Click to Enlarge.

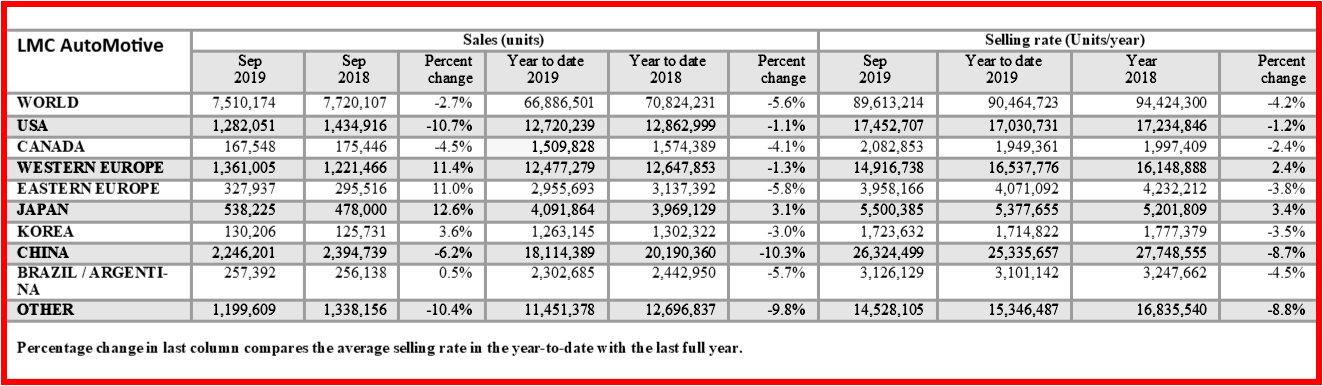

Global Light Vehicle (LV) sales fell 2.7% year-on-year (YoY) in September, while the selling rate dropped to 89.6 mn units/year, from 94.4 mn units/year in August, according to consultancy LMC.

In their view the decline in the selling rate in September seems partly a result of further changes to the WLTP** emissions testing regime in Europe, which may have pulled sales forward to August, at the expense of September. In China, LV sales dropped once again. Unfavorable calendar effects thwarted any chance of YoY growth in the US, even though the selling rate was good.

North America

With Labor Day weekend included in August sales this year, but in September last year, US LV sales plunged by 10.7% YoY to 1.28 mn last month. However, when August and September are combined, sales were flat (+0.2% YoY). The September annualized rate reached 17.45 mn units, up by 463,000 units from August. Vehicle prices rose by 3.2% to $37,655, but no surprise cash incentives grew at the same pace, up by 3.1% to $1,819. However, the calendar hurt retail sales, which fell by 13.2% YoY to 1.03 mn LVs.

After growing 0.4% YoY in August, Canadian LV sales fell by 4.5% YoY in September (preliminary number). Approximately 168,000 LVs were sold, which translates into a selling rate of 2.08 mn units/year, up by 185,000 units from last month. Mexico faced another negative month, with sales down to 100,00 units in September (-12.2% YoY). The selling rate dropped to 1.26 mn units/year from 1.31 mn units/year in August. Canada and Mexico of course are being hurt by President Trump’s “shoot from the lip” trade non-policy and the promise of a rewritten NAFTA is now just political vaporware.

Europe

Western European LV sales grew 11.4% YoY in September, due to a low base effect stemming from last year’s WLTP-related disruption. However, the selling rate fell to 14.9 mn units/year in September, from 19.1 mn units/year in August. Further changes to the WLTP procedure implemented on 1st September contributed to a pull-forward effect once again this year, inflating August’s sales, but September’s result was still weaker than expected. In the nine months of 2019 to date, only in September has the LV selling rate failed to reach 16 mn units/year. Germany’s car selling rate of just under 3.0 mn units/year was significantly below recent levels. The UK’s car selling rate of 2.0 mn units/year was also a deeply disappointing BREXIT chaos induced outcome.

Russian LV sales came in at 157,000 in September, meaning that the market declined by just 0.2% YoY. The selling rate was 1.77 mn units/year in September, compared to 1.59 mn units/year in August. The upward evolution in the selling rate is caused by the socialist re-introduction of the government’s preferential loan interest scheme from 1 July. Underlying demand in the Russian market still appears bland, although changes to fees levied on imports from January 2020 could pull sales forward to the end of 2019.

