GM Vice Chairman Stephen Girsky (l to r), N.A President Mark Reuss, Vice Chairman Tom Stephens, International Operations President Tim Lee at a reception at GM headquarters following the close of trading on the first day as a public company Thursday 18 November 2010. The stock is now languishing at ~$23 a share down from the $33 IPO and a high of 39.48 for the new shares.

General Motors Company (NYSE: GM) today said Q3 earnings were $1.7 billion, or $1.03 per fully-diluted share, down from the third quarter of 2010 with GM’s net income at $2.0 billion, or $1.20 per fully-diluted share.

The results show that GM is making a slow recovery post bankruptcy, but it still has a long way to go improve its operating margins. During Q3 GM delivered 2.2 million cars and trucks for a global market share of 12%. GM remains in debt, with underfunded pensions and with outstanding preferred stock of 500 million shares – a 26% stake – owned by U.S. taxpayers.

All told, GM’s obligations total $27.9 billion at the end of Q3, with liquidity at $39 billion and it’s not clear what the next steps are to improve GM’s balance sheet. The rating agencies – if they have any credibility after the sub-prime mortgage fiasco they enabled – still have GM debt rated as junk, which raises borrowing costs. And given its sinking share price, issuing new stock seems untenable. Moreover, there remains no word on when GM will pay a dividend on its common stock.

Virtually all of the Q3 earnings came from North America – $2.2 billion, where Japanese competitors were largely out of the market during the period because of the Japan earthquake in March, which allowed GM to increase prices – but not share – to offset increasing costs. GM Europe lost money; GM South America broke even; and International Operations – home of the booming China market where GM leads – made $400 million.

This global weakness remains a troubling trend since GM is the most international of the Detroit 3. GM’s largest markets are China, followed by the United States, Brazil, the United Kingdom, Germany, Canada, and Italy. Right now GM is a two trick pony as far as earnings are concerned – the U.S. and China; or rather a one trick pony and a one trick dragon. Still, GM in Q3 was the most profitable Detroit automaker, out earning Ford Motor at $1.6 billion and Fiat-controlled Chrysler Group at $228 million.

"But solid isn’t good enough, even in a tough global economy,” said Dan Akerson, chairman and CEO. The stock market apparently agrees.

“Our overall results underscore the work we have to do to leverage our scale and further improve our margins everywhere we do business,” said Dan Akerson, chairman and CEO.

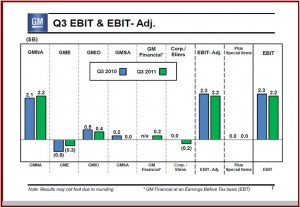

GM net revenue increased $2.6 billion to $36.7 billion, compared with the third quarter of 2010. Earnings before interest and tax (EBIT) adjusted was $2.2 billion, compared with $2.3 billion in the third quarter of 2010. There were no special items in either period.

- GM North America (GMNA) reported EBIT-adjusted of $2.2 billion, an improvement of $0.1 billion compared with the third quarter of 2010.

- GM Europe (GME) reported an EBIT-adjusted loss of $0.3 billion, an improvement of $0.3 billion compared with the third quarter of 2010.

- GM International Operations (GMIO) reported EBIT-adjusted of $0.4 billion, down $0.1 billion from the third quarter of 2010.

- GM South America (GMSA) reported breakeven results on an EBIT-adjusted basis, down $0.2 billion from the third quarter of 2010.

| General Motors Q3 Results | Q3 2010 | Q3 2011 |

| Revenue | $34.1 | $36.7 |

| Net income common stockholders | $2.0 | $1.7 |

| Earnings per share (EPS) diluted | $1.20 | $1.03 |

| EBIT-adjusted | $2.3 | $2.2 |

| Special items | $0 | $0 |

| Automotive net cash flow | $2.6 | $1.8 |

| Automotive free cash flow | $1.4 | $0.3 |

In a statement GM said that based on current industry outlook, the company expects EBIT-adjusted results in the fourth quarter of 2011 will be similar to the fourth quarter of 2010 as a result of seasonal trends in North America and weakness in Europe. GM also expects to record a special item in the fourth quarter to recognize an $800 million non-cash settlement gain related to a Canadian Health Care Trust settlement. (See GM Moves Canadian Healthcare off Balance Sheet to Trust)

GM does not expect to achieve its target to break even before restructuring charges in Europe, “due to deteriorating economic conditions.”

See:

- GM Europe President Nick Reilly Retires in March 2012. Karl Stracke Assumes Role in January; Remains Opel/Vauxhall CEO

- GM China Sales Set October Record – Surpass U.S.

- GM CEO Akerson Buys Another 10,000 Shares at $25.05

- General Motors Post Q2 Earnings of $2.5 Billion. Most from N.A.

- Toyota Loses ¥33 Billion in First Half FY 2012. Scraps Forecast

- Ford Common Stock Dividend Coming Next Year?

- Chrysler Group Reports Q3 Net Income of $212 Million

- Ford Q3 Income, Profits Down as Volume Increases. No Dividend Yet, But Sooner Rather than Later Promised