A rising U.S. economy with the Federal Reserve pumping money in at low rates per Trump will help U.S. sales – and his re-election.

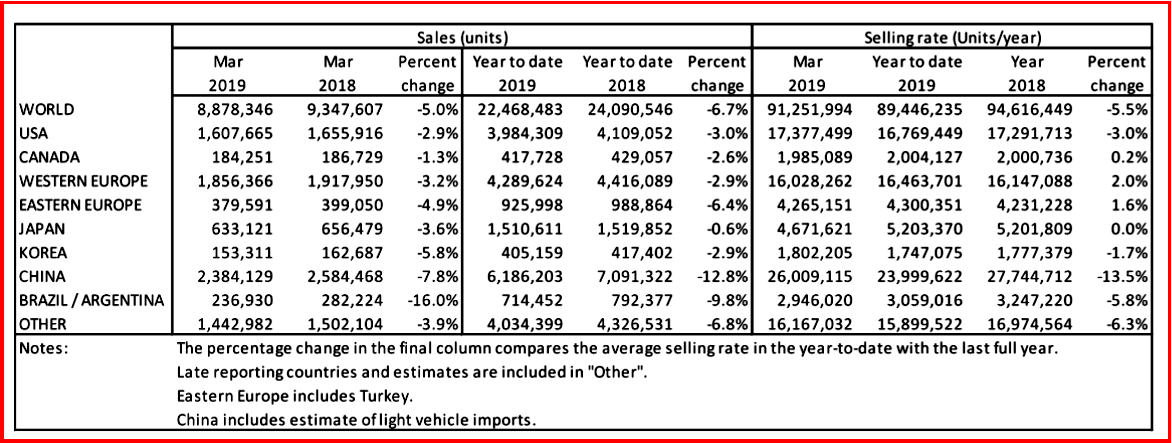

There was no growth in light vehicles sales anywhere during March as Global sales fell -5% in year-on-year. However, the selling rate picked up to 91 million units/year, a slight improvement over the first two months of the year. The slight nudge up came from an easing in YoY losses in China, and an improved selling rate in the USA. Consultancy LMC notes that Western Europe had a “disappointing month, while the Japanese, Korean and South American markets all continued to struggle in YoY terms.” (See AutoInformed on WLTP How Does It Work? Will it Work?)

North America

U.S. sales fell by -2.9% YoY in March but the 1.61 million units sold last month indicate an annualized selling rate of 17.4 million units/year, up by 1 million units/year from February. Retail sales plunged by 6.6% to 1.2 million units, while fleet deliveries soared by 10.1% to 411,000. Cash incentives were cut by more than 10% YoY, to $1,634. The quarter ended with 3.99 million units sold, down by -3.0% from Q1 2018.

Sales in Canada shrank once again in March – dropping by 1.3% YoY to 184,000 units – which also brought the selling rate down by 50,000 to 1.99 million units/year. This March result led to 418,000 units being sold in Q1, down by -2.6% YoY. Mexico also saw a decline in March, with sales falling 1% to 117,000 units, bringing the quarterly total to 331,000 LVs sold. March sales translate into a selling rate of 1.43 million units/year, up by 40,000 from February.

Europe

Western European sales fell by -3.2% YoY in March, in a setback for the region following two positive months after WLTP-related disruption in late 2018. The selling rate went into reverse, falling from 16.9 million units/year in February to 16.0 million units/year in March. For the first quarter of the year, LV sales across Western Europe are down -2.9% YoY. Brexit-related uncertainty and weak consumer confidence are currently casting a shadow over the Western European LV market.

Russian sales edged up by 1.8% in March to just over 160,000, with a selling rate stable at just under 1.9 million units/year. The re-launch of the ‘Family Car’ and ‘First Car’ preferential loan schemes from 1 March may have had a positive effect. “While the macroeconomic backdrop is still very unsettled, the outlook for both GDP and consumer spending is slightly more positive for 2019, helped by the upward trajectory in the oil price recently,” said LMC. The LMC forecast for 2019 sees LV sales rising by 5% to 1.89 million units.

China

Advance data indicate that sales (wholesales in a non-transparent market) in China rebounded in March. The Chinese New Year, which fell in February this year, might have pushed sales into March. The March selling rate was a three-month high of 26 million units/year, up nearly 17% from a now downwardly revised February. The YoY fall in wholesales shrank to about -8% in March, after two straight months of double-digit rate declines.

The economy has some signs of improvement from government programs, such as increased infrastructure projects, the recent substantial value-added tax (VAT) cuts, and lending growth that is focused on smaller companies. On the news positive manufacturing data, stock markets have rallied. Nonetheless, the trade dispute with the US is far from over and exports remain weak. “It is too early to see if the rebound in the economy and LV sales will be sustained.”

Other Asia

The Japanese market dove sharply for the third consecutive month in March. The March selling rate of 4.7 million units/year was nearly -9% lower than February, while sales were down -3.6% on a YoY basis. The positive impact of the number of new model launches over the past year has faded. The foggy global outlook is hurting consumer and business confidence. Sales are still expected to surge in the run-up to the planned consumption tax hike on 1 October 2019.