China

Advance data in the opaque China market indicates the selling rate is down to 26.3 mn units/year in September, after exceeding 27 mn units/year in the previous three months. September’s selling rate is higher than the average rate of 24 mn units/year between January and May this year. LMC claims it is premature to say that September was the beginning of the renewed downward trend. On a YoY basis, sales declined by 6.2% in September, the 15th consecutive month of decline, but that was change for the better than the double-digit falls earlier this year.

For the third month in a row, sales of electric vehicles fell sharply due to cuts in government subsidies. Sales (wholesales) in general continued to be disrupted by the timing of the launch of State VI- compliant vehicles, which varies depending on the region. Nonetheless, the falling inventory of State V- compliant vehicles and increasingly available State VI-compliant vehicles might help sales in the coming months, but the next Trump trade chaos wild card is unknown.

Other Asia

In Japan, sales did not surge strongly in September, despite the fact that the consumption tax hike was implemented on 1 October. While the September selling rate of 5.5 mn units/year was a good for Japan, it was weak, compared to the run-up to the last consumption tax hike in 2014. Consumers chose to save, instead of spending on new vehicles, before the tax hike.

The South Korean automotive market remains resilient, although the economy is facing big problems from global trade tensions. The September selling rate was 1.72 mn units/year, little changed from August. On a YoY basis, sales expanded by nearly 4%, the first YoY increase since January 2019.

South America

In Brazil, September’s annualized selling rate was the highest in Q3, at 2.74 mn units/year. The month ended with 223,000 LVs sold, up by 8.7% YoY. However, consumer intentions to buy durable goods has been down, with fleet demand accounting for an increased percentage of sales last month.

Argentina is on hold waiting for the 27 October presidential election, and September sales dropped by 32.6% YoY, virtually the same percentage change that was registered in August. The 34,000 units sold translate into an annualized rate of 386,000 units/year.

**WLTP

Under conditions defined by EU law, the Worldwide Harmonized Light Vehicle Test Procedure (WLTP) laboratory test is used to measure fuel consumption and CO2 emissions from passenger cars, as well as their pollutant emissions.

The old lab test – called the New European Driving Cycle (NEDC) – was designed in the 1980s and demonstrably prone to cheating by automakers who designed for the test, not real-world results. Due to evolution in technology – some of it programming deliberately used for cheating – and driving conditions, it became outdated.

After the scope of the Dieselgate scandal was revealed by American University and regulatory agency tests, an embarrassed European Union developed a new test, called the Worldwide Harmonized Light Vehicle Test Procedure (WLTP).

The EU automobile industry facing ruinous fines and company-threatening legal actions and lawsuits – the negative financial effects are still ongoing – had no choice but to the shift to WLTP and for better or worse has actively contributed to the development of this new apparently more honest test cycle.

While the old NEDC test determined passing values based on a theoretical driving profile, the WLTP cycle was developed using real-driving data, gathered from around the world. WLTP in theory represents everyday driving profiles and provides more truthful results.

The WLTP driving cycle is divided into four parts with different average speeds: low, medium, high and extra high. Each part contains a variety of driving phases, stops, acceleration and braking phases. For a certain car type, each powertrain configuration is tested with WLTP for the car’s lightest (most economical) and heaviest (least economical) versions.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales Fall Again in September

Click to Enlarge.

Global Light Vehicle (LV) sales fell 2.7% year-on-year (YoY) in September, while the selling rate dropped to 89.6 mn units/year, from 94.4 mn units/year in August, according to consultancy LMC.

In their view the decline in the selling rate in September seems partly a result of further changes to the WLTP** emissions testing regime in Europe, which may have pulled sales forward to August, at the expense of September. In China, LV sales dropped once again. Unfavorable calendar effects thwarted any chance of YoY growth in the US, even though the selling rate was good.

North America

With Labor Day weekend included in August sales this year, but in September last year, US LV sales plunged by 10.7% YoY to 1.28 mn last month. However, when August and September are combined, sales were flat (+0.2% YoY). The September annualized rate reached 17.45 mn units, up by 463,000 units from August. Vehicle prices rose by 3.2% to $37,655, but no surprise cash incentives grew at the same pace, up by 3.1% to $1,819. However, the calendar hurt retail sales, which fell by 13.2% YoY to 1.03 mn LVs.

After growing 0.4% YoY in August, Canadian LV sales fell by 4.5% YoY in September (preliminary number). Approximately 168,000 LVs were sold, which translates into a selling rate of 2.08 mn units/year, up by 185,000 units from last month. Mexico faced another negative month, with sales down to 100,00 units in September (-12.2% YoY). The selling rate dropped to 1.26 mn units/year from 1.31 mn units/year in August. Canada and Mexico of course are being hurt by President Trump’s “shoot from the lip” trade non-policy and the promise of a rewritten NAFTA is now just political vaporware.

