General Motors Co. (NYSE: GM) today reported Q3 earnings helped by China and North American Sales of truck and SUVs despite the COVID-19 pandemic. Specifically, GM launched an all-new portfolio of full-size Chevrolet, GMC and Cadillac sport utility vehicles, and maintained its leading U.S. full-size pickup truck and large SUV market share.

“GM is benefiting from robust customer demand for our new vehicles and services, especially our full-size pickups and SUVs. These strong fundamentals and the positive impact of our transformation and austerity measures are helping us to deliver solid earnings, generate significant cash and quickly repay the debt we incurred during the early days of the pandemic,” said John Stapleton, Interim CFO.

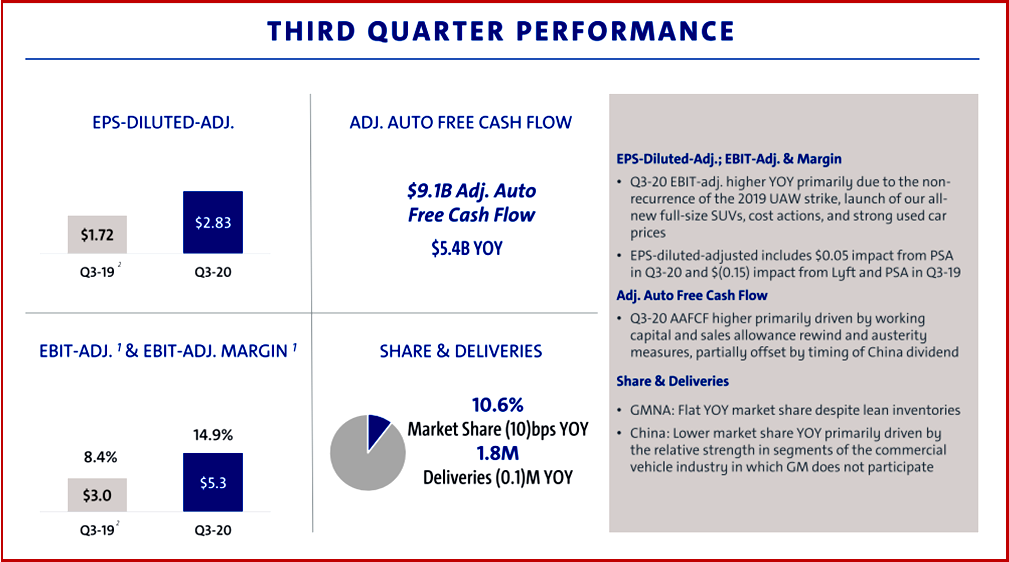

U.S. sales improved successively each month within the quarter, from strong sales of crossovers, full-size pickups and large SUVs. The Chevrolet Blazer posted its best quarter ever and the Cadillac XT6 was up 45% compared to last year. Despite tight inventory, GM’s large pickup trucks sold well, chiefly heavy-duty pickups. Through Q3, GM’s large pickups gained 1.7 percentage points in retail market share, leading the segment with 37.5% share (J.D. Power). GM’s all-new full-size SUVs are also in high demand: Chevrolet Tahoe and Suburban, and GMC Yukon and Yukon XL gained three percentage points in retail segment share since launching in the second quarter (J.D. Power).

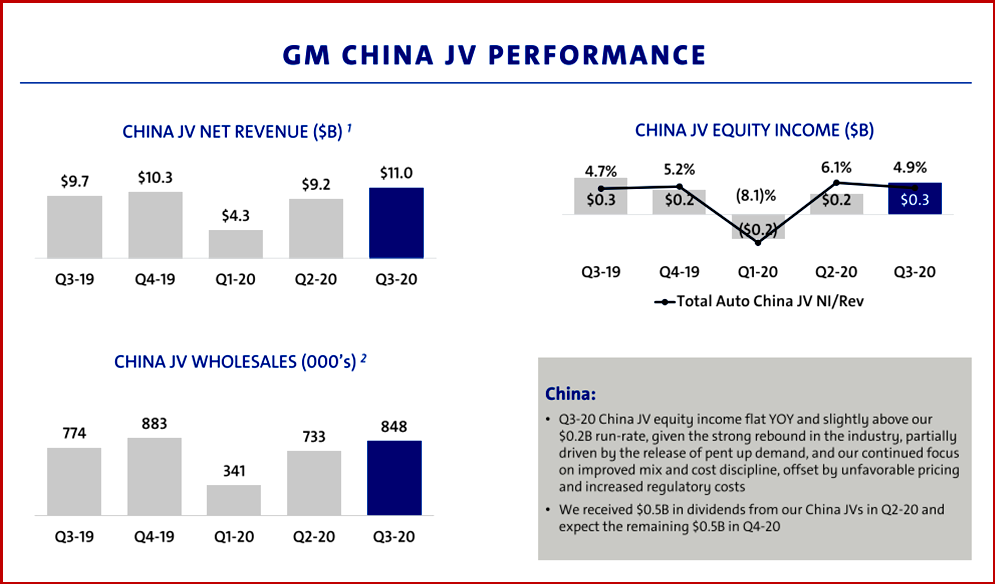

GM’s sales in China in the third quarter grew 12% year-over-year as the market continued its recovery. Buick and Cadillac increased 26% and 28%, respectively. The Wuling Hong Guang MINI EV became the best-selling EV model in China, and Buick started sales of the VELITE 7 all-electric SUV and VELITE 6 plug-in hybrid electric vehicle in the third quarter.

