Click to Enlarge.

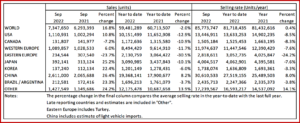

The Global Light Vehicle selling rate ended a four-month growth streak in September by falling to 85.8 million units/year from a high of 91 million units/year seen in August, according to data just released by the respected LMC Automotive* consultancy. The year‐to‐date (YTD) raw sales figure is down 2.0% from the weak base of 2021.

However, LMC noted that notwithstanding a reduced global selling tempo, China’s market remained “robust with year-to-date growth of 8.0%. North America and Europe, however, both experienced a sharp decline in their selling rates as supply issues continued to affect these markets.”

Some notable items:

US Light Vehicle (LV) sales grew by 10.8% YoY in September, to 1.1 million units. While this was the second consecutive month of YoY increases, it was helped by weak sales in H2 2021. The selling rate was 13.5 million units/year, the best since April. “However, there are signs of the market slowing. Inventory levels increased 12.6% from last month and are the highest since May 2021,” said LMC.

Canadian LV sales are estimated to have dropped by -7.2% YoY in September, to 132k units. While the selling rate would therefore have increased to 1.5 million units/year, the highest since March, in volume it was the fourth lowest month of the year. This is an indication that increasing inflation and interest rates are likely having a cooling effect, according to LMC.

The West European selling rate decreased to 12.0 million units/year in September, from 14.3 million units/year in August. Most of the major West European countries experienced slower sales, predominantly driven by supply constraints. Registration numbers grew 6.0% YoY to 1.1 million units, with the YTD selling rate -7.6% lower than the 202.

The East European selling rate grew slightly from the previous month to 2.8 million units/year, down -24.2% year‐to‐date, with the war in Ukraine continuing to restrict supplies. Moreover, Russia’s sales are “crushed by sanctions and other related actions and, as a result, hamper the region’s sales activity.”

Sales in Japan remain volatile due to supply disruptions. After a strong increase in August, the September selling rate slowed sharply to 4 million units/year. In YoY terms, however, sales increased for the first time in 15 months as parts shortages decrease. EV sales are gaining, although EV share is still small at less than 3% of total Passenger Vehicle sales.

The Korean market speed up in September, as the parts supply improved significantly. The September selling rate reached a 15‐month high of 1.74 million units/year, up over 4% from a lackluster August. “Almost all Korean OEMs registered double‐digit YoY growth in production and both domestic and export sales. (Note, YoY comparisons are not distorted by the lunar Chuseok holiday, as the number of selling days in September 2022 was the same as a year ago.) Yet, demand continues to outstrip supply and sales volumes are being driven by supply‐side factors,” LMC said.

*LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales Fall in September

Click to Enlarge.

The Global Light Vehicle selling rate ended a four-month growth streak in September by falling to 85.8 million units/year from a high of 91 million units/year seen in August, according to data just released by the respected LMC Automotive* consultancy. The year‐to‐date (YTD) raw sales figure is down 2.0% from the weak base of 2021.

However, LMC noted that notwithstanding a reduced global selling tempo, China’s market remained “robust with year-to-date growth of 8.0%. North America and Europe, however, both experienced a sharp decline in their selling rates as supply issues continued to affect these markets.”

Some notable items:

US Light Vehicle (LV) sales grew by 10.8% YoY in September, to 1.1 million units. While this was the second consecutive month of YoY increases, it was helped by weak sales in H2 2021. The selling rate was 13.5 million units/year, the best since April. “However, there are signs of the market slowing. Inventory levels increased 12.6% from last month and are the highest since May 2021,” said LMC.

Canadian LV sales are estimated to have dropped by -7.2% YoY in September, to 132k units. While the selling rate would therefore have increased to 1.5 million units/year, the highest since March, in volume it was the fourth lowest month of the year. This is an indication that increasing inflation and interest rates are likely having a cooling effect, according to LMC.

The West European selling rate decreased to 12.0 million units/year in September, from 14.3 million units/year in August. Most of the major West European countries experienced slower sales, predominantly driven by supply constraints. Registration numbers grew 6.0% YoY to 1.1 million units, with the YTD selling rate -7.6% lower than the 202.

The East European selling rate grew slightly from the previous month to 2.8 million units/year, down -24.2% year‐to‐date, with the war in Ukraine continuing to restrict supplies. Moreover, Russia’s sales are “crushed by sanctions and other related actions and, as a result, hamper the region’s sales activity.”

Sales in Japan remain volatile due to supply disruptions. After a strong increase in August, the September selling rate slowed sharply to 4 million units/year. In YoY terms, however, sales increased for the first time in 15 months as parts shortages decrease. EV sales are gaining, although EV share is still small at less than 3% of total Passenger Vehicle sales.

The Korean market speed up in September, as the parts supply improved significantly. The September selling rate reached a 15‐month high of 1.74 million units/year, up over 4% from a lackluster August. “Almost all Korean OEMs registered double‐digit YoY growth in production and both domestic and export sales. (Note, YoY comparisons are not distorted by the lunar Chuseok holiday, as the number of selling days in September 2022 was the same as a year ago.) Yet, demand continues to outstrip supply and sales volumes are being driven by supply‐side factors,” LMC said.

*LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.