Click to enlarge.

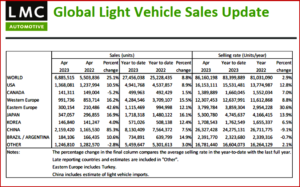

The Global Light Vehicle (LV) selling rate rose to 86 million units annually in April 2023, up from March’s 84 million units per year, according to data just released from the LMC Automotive* consultancy. The US market remains strong. (AutoInformed: US New Vehicle Sales Soar in April 2023 at 1.3 Million)

Numerous national or regional markets also have advanced from an easing of supply constraints, with overall Year-over-Year growth of 25%. China, the world’s largest auto market remains problematic. Following are LMC observations.

North America

US light vehicle sales continued to grow in April as sales increased 10.5% YoY to 1.4 million units. The selling rate accelerated to 16.2 million units annually in April, from 14.8 million units a year in March. “A strong close to the month and clear improvements in vehicle availability to meet pent-up demand has meant a Month-over-Month decline in inventory stock by 46,000 units. The average transaction price in April rose to $46,266, after declining since December 2022, while incentives were virtually unchanged MoM at US $1678,” said LMC.

Canadian LV sales fell in April by 5.2% YoY to 141,000 units (-9000 units MoM). “This decline could be associated with the current economic uncertainty, as the selling rate reduced to 1.39 million units/year in April from 1.6 million units/year in March. Mexican LV sales increased by 17.2% YoY to 97.2k units in April, while the selling rate for 2023 rose slightly to just under 1.4 million units/year, from 1.3 million units/year in March,” said LMC.

Europe

The West European selling rate in April was unchanged from March at 12.3 million units/year. “however, vehicle registrations totaled 992,000, 16.2% YoY growth, “specifically helped by the easing of supply constraints and a pickup in delivery rates, ” said LMC.

The East European selling rate rose to 3.8 million units/year in April from a revised 3.6 million units/year in March. Sales were almost 43% higher than in 2022, at 300k units. This was helped by Russian light vehicle sales at 68,000 units (+103.5% YoY) because of stronger purchasing activity and customer interest relative to a weak 2022. The Ukraine War, however, continues to hurt the region’s market activity.

China

Advance data in the notoriously opaque Chinese market show that it kept pace in April. “The April selling rate was 26.3 million units/year, unchanged from a revised March figure. In YoY terms, sales (i.e., wholesales) expanded by 85% in April, as sales a year ago were abnormally weak due to the Shanghai lockdown. NEVs remained the key market driver, with their sales expanding by 113% YoY in April and 43% YTD.

“At the Shanghai Auto Show last month, over 80% of the new models on display were NEVs. • Some provincial governments and dealers have extended tax incentives and discounts beyond their original end dates of March or April, as dealers still have many vehicles that are not compliant with the upcoming State VI-B emission standard. From 1st July, production, import and sales of vehicles that do not meet the new standard will be banned. As such, the price war is likely to continue and squeeze OEMs’ earnings, although massive price reductions and incentives have failed to boost sales significantly so far,” said LMC.

Elsewhere in Asia

In Japan, sales vaulted in May, as the supply of semiconductors improved. The April selling rate reached an “exceptionally strong 5.3 million units/year, up 23% from a solid March. That compares to the Q1 average of 4.6 million units/year. In April, several major companies raised wages substantially which, along with moderating inflation and the fading fear for the pandemic, lifted consumer confidence. Despite strong sales, the delivery times for most popular models remain long, ranging from a few months to a few years.,” said LMC.

In Korea, the selling rate slowed to 1.7 million units/year in April, down 7% from a strong March. “While supply issues have dissipated and local production is running at normal levels, demand has started to lose some steam due to high interest rates and a slowing economy. The Korean brands performed relatively well, but imports recorded a decline because of higher financing rates. The popular German brands also reported supply shortages. In May and June, sales are expected to pick up ahead of the expiry of the temporary excise tax reduction at the end of June,” LMC said.

South America

Brazilian LV sales are estimated to have increased by 10.8% YoY in April, to 152,000. The selling rate slightly declined in April from March, to 2 million units/year. Inventory levels increased again in April, but at a much lower rate compared to previous months as stocks reached 206,000, compared to 204,000 in March 2023. “Days’ supply was unchanged MoM in April at 38 days, which could indicate weakening demand as production was disrupted by stoppages in March and April.,” said LMC.

In Argentina, LV sales are estimated to have increased in April, to 324,000, up by 9.8% YoY. The selling rate remained flat from March into April at 422,000 units/year. “This is the second consecutive month in which the selling rate has exceeded the 400,000 units annually, as the market appears to remain resilient against economic headwinds,” said LMC.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle Sales Soar in April 2023

Click to enlarge.