Despite global uncertainty, the South Korean market had a March selling rate at 1.8 million units/year, up over 4% from a relatively weak February. On a YoY basis, however, sales declined by -5.8% in March, dragged down by sluggish sales of imported diesel models. The shortage of WLTP-compliant models and the issue of diesel engine fires at BMW are a large part of weak import sales.

South America

With Carnival celebrated in March this year, but in February in 2018, sales in Brazil remained flat in March in YoY terms. LV sales inched down by -0.5% YoY to 200,000 units, or a selling rate of 2.5 million units/year. Nevertheless, Brazil’s recovery remains strong. Sales in Q1 totaled 581,000 LVs, up by 10% YoY.

Yes, cry for me Argentina: Weak macroeconomic conditions continue to hurt sales. March sales plunged by -54.3% YoY to just over 37,000 units – the worst result so far in 2019. The selling rate fell to 433,000 units/year, down by 112,000 from February. For the full quarter, the market plummeted by -49.3% YoY to 134,000 units.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales Drop -5% in March

A rising U.S. economy with the Federal Reserve pumping money in at low rates per Trump will help U.S. sales – and his re-election.

There was no growth in light vehicles sales anywhere during March as Global sales fell -5% in year-on-year. However, the selling rate picked up to 91 million units/year, a slight improvement over the first two months of the year. The slight nudge up came from an easing in YoY losses in China, and an improved selling rate in the USA. Consultancy LMC notes that Western Europe had a “disappointing month, while the Japanese, Korean and South American markets all continued to struggle in YoY terms.” (See AutoInformed on WLTP How Does It Work? Will it Work?)

North America

U.S. sales fell by -2.9% YoY in March but the 1.61 million units sold last month indicate an annualized selling rate of 17.4 million units/year, up by 1 million units/year from February. Retail sales plunged by 6.6% to 1.2 million units, while fleet deliveries soared by 10.1% to 411,000. Cash incentives were cut by more than 10% YoY, to $1,634. The quarter ended with 3.99 million units sold, down by -3.0% from Q1 2018.

Sales in Canada shrank once again in March – dropping by 1.3% YoY to 184,000 units – which also brought the selling rate down by 50,000 to 1.99 million units/year. This March result led to 418,000 units being sold in Q1, down by -2.6% YoY. Mexico also saw a decline in March, with sales falling 1% to 117,000 units, bringing the quarterly total to 331,000 LVs sold. March sales translate into a selling rate of 1.43 million units/year, up by 40,000 from February.

Europe

Western European sales fell by -3.2% YoY in March, in a setback for the region following two positive months after WLTP-related disruption in late 2018. The selling rate went into reverse, falling from 16.9 million units/year in February to 16.0 million units/year in March. For the first quarter of the year, LV sales across Western Europe are down -2.9% YoY. Brexit-related uncertainty and weak consumer confidence are currently casting a shadow over the Western European LV market.

Russian sales edged up by 1.8% in March to just over 160,000, with a selling rate stable at just under 1.9 million units/year. The re-launch of the ‘Family Car’ and ‘First Car’ preferential loan schemes from 1 March may have had a positive effect. “While the macroeconomic backdrop is still very unsettled, the outlook for both GDP and consumer spending is slightly more positive for 2019, helped by the upward trajectory in the oil price recently,” said LMC. The LMC forecast for 2019 sees LV sales rising by 5% to 1.89 million units.

China

Advance data indicate that sales (wholesales in a non-transparent market) in China rebounded in March. The Chinese New Year, which fell in February this year, might have pushed sales into March. The March selling rate was a three-month high of 26 million units/year, up nearly 17% from a now downwardly revised February. The YoY fall in wholesales shrank to about -8% in March, after two straight months of double-digit rate declines.

The economy has some signs of improvement from government programs, such as increased infrastructure projects, the recent substantial value-added tax (VAT) cuts, and lending growth that is focused on smaller companies. On the news positive manufacturing data, stock markets have rallied. Nonetheless, the trade dispute with the US is far from over and exports remain weak. “It is too early to see if the rebound in the economy and LV sales will be sustained.”

Other Asia

The Japanese market dove sharply for the third consecutive month in March. The March selling rate of 4.7 million units/year was nearly -9% lower than February, while sales were down -3.6% on a YoY basis. The positive impact of the number of new model launches over the past year has faded. The foggy global outlook is hurting consumer and business confidence. Sales are still expected to surge in the run-up to the planned consumption tax hike on 1 October 2019.

Despite global uncertainty, the South Korean market had a March selling rate at 1.8 million units/year, up over 4% from a relatively weak February. On a YoY basis, however, sales declined by -5.8% in March, dragged down by sluggish sales of imported diesel models. The shortage of WLTP-compliant models and the issue of diesel engine fires at BMW are a large part of weak import sales.

South America

With Carnival celebrated in March this year, but in February in 2018, sales in Brazil remained flat in March in YoY terms. LV sales inched down by -0.5% YoY to 200,000 units, or a selling rate of 2.5 million units/year. Nevertheless, Brazil’s recovery remains strong. Sales in Q1 totaled 581,000 LVs, up by 10% YoY.

Yes, cry for me Argentina: Weak macroeconomic conditions continue to hurt sales. March sales plunged by -54.3% YoY to just over 37,000 units – the worst result so far in 2019. The selling rate fell to 433,000 units/year, down by 112,000 from February. For the full quarter, the market plummeted by -49.3% YoY to 134,000 units.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.