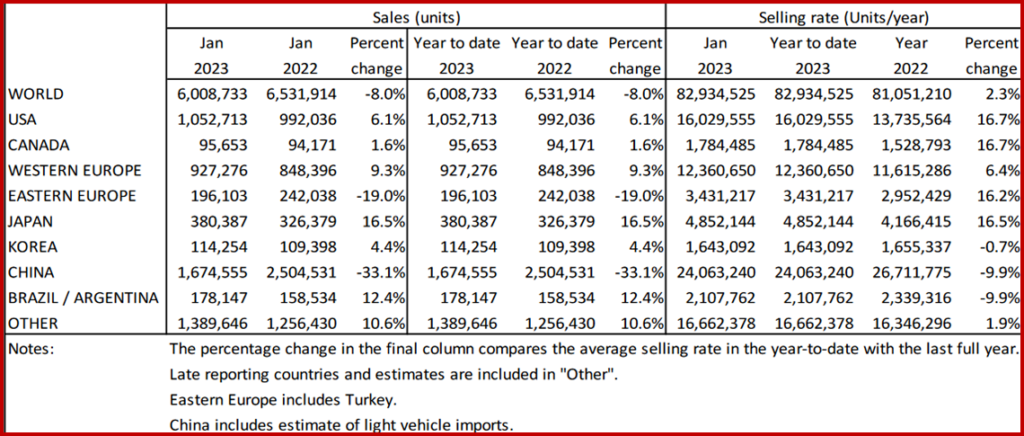

January’s Global Light Vehicle (LV) selling rate stood at 83 million units annually, consistent with the previous month, according to the latest data just published by LMC Automotive.* Global supply constraints remain a key issue with some “distortions from tax changes,” in the respected consultancy’s view. Monthly registrations were down 8% year-on-year (YoY), at 6 million units for the month.

“China’s market had a sluggish start in 2023 with raw sales down 33% YoY, largely due to the spike in national COVID-19 infections and the termination of the tax incentives. Both North America and Western Europe had positive YoY growth in January, but this should not be over-emphasized as 2022 was a weak base of comparison. Eastern Europe, on the other hand, continued to suffer YoY negative growth,” LMC said.

Click for more Information.

North America

US LV sales grew by 6.1% YoY in January, to 1.1 million units, compared with a weak start to 2022. “While the selling rate rose to 16.0 million units/year from 13.5 million units/year the previous month, this increase should not be over-emphasized as seasonality has been disrupted the last several years. The daily selling rate provides a better view as it declined to 43,000 units/day from 48,000 units/day in December. Average transaction prices, however, fell to $46,771, ‐1.2% MoM, but still rose 4.9% YoY,” LMC said.

Canadian LV sales rose 1.6% YoY at 96,000 units, with selling rate rising to 1.8 million units/year, from 1.5 million units/year in December. “Limited inventory is likely still holding back sales. In Mexico, sales were up by 20% YoY in January to 94k units. The selling rate also increased to 1.2 million units/year, from 1.1 million units/year in December, the highest rate since February 2020,” LMC said.

Europe

The West European selling rate fell from 14.7 million units/year in December to 12.4 million units/year in January – the 2022 year‐end having a stronger selling rate in part due to legislation changes pulling forward sales. “In raw monthly terms, January registered 930k units, up 9% YoY, though this compares to a weak January 2022,” LMC said.

The East European selling rate rose slightly to 3.4 million units/year in January from 3.0 million units/year in December. The conflict in Ukraine continues to hamper the region’s LV market performance, with raw registrations down 19% YoY, at 200k units. “Russia is driving this decline as raw registrations fell almost 62% YoY,” LMC observed.

China

The opaque Chinese market is off to a listless start in the New Year. “Advance data indicates that the January selling rate was 24.1 million units/year, down 5% from a lackluster December. In YoY terms, sales (i.e., wholesales) plunged by 33%. The slowdown was caused by the spike in COVID‐19 infections across the country and the termination of the tax incentives. In December, the temporary purchase tax cut on ICE Passenger Vehicle (PV) models and the decade‐old NEV subsidy program both ended. The timing of the Chinese New Year holiday (which started on 21st January this year, while it began on 31st January last year) distorted YoY comparisons, too,” LMC said.

According to China Passenger Car Association, NEVs (new electric vehicles) accounted for almost 26% of retail passenger vehicle sales in January. “Sales of NEVs continued to outpace those of non‐NEVs and Chinese brands performed relatively well, compared to foreign brands. Sales are likely to grow in 2023, with COVID infections subsiding and economic activities normalizing fast,” said LMC.

Elsewhere in Asia

The Japanese market recorded the highest selling rate since April 2021 at 4.9 million units/year in January. Sales increased by 17% YoY compared to a weak 2022 and continued to improve along with an easing of the supply‐chain bottlenecks. “Mini Vehicles’ sales (accounting for about 40% of total LV sales) have been recovering at a faster pace than those of non‐Mini Vehicles, as they require less semiconductors than larger vehicles. Yet, demand continues to outstrip supply,” said LMC.

The Korean market started the New Year with mixed results. PV sales expanded by 9% YoY with the extension of the temporary excise tax cut and abolishment of the mandatory public bond purchase (a kind of tax) for smaller PVs, which became effective on 1 January 2023. Brisk sales of the all‐new Hyundai Grandeur (406% YoY) led the PV market. In contrast, Light Commercial Vehicle sales declined by 22% YoY, as buyers held off on purchases, waiting for the government to finalize the BEV subsidies for LCVs.

South America

Brazilian LV sales grew by 11.3% YoY in January to 130,000, recording the second lowest January result since 2016. The selling rate declined to 1.7 million units/year, which is the lowest since April 2022. LMC thinks that the increasing cost of vehicles is starting to impact demand. Despite improvements in inventory since 2022, dealership stocks did decline between December and January.

In Argentina, sales are estimated to have grown by 15.4% YoY in January, to 47.7k units, although the selling rate declined to 374,000 units/year. While this is a slowdown from the surge at the end of 2022, it is the best January result since 2016. The uptick in sales comes despite inflation nearing 100%.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector.

The Global Light Vehicle Sales Forecast. Published in association with Jato Dynamics Ltd, builds on macro‐economic forecasts generated by our partner, the renowned Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve‐year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

In its most detailed form, model level forecasts are updated monthly and are provided in annual, quarterly and monthly time slices. Quarterly summary reports analyze the current market situation and likely future evolution from the perspective of developments at a country level and from the position of each major OEM. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

January Global Light Vehicle Sales Flat at 83 Million

January’s Global Light Vehicle (LV) selling rate stood at 83 million units annually, consistent with the previous month, according to the latest data just published by LMC Automotive.* Global supply constraints remain a key issue with some “distortions from tax changes,” in the respected consultancy’s view. Monthly registrations were down 8% year-on-year (YoY), at 6 million units for the month.

“China’s market had a sluggish start in 2023 with raw sales down 33% YoY, largely due to the spike in national COVID-19 infections and the termination of the tax incentives. Both North America and Western Europe had positive YoY growth in January, but this should not be over-emphasized as 2022 was a weak base of comparison. Eastern Europe, on the other hand, continued to suffer YoY negative growth,” LMC said.

Click for more Information.

North America

US LV sales grew by 6.1% YoY in January, to 1.1 million units, compared with a weak start to 2022. “While the selling rate rose to 16.0 million units/year from 13.5 million units/year the previous month, this increase should not be over-emphasized as seasonality has been disrupted the last several years. The daily selling rate provides a better view as it declined to 43,000 units/day from 48,000 units/day in December. Average transaction prices, however, fell to $46,771, ‐1.2% MoM, but still rose 4.9% YoY,” LMC said.

Canadian LV sales rose 1.6% YoY at 96,000 units, with selling rate rising to 1.8 million units/year, from 1.5 million units/year in December. “Limited inventory is likely still holding back sales. In Mexico, sales were up by 20% YoY in January to 94k units. The selling rate also increased to 1.2 million units/year, from 1.1 million units/year in December, the highest rate since February 2020,” LMC said.

Europe

The West European selling rate fell from 14.7 million units/year in December to 12.4 million units/year in January – the 2022 year‐end having a stronger selling rate in part due to legislation changes pulling forward sales. “In raw monthly terms, January registered 930k units, up 9% YoY, though this compares to a weak January 2022,” LMC said.

The East European selling rate rose slightly to 3.4 million units/year in January from 3.0 million units/year in December. The conflict in Ukraine continues to hamper the region’s LV market performance, with raw registrations down 19% YoY, at 200k units. “Russia is driving this decline as raw registrations fell almost 62% YoY,” LMC observed.

