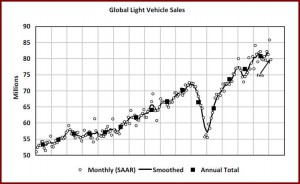

Global light vehicles sales slowed in February for a seasonally adjusted annualized rate or SAAR of 79.7 million units. Some of the decrease was due to the timing of the Chinese New Year holiday during the month instead of the usual January celebration. The consultancy LMC Automotive noted that the first two months taken together are running as 82.7 million units per year, and is likely a more stable measure of recent demand levels.

The U.S. market continued to recover, with Japan also posting solid results, while slumping markets in Western Europe remain a continuing cause for concern as it the Eurozone crisis showed no sign of abating as Light Vehicle sales in the region fell by 11%. The outlook for 2013 in total is for a further decline. East European demand continues to improve steadily, with Russian sales close to an annualized 2.9 million units, up 2%, year-on-year. Overall European light vehicle sales were down by 8% as the small gains in the East were not sufficient to offset losses in the West.

China – after reaching a record-high of 23.8 million annually in January – declined by -22% to 18.5 million. Nonetheless, the selling rate averaged 21.2 million units during the first two months of this year, compared with an average of 19.7 million units during Q4 of 2012.

LMC’s 2013 forecast remains unchanged at 21 million units, since it thinks as there is a “good chance that the selling rate will moderate in the coming months.” The Chinese central bank has already started to remove liquidity from the market and several major cities have tightened housing loans in the face of the renewed risk of a property bubble. Moreover, government measures to reduce air pollution in big cities could negatively affect the economy and vehicle sales.

- In Japan, the selling rate continued to climb to a 5.2 million units/year in February, mirroring the stock market rally, the weakening yen, and rising consumer and investor confidence. How sustainable the rally will be is unknown.

- In Korea, the selling rate declined for the third consecutive month in February. The end of the temporary tax incentive in December and the Lunar New Year holiday distorted sales. However, President Park’s new government plans to increase social spending, which may boost sales.

- Advanced reports showed that Brazil’s selling rate in February plunged by 30% to 2.8 million annually after registering a historical high of 4.0 million units/year in January. The extended Carnival holiday was the main cause of the huge decline. High household debt, rising inflation, and possible monetary tightening are among concerns for sales this year.

- Argentina’s volatile market, showed a selling rate that averaged 785,000 units annually during the first two months of this year after recording a historical high of 970,000 units/year in December 2012. In general, LMC said the selling rate stagnated over the past year because of rampant inflation and a weakening peso. The other economist’s hand, though, noted that consumer confidence increased in both January and February, leaving the chance of a recovery in sales in the coming months.