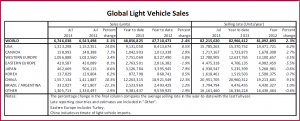

The July rate in China was 21 million, off -4% from a record-high in June. Europe should be so lucky.

While global light vehicle sales slowed during July, the selling rate is still ahead of year-ago levels with a Seasonally Adjusted Annualized Rate or SAAR at 82.2 million.

In the U.S. during July, sales were once again strong, with a SAAR of nearly 15.8 million, an increase of 14% versus July 2012. (Offshore Brands Move Ahead in July. Toyota outsells Ford) This is a +8.5% gain through the first seven months of 2013 as the U.S. economy continues to improve.

Robust truck sales continued in July, outpacing car sales, and raised the question at AutoInformed if the Detroit Three need more plants to keep pace. So far this year, large pickup truck sales have increased 24%, while car sales improved 12.6%. In Canada, sales rose as well in July, up 7.1%, with the selling rate standing at 1.7 million units a year.

One again Western Europe, at 12.8 million, was weak, but still better than earlier in the year as it heads for its sixth straight year of contraction. (New ACEA Head Announced as EU Crisis Continues) The UK remains the best performer in terms of year-on-year growth among the major markets. Spain continues to be supported by scrappage incentives – extended once again. LMC Automotive, the source of the data, claims the bottom of the market has been reached, but hedges by saying “any growth we see over the next year or so is expected to be fairly modest.” We see no growth at all.

The Russian market continues to contract with sales off -8%, and the selling rate dropping below 2.6 million annually, down from almost 3 million last year. Ford Motor’s JV is now cutting Focus, shutting the St. Petersburg plant for 20 days and then eliminating the third shift when it reopens. A new interest rate subsidy could make things better starting in September.

According to preliminary data, the July selling rate in China was 21 million, off -4% from a record-high in June. Nonetheless, the rate averages at an astonishing 21 million units annually so far this year, indicating that buyers are not deterred by the economy’s slowdown. LMC thinks there is a possibility that sales are being pulled ahead on an expectation that the government will impose purchasing restrictions in some cities. LMC’s 2013 China sales forecast remains unchanged at 21.3 million units.

The Japanese market continued to retreat with waning expectations for so-called Abenomics, along with a volatile stock market, and rising prices of basic items. In July, the selling rate slipped back to below 5 million units a year for the first time since December.

In South Korea, fiscal stimulus measures seem to have helped boost sales in July, with the selling rate accelerating to 1.6 million units/ annually, the highest rate so far this year. Yet weak exports and the ongoing labor dispute at Hyundai may undermine sales in the coming months.

In Brazil, sales plummeted in July in the wake of the widespread anti-government protests over profligate spending on sports arenas and events. The July selling rate of 2.9 million units a year was a 20% decline from June, and the lowest rate in nearly four years. High inflation, rising borrowing rates and falling stock prices are also factors.

Argentina’s volatile market continued a downward correction after the selling rate spiked to a record-high of 1 million units a year in May. Given rampant inflation and the government’s, well, “erratic” economic policies, sales are expected to continue to lose momentum in the second half of this year.