In South America, GM sold ~123,000 vehicles in the quarter and the Chevrolet Onix was the best-selling vehicle in the region.

The bet GM and Honda Motor made by signing a non-binding memorandum of understanding toward establishing a North American automotive alliance during the quarter is in my view an odds-on favorite to succeed. (Unless shareholders self-destructively farce GM to embark on another share buyback program instead of using capital to grow and thrive.)

The reach includes a range of vehicles to be sold under each company’s brands, and cooperation in purchasing, research and development, and connected services. The companies will explore vehicle platform-sharing possibilities, along with propulsion systems and advanced driver-assist features. This alliance will help realize significant cost savings, freeing up resources to invest in future mobility opportunities. (see Honda, GM Ink MoU on North American Alliance!)

The Alliance follows collaboration in electrified vehicles and technologies. (GM and Honda to Jointly Develop Honda Electric Vehicles) While this is consistent with an industry trend to share ruinous development costs on future CO2-free vehicles, the vast financial resources of both global automotive giants underscore the severity of the problem that automakers face. For many companies mergers will be the only way to survive – if they survive at all. (GM and Honda to Make Fuel Cells in Michigan)

Under the proposed alliance, Honda and GM would collaborate in a variety of segments in North America, intending to share common vehicle platforms, including both electrified and internal combustion propulsion systems that align with the vehicle platforms. Co-development planning discussions are underway with engineering work beginning in early 2021. (Honda, GM Expand Cooperation for Next Gen Battery)

In October, the GM unveiled the GMC HUMMER EV super truck, its first EV powered by the Ultium battery system. It will be built at GM’s Factory ZERO, Detroit-Hamtramck Assembly Center, with production beginning in late 2021. From kickoff to production, GM claims the HUMMER EV represents the quickest vehicle development program in GM’s recent history. (Don’t Hold Your Breath Waiting for the New Hummer EV and GMC Hummer EV – Its First All-Electric Truck)

GM also announced a $2 billion investment in its Spring Hill, Tennessee manufacturing plant (RIP Saturn – a spectacular GM feat of reverse alchemy tuning Gold in base metals) , which will enable the site to transition to produce EVs, joining Factory ZERO and Orion Assembly. GM also announced a $2 billion investment in its Spring Hill, Tennessee manufacturing plant, which will enable the site to transition to produce EVs, joining Factory ZERO and Orion Assembly.

Jeep and Ford electrification appear to have a couple of laps up on Hummer, which is in the pits, err, GM prototyping. It all depends on how buyers choose – hybrids or pure EVs? Conservative buyers, aka truck buyers, have thus far shunned such powertrains. Pure EVs are expensive (the Cadillac ELR abject failure comes to mind) compared to hybrids and conventional vehicles. At least HUMMER EV wanna-bees have time to save the large amounts of currency that will be required for either a lease or purchase.The Cadillac LYRIQ will be the first EV produced at Spring Hill, and production of the Cadillac XT5 and XT6 will continue. (Cadillac LYRIC – Taking Back the Luxury EV Lead? GM to Invest $22 Million in Spring Hill for Big V8 Engines)

“We acted decisively to keep our teams safe, conserve cash and preserve liquidity, all while keeping our critical product programs on track. Now we are well positioned to meet rising customer demand, accelerate our transformation and deliver our vision of a world with zero crashes, zero emissions and zero congestion,” said Mary Barra GM Chair and CEO on the earnings call.

GM Q3 2020

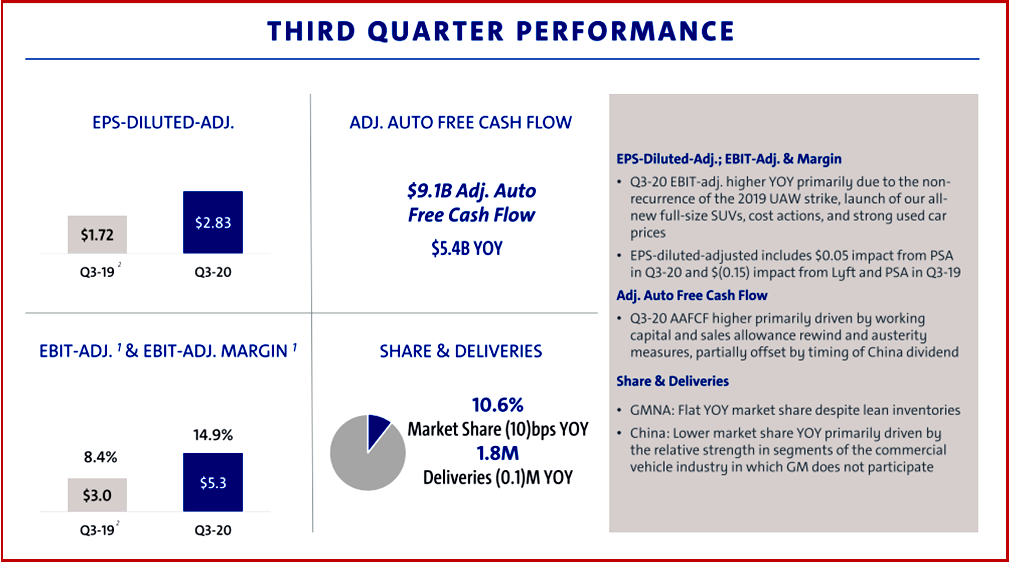

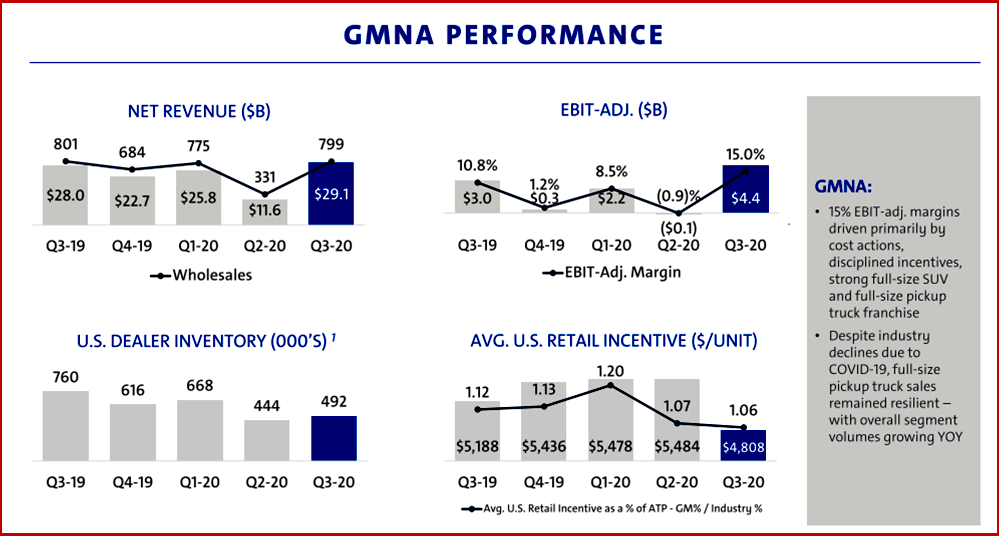

- EPS-diluted of $2.78, and EPS-diluted-adjusted of $2.83. (EPS-diluted-adjusted includes a $0.05 gain from Groupe PSA revaluations)

- Income of $4.0 billion, and EBIT-adjusted of $5.3 billion

- EBIT-adjusted margin of 14.9%

- Revenue of $35.5 billion

- Automotive liquidity of $37.8 billion

- Automotive operating cash flow of $9.9 billion, and adjusted automotive free cash flow of $9.1 billion

- GM North America EBIT-adjusted of $4.4 billion

- GM Financial EBT-adjusted of $1.2 billion

GM’s automotive liquidity was above target, ending the quarter at $37.8 billion. GM repaid $5.2 billion of its revolving credit facilities during the third quarter, and an additional $3.9 billion in October. The company expects to repay the balance by year-end while maintaining “a strong cash balance.” GM achieved its cost savings target of $4.0 billion since 2018, including $200 million in the quarter. GM expects to continue making progress on the target range of $4.0 to $4.5 billion through the end of the year. Click to Enlarge.

“My modal outlook is for a continued expansion, but at a slower pace than we had right after we came back from the shelter in place orders, and that’s really a reaction to two things. First of all, we had to ramp up to get back into activity and that caused a surge in growth, so a natural slowing is expected. But I also see the rising caseloads and we know that, voluntarily, people are going back into their homes; they’re less confident in going out when caseloads rise, and so I would expect some further slowing as we go forward consistent with the rising caseloads. Same thing we’ve been hearing for a while, [the] top priority is [to] get the virus under control. The economy goes where the virus goes.” Mary Daly is President of the San Francisco Fed.

“We are pleased our 1,600 Unifor represented employees ratified a new collective agreement for our St. Catharines Propulsion Plant, Oshawa OEM Stamped Products and Service Operations and the Woodstock Parts Distribution Centre. This agreement provides new product investment for our highest volume products which are the number one segment in Canada. This investment will create jobs and further the growth of our Canadian operations.”

Pingback: FAW J7+ Autonomous Truck Passes Chinese Certification | AutoInformed

GM Canada president and managing director Scott Bell today made the following statement upon reaching a tentative agreement with Unifor in 2020 Contract Bargaining. The agreement is subject to member ratification, which is expected to be held on November 8, 2020. We have no further comment at this time.

“Subject to ratification of our 2020 agreement with Unifor, General Motors plans to bring pickup production back to the Oshawa Assembly Plant while making additional investments at the St. Catharines Propulsion Plant and Woodstock Parts Distribution Centre.”