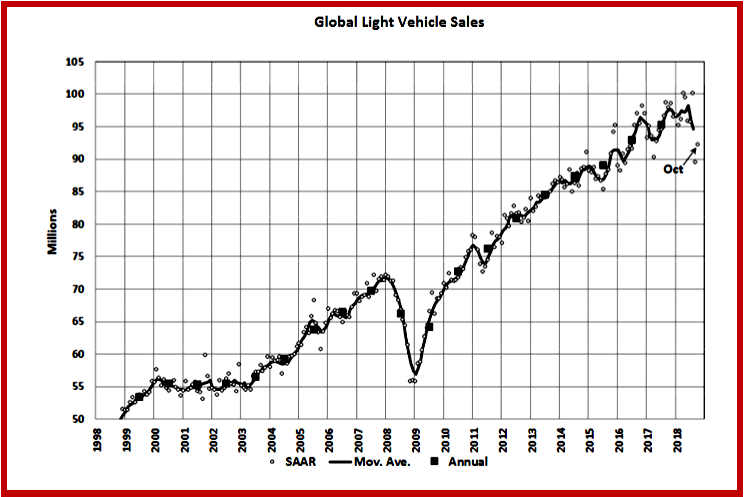

Global Light Vehicle (LV) sales fell 3.8% in year-on-year (YoY) terms in October, while the selling rate rose to 92.2 million units/year, from September’s 90.2 million units/year, according to consultancy LMC. The continuing cooling of the Chinese LV market is a significant influence over global sales, while Western Europe has been slow to recover from WLTP-related disruption (Worldwide Harmonized Light Vehicle Test Procedure). North American sales were virtually flat YoY in October, with some of the few areas of growth coming from Japan and Korea. (October Western European Passenger Car Sales Drop -7.3%, Brexit Panic Takes Hold. Auto Industry Urges – Begs? – Negotiators to Avert the Business Killing Worst-Case Scenario)

Global Light Vehicle (LV) sales fell 3.8% in year-on-year (YoY) terms in October, while the selling rate rose to 92.2 million units/year, from September’s 90.2 million units/year, according to consultancy LMC. The continuing cooling of the Chinese LV market is a significant influence over global sales, while Western Europe has been slow to recover from WLTP-related disruption (Worldwide Harmonized Light Vehicle Test Procedure). North American sales were virtually flat YoY in October, with some of the few areas of growth coming from Japan and Korea. (October Western European Passenger Car Sales Drop -7.3%, Brexit Panic Takes Hold. Auto Industry Urges – Begs? – Negotiators to Avert the Business Killing Worst-Case Scenario)

North America

U.S. consumers bought 1,358,000 LVs in October, just 0.5% more than in October 2017. Retail deliveries finished with 1,063,000 units sold, down by 0.3% YoY, while fleet deliveries rose by 3.5%, to 295,000 units. This translates to a selling rate of 17.6 million units/ year, down 3,000 from last month. As has been the case in other months, SUVs grew faster than the total industry. No news here.

October Canadian sales also remained flat from 2017, inching up by 0.03%, to 165,000 units. This October performance translates to a selling rate of 2.03 million units/year, which marks the seventh month this year that it has been above 2 million units/year.

Mexican sales fell for the 17th consecutive month, declining by 4.8% YoY, with the 117,000 units sold – translating into a selling rate of 1.4 million units/year.

Europe

West European LV registrations fell by 5.6% YoY in October, as WLTP continued to cast a shadow over the new car market. The regional selling rate edged up to 14.6 million units/year, from 13.2 million units/year in September. This left the region just 1% up in YoY year to date (YTD) terms, with the fact that some models were slow to become available again due to WLTP testing backlogs impacting October’s sales. With these issues now mostly worked through, we expect some recovery in the rest of the year.

Russian LV sales were up 8% in October, although the selling rate slowed to 1.68 million units/year from 1.75 million units/year units in September. We expect a boost to the market in November and December ahead of the VAT hike (from 18% to 20%) in January. LMC affirms its 2018 LV forecast (+12.5% YoY) followed by 7% growth in 2019.

Turkey’s LV market has collapsed in recent months, with October sales down 76% YoY, prompting the government to cut automotive taxes for November and December.

China

Amid global uncertainty, the Chinese market continues to decelerate. The October selling rate was 26.2 million units/year, down 1% from September. On a YoY basis, sales fell by 11% in October, the fourth straight month of YoY decline. Sales of lower-end vehicles were hit hard, as economic growth in lower-tier cities slowed abruptly.

The Chinese market is now set to register its first annual decline this century. The slowdown in sales can be attributed to several factors:

1) Consumers are holding off on vehicle purchases in the expectation that the government will launch a purchase tax cut (not announced).

2) The government is cracking down on the shadow banking system that has financed vehicle purchases, especially in rural areas.

3) The second-hand vehicle market is growing fast.

4) The planned implementation of the State VI emission standard in 2019 is delaying purchasing decisions.

Other Asia

The Japanese market accelerated in October, with the selling rate reaching a strong 5.5 million units/year. A very tight job market and slowly rising wages are helping to support consumer confidence and spending. On a YoY basis, sales increased by 12% in October, but that is because sales a year ago were depressed, as a result of the scandal at Nissan.

Sales in South Korea rebounded strongly in October after a weak September, due to distortions caused by the Chuseok holiday (in September this year, but in October last year). On a YoY basis, sales increased by 23% in October. With September and October combined, the selling rate averaged 1.77 million units/year, which is not exceptionally high, despite the ongoing temporary tax cut on Personal Vehicles.

South America

In Brazil, the election of the far-right Jair Bolsonaro as the next President boosted not only the country’s financial markets, but also LV sales. The selling rate soared to 2.9 million units/year in October, the highest rate since early 2015. Yet, such a strong pace may not be sustained, given the still high unemployment rate and the government’s fiscal austerity measures.

The October selling rate in Argentina was 545,000 units/year, up marginally from a weak September. On a YoY basis, however, sales continued to plummet (-37% in October), in the face of the ongoing financial crisis. The deteriorating economic conditions suggest that sales have not bottomed out yet.

In October 2018, registrations of new passenger cars continued to decline across the European Union (-7.3%), although at a more moderate pace than in September. The main cause is still the introduction of the new WLTP emissions test on 1 September, which resulted in an exceptional surge in registrations over the summer. As a result, demand for new cars fell in most EU countries last month, including the five major markets.

From January to October 2018, EU demand for passenger cars went up by 1.6% compared to one year ago. Looking at the five biggest car markets, Spain (+10.0%) saw the highest growth rates, followed by France (+5.7%) and Germany (+1.4%). By contrast, registrations declined in Italy (-3.2%) and the United Kingdom (-7.2%).