Click to Enlarge.

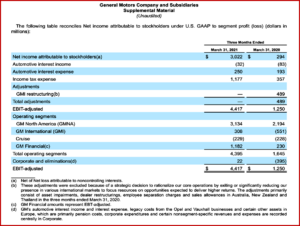

General Motors Co. (NYSE: GM) today reported Q1 2021 earnings of $2.98 billion boosted by strong price and better model-mix sales in North America, solid credit and residual value performance at GM Financial, as well as effective participation in the auto industry recovery in China, the world’s largest vehicle market.

During a call to media and investors GM said it was confident in its full-year 2021 guidance outlined earlier as it works to manage through the semiconductor shortage, which is negatively impacting all automakers globally. GM said it will lose production of 1.1 million vehicles during 2021, up from an earlier estimate of 200,000 to 400,000.

GM is managing plant downtime and the model mix of vehicles it can build and sell wisely as its results prove. Based on information available today, the company expects to be at the higher-end of the EBIT-adjusted range forecast. Full-year pretax earnings guidance remains $10 billion to $11 billion as predicted earlier, and earnings would be at the “high end of the range.”

Full-year net income is projected between $6.8 billion and $7.6 billion. The company predicts a strong first half with a pretax profit of around $5.5 billion. Omitting so-called non-recurring items, GM made $2.25 per share from January through March, doubling Wall Street estimates of $1.05.

In GM’s most profitable market, the US, sales increased 4% during Q1 compared with 2020 – first-quarter sales of 639,406 vehicles was the second-lowest level in the first quarter since 2015, and down 4% from 2019,

CEO Mary Barra said personal ownership of autonomous vehicles would grow. GM’s Cruise autonomous vehicle subsidiary is close to starting a driverless ride-hailing service in San Francisco. “It’s not years out,” she said. Cruise expects to have up to 4,000 self-driving vehicles operating in Dubai by 2030, she said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Posts Formidable First-Quarter 2021 Results

Click to Enlarge.

General Motors Co. (NYSE: GM) today reported Q1 2021 earnings of $2.98 billion boosted by strong price and better model-mix sales in North America, solid credit and residual value performance at GM Financial, as well as effective participation in the auto industry recovery in China, the world’s largest vehicle market.

During a call to media and investors GM said it was confident in its full-year 2021 guidance outlined earlier as it works to manage through the semiconductor shortage, which is negatively impacting all automakers globally. GM said it will lose production of 1.1 million vehicles during 2021, up from an earlier estimate of 200,000 to 400,000.

GM is managing plant downtime and the model mix of vehicles it can build and sell wisely as its results prove. Based on information available today, the company expects to be at the higher-end of the EBIT-adjusted range forecast. Full-year pretax earnings guidance remains $10 billion to $11 billion as predicted earlier, and earnings would be at the “high end of the range.”

Full-year net income is projected between $6.8 billion and $7.6 billion. The company predicts a strong first half with a pretax profit of around $5.5 billion. Omitting so-called non-recurring items, GM made $2.25 per share from January through March, doubling Wall Street estimates of $1.05.

In GM’s most profitable market, the US, sales increased 4% during Q1 compared with 2020 – first-quarter sales of 639,406 vehicles was the second-lowest level in the first quarter since 2015, and down 4% from 2019,

CEO Mary Barra said personal ownership of autonomous vehicles would grow. GM’s Cruise autonomous vehicle subsidiary is close to starting a driverless ride-hailing service in San Francisco. “It’s not years out,” she said. Cruise expects to have up to 4,000 self-driving vehicles operating in Dubai by 2030, she said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.