Europe

Western European LV sales grew 11.4% YoY in September, due to a low base effect stemming from last year’s WLTP-related disruption. However, the selling rate fell to 14.9 mn units/year in September, from 19.1 mn units/year in August. Further changes to the WLTP procedure implemented on 1st September contributed to a pull-forward effect once again this year, inflating August’s sales, but September’s result was still weaker than expected. In the nine months of 2019 to date, only in September has the LV selling rate failed to reach 16 mn units/year. Germany’s car selling rate of just under 3.0 mn units/year was significantly below recent levels. The UK’s car selling rate of 2.0 mn units/year was also a deeply disappointing BREXIT chaos induced outcome.

Russian LV sales came in at 157,000 in September, meaning that the market declined by just 0.2% YoY. The selling rate was 1.77 mn units/year in September, compared to 1.59 mn units/year in August. The upward evolution in the selling rate is caused by the socialist re-introduction of the government’s preferential loan interest scheme from 1 July. Underlying demand in the Russian market still appears bland, although changes to fees levied on imports from January 2020 could pull sales forward to the end of 2019.

China

Advance data in the opaque China market indicates the selling rate is down to 26.3 mn units/year in September, after exceeding 27 mn units/year in the previous three months. September’s selling rate is higher than the average rate of 24 mn units/year between January and May this year. LMC claims it is premature to say that September was the beginning of the renewed downward trend. On a YoY basis, sales declined by 6.2% in September, the 15th consecutive month of decline, but that was change for the better than the double-digit falls earlier this year.

For the third month in a row, sales of electric vehicles fell sharply due to cuts in government subsidies. Sales (wholesales) in general continued to be disrupted by the timing of the launch of State VI- compliant vehicles, which varies depending on the region. Nonetheless, the falling inventory of State V- compliant vehicles and increasingly available State VI-compliant vehicles might help sales in the coming months, but the next Trump trade chaos wild card is unknown.

Other Asia

In Japan, sales did not surge strongly in September, despite the fact that the consumption tax hike was implemented on 1 October. While the September selling rate of 5.5 mn units/year was a good for Japan, it was weak, compared to the run-up to the last consumption tax hike in 2014. Consumers chose to save, instead of spending on new vehicles, before the tax hike.

The South Korean automotive market remains resilient, although the economy is facing big problems from global trade tensions. The September selling rate was 1.72 mn units/year, little changed from August. On a YoY basis, sales expanded by nearly 4%, the first YoY increase since January 2019.

South America

In Brazil, September’s annualized selling rate was the highest in Q3, at 2.74 mn units/year. The month ended with 223,000 LVs sold, up by 8.7% YoY. However, consumer intentions to buy durable goods has been down, with fleet demand accounting for an increased percentage of sales last month.

Argentina is on hold waiting for the 27 October presidential election, and September sales dropped by 32.6% YoY, virtually the same percentage change that was registered in August. The 34,000 units sold translate into an annualized rate of 386,000 units/year.

**WLTP

Under conditions defined by EU law, the Worldwide Harmonized Light Vehicle Test Procedure (WLTP) laboratory test is used to measure fuel consumption and CO2 emissions from passenger cars, as well as their pollutant emissions.

The old lab test – called the New European Driving Cycle (NEDC) – was designed in the 1980s and demonstrably prone to cheating by automakers who designed for the test, not real-world results. Due to evolution in technology – some of it programming deliberately used for cheating – and driving conditions, it became outdated.

After the scope of the Dieselgate scandal was revealed by American University and regulatory agency tests, an embarrassed European Union developed a new test, called the Worldwide Harmonized Light Vehicle Test Procedure (WLTP).

The EU automobile industry facing ruinous fines and company-threatening legal actions and lawsuits – the negative financial effects are still ongoing – had no choice but to the shift to WLTP and for better or worse has actively contributed to the development of this new apparently more honest test cycle.

While the old NEDC test determined passing values based on a theoretical driving profile, the WLTP cycle was developed using real-driving data, gathered from around the world. WLTP in theory represents everyday driving profiles and provides more truthful results.

The WLTP driving cycle is divided into four parts with different average speeds: low, medium, high and extra high. Each part contains a variety of driving phases, stops, acceleration and braking phases. For a certain car type, each powertrain configuration is tested with WLTP for the car’s lightest (most economical) and heaviest (least economical) versions.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.