The Global Light Vehicle (LV) selling rate rose to 86 million units annually in April 2023, up from March’s 84 million units per year, according to data just released from the LMC Automotive* consultancy. The US market remains strong. (AutoInformed: US New Vehicle Sales Soar in April 2023 at 1.3 Million)

Numerous national or regional markets also have advanced from an easing of supply constraints, with overall Year-over-Year growth of 25%. China, the world’s largest auto market remains problematic. Following are LMC observations.

North America

US light vehicle sales continued to grow in April as sales increased 10.5% YoY to 1.4 million units. The selling rate accelerated to 16.2 million units annually in April, from 14.8 million units a year in March. “A strong close to the month and clear improvements in vehicle availability to meet pent-up demand has meant a Month-over-Month decline in inventory stock by 46,000 units. The average transaction price in April rose to $46,266, after declining since December 2022, while incentives were virtually unchanged MoM at US $1678,” said LMC.

Canadian LV sales fell in April by 5.2% YoY to 141,000 units (-9000 units MoM). “This decline could be associated with the current economic uncertainty, as the selling rate reduced to 1.39 million units/year in April from 1.6 million units/year in March. Mexican LV sales increased by 17.2% YoY to 97.2k units in April, while the selling rate for 2023 rose slightly to just under 1.4 million units/year, from 1.3 million units/year in March,” said LMC.

Europe

The West European selling rate in April was unchanged from March at 12.3 million units/year. “however, vehicle registrations totaled 992,000, 16.2% YoY growth, “specifically helped by the easing of supply constraints and a pickup in delivery rates, ” said LMC.

The East European selling rate rose to 3.8 million units/year in April from a revised 3.6 million units/year in March. Sales were almost 43% higher than in 2022, at 300k units. This was helped by Russian light vehicle sales at 68,000 units (+103.5% YoY) because of stronger purchasing activity and customer interest relative to a weak 2022. The Ukraine War, however, continues to hurt the region’s market activity.

China

Advance data in the notoriously opaque Chinese market show that it kept pace in April. “The April selling rate was 26.3 million units/year, unchanged from a revised March figure. In YoY terms, sales (i.e., wholesales) expanded by 85% in April, as sales a year ago were abnormally weak due to the Shanghai lockdown. NEVs remained the key market driver, with their sales expanding by 113% YoY in April and 43% YTD.

“At the Shanghai Auto Show last month, over 80% of the new models on display were NEVs. • Some provincial governments and dealers have extended tax incentives and discounts beyond their original end dates of March or April, as dealers still have many vehicles that are not compliant with the upcoming State VI-B emission standard. From 1st July, production, import and sales of vehicles that do not meet the new standard will be banned. As such, the price war is likely to continue and squeeze OEMs’ earnings, although massive price reductions and incentives have failed to boost sales significantly so far,” said LMC.

Elsewhere in Asia

In Japan, sales vaulted in May, as the supply of semiconductors improved. The April selling rate reached an “exceptionally strong 5.3 million units/year, up 23% from a solid March. That compares to the Q1 average of 4.6 million units/year. In April, several major companies raised wages substantially which, along with moderating inflation and the fading fear for the pandemic, lifted consumer confidence. Despite strong sales, the delivery times for most popular models remain long, ranging from a few months to a few years.,” said LMC.

In Korea, the selling rate slowed to 1.7 million units/year in April, down 7% from a strong March. “While supply issues have dissipated and local production is running at normal levels, demand has started to lose some steam due to high interest rates and a slowing economy. The Korean brands performed relatively well, but imports recorded a decline because of higher financing rates. The popular German brands also reported supply shortages. In May and June, sales are expected to pick up ahead of the expiry of the temporary excise tax reduction at the end of June,” LMC said.

South America

Brazilian LV sales are estimated to have increased by 10.8% YoY in April, to 152,000. The selling rate slightly declined in April from March, to 2 million units/year. Inventory levels increased again in April, but at a much lower rate compared to previous months as stocks reached 206,000, compared to 204,000 in March 2023. “Days’ supply was unchanged MoM in April at 38 days, which could indicate weakening demand as production was disrupted by stoppages in March and April.,” said LMC.

In Argentina, LV sales are estimated to have increased in April, to 324,000, up by 9.8% YoY. The selling rate remained flat from March into April at 422,000 units/year. “This is the second consecutive month in which the selling rate has exceeded the 400,000 units annually, as the market appears to remain resilient against economic headwinds,” said LMC.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.