India will become the world’s third largest light vehicle market by the end of the decade behind China and the U.S., according to a new study. However, India won’t be as profitable as the other two. That prediction comes after India eclipsed France, the United Kingdom and Italy to become the sixth-largest global auto market in the world last year.

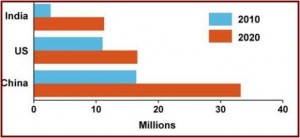

More than 2.7 million passenger cars and light-commercial vehicles were sold in India in 2010, up from just 700,000 light vehicles in 2000. India, a country with a population of nearly 1.2 billion, is expected to reach 11 million light-vehicle sales by 2020, according to a report titled “India Automotive 2020: The Next Giant from Asia,” just released by J.D. Power and Associates.

This would make India the third-largest light-vehicle market in the world, behind China (expected to reach 35 million light-vehicle sales in 2020) and the United States (expected to reach 17.4 million sales in 2020). Not surprisingly government policies are helping the economic growth and attracting investments from major automakers. Incentives are used to promote exports of vehicles.

“India has quickly become one of the largest and fastest-growing automotive markets in the world,” said John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates. “This momentum has been driven by a more open and market-driven economy, an empowered and less risk-averse work force, a more consumer-driven culture and an emphasis on small car production.”

In 2010, nearly 80% of all new passenger vehicles sold in India were either mini cars or subcompact passenger cars. By comparison, the mini car and subcompact segments accounted for only 24% of passenger-vehicle sales in China in 2010, and just 3% of passenger-vehicle sales in the U.S.

The average transaction price for all new passenger vehicles sold in 2010 in India was $10,000 (compared with $17,500 in China and $28,000 in the United States), while the best-selling passenger car in India, the Maruti Suzuki Alto, had an average transaction price of about $6,200. While India’s emphasis on small vehicles has helped sales to grow quickly, it also means that automaker earnings will depend primarily on small car segments, where profit margins are traditionally thin.

“Should fuel prices continue to climb globally in the future—and as demand for inexpensive and reliable transportation increases in many of the world’s developing markets—India could find itself well-positioned to fulfill the needs of the small car segment,” said Humphrey. “That said, profit margins are thinner in the small car segment, so automakers are going to need to manage their businesses carefully to optimize profits.”

While progress has been made in building the Indian automotive industry, the rosy future predicted is by no means assured. Some economists and automotive industry executives believe that much still needs to be done about India’s “three deficits.” These “deficits” are continual international trade deficits; chronic government budget deficits; and an underdeveloped power generation and distribution infrastructure.

“Much of India’s future growth in the automotive sector will depend on successfully creating the infrastructure to support its economy,” said Humphrey.