Click to Enlarge.

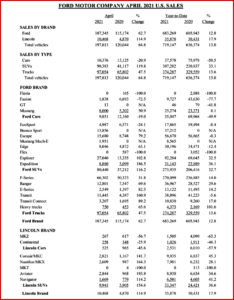

Ford Motor April US retail sales were up 57.1%, not only selling above 2020 April results, but also up 24% compared to pre-Covid pandemic April 2019 results. Together, retail truck and SUV sales were up 70% providing Ford Truck and SUV sales with their best April retail sales performance since 2006. Morgan Stanley said April’s SAAR – seasonally adjusted annual rate – of light-vehicle sales set a record high of 18.5 million units.

The Ford F-Series retail share expanded 2 percentage points through April of this year in the full-size pickup segment. F-Series retail sales themselves were up 20% for the month, beating April 2019 retail sales levels by 9.3%. Ford Brand SUVs posted higher April Sales on new Bronco Sport sales. Even Lincoln SUVs posted record April retail sales across the board in April, with a total of 9,943 SUVs sold.

New products and external market conditions – such as soaring used car prices – had Ford transaction pricing at record levels, with a 94% mix of trucks and SUVs. Ford transaction pricing in April totaled $43,600 per vehicle. Bronco Sport, turning on dealer lots in 13 days, produced an average transaction price of $31,800 per SUV – the highest in segment it appears. Mustang Mach-E is turning in 4 days on dealer lots and transacting at $45,800. Ford’s investment in trucks and SUVs is not only producing greater volume, but replaces sedans like the aging Fusion, which produced an average transaction price of $22,600 in April 2021.

Ford’s gross inventory at the end of April remains favorable relative to competitors, according to Ford – a debatable assertion since it also signals a lack of flexibility and response in trimming what are non-performing assets. Ford’s overall gross stock position going into May was 265,000 vehicles, which is at the higher end relative to the overall industry and stands at 35 days’ supply. This compares to an overall industry with 33 days’ supply. AutoInformed’s view is that the industry needs to reduce inventory with responsive, flexible policies and not boast about returning to former levels.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Rides Biden Administration’s Economic Recovery Surge and a Record April SAAR to a Good Sales Result

Click to Enlarge.

Ford Motor April US retail sales were up 57.1%, not only selling above 2020 April results, but also up 24% compared to pre-Covid pandemic April 2019 results. Together, retail truck and SUV sales were up 70% providing Ford Truck and SUV sales with their best April retail sales performance since 2006. Morgan Stanley said April’s SAAR – seasonally adjusted annual rate – of light-vehicle sales set a record high of 18.5 million units.

The Ford F-Series retail share expanded 2 percentage points through April of this year in the full-size pickup segment. F-Series retail sales themselves were up 20% for the month, beating April 2019 retail sales levels by 9.3%. Ford Brand SUVs posted higher April Sales on new Bronco Sport sales. Even Lincoln SUVs posted record April retail sales across the board in April, with a total of 9,943 SUVs sold.

New products and external market conditions – such as soaring used car prices – had Ford transaction pricing at record levels, with a 94% mix of trucks and SUVs. Ford transaction pricing in April totaled $43,600 per vehicle. Bronco Sport, turning on dealer lots in 13 days, produced an average transaction price of $31,800 per SUV – the highest in segment it appears. Mustang Mach-E is turning in 4 days on dealer lots and transacting at $45,800. Ford’s investment in trucks and SUVs is not only producing greater volume, but replaces sedans like the aging Fusion, which produced an average transaction price of $22,600 in April 2021.

Ford’s gross inventory at the end of April remains favorable relative to competitors, according to Ford – a debatable assertion since it also signals a lack of flexibility and response in trimming what are non-performing assets. Ford’s overall gross stock position going into May was 265,000 vehicles, which is at the higher end relative to the overall industry and stands at 35 days’ supply. This compares to an overall industry with 33 days’ supply. AutoInformed’s view is that the industry needs to reduce inventory with responsive, flexible policies and not boast about returning to former levels.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.