has more than 97,000 customers enrolled. It has accumulated more than 28 million hands-free miles with a network of over 130,000 Blue Zone miles across North America.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor US Sales Drop 10% during October 2022

Ford Motor Company said today that its US vehicles sales at 158,327 during October of 2022 dropped 10% compared to the prior year, which was plagued by low inventory problems. Ford also claimed it remains the No. 2 EV brand behind Tesla in the US, although other automaker results for the month are not yet available. Preliminary data indicate the market grew by ~10%. GM sales were up ~50%. Ford said that Super Duty orders were ~50,000 in five days. (AutoInformed on: Ford – $700M to Louisville Plant for 2023 Super Duty Pickup; Ford Motor Posts Q3 Net Loss of $827 Million)

A look at the sales by model reveals that Ford is now essentially a truck and SUV maker with dwindling car sales of ~41,000 year-to-date. Lincoln sold no cars at all ytd. Mercedes Benz posted a huge increase in sales of more than 50%. The difficulty in analyzing what the data mean comes from what sales were from previously placed orders, and when the US will return to a normal sales environment, which might be undefinable at this time. Ford no longer holds sales calls for media and analysts.

Click for more informative.

In one case where Ford provided clarification, Bronco sales totaled 10,928 and were up 48.4%. Bronco is turning on dealer lots in just 9 days, with 91% of Bronco’s retail sales coming from previously placed orders. Combined, Bronco and Bronco Sport sales totaled 18,300 for the month, an increase of 10.5% compared to last year. Retail sales are comprised of ~50% of previously ordered vehicles with the wait time unspecified.

“Ford continues to see strong demand for its vehicles, with orders for ’23MY vehicles up 134% over this time last year. The all-new Super Duty saw a record 52,000 orders in just five days. The F-Series continued as America’s No. 1 truck, expanding its lead over our second-place competitor to more than 100,000 trucks this year. We doubled our electric vehicle sales. F-150 Lightning had its best monthly sales performance since launch,” said Andrew Frick, vice president, Sales, Distribution & Trucks, Ford Blue.

Ford Data Points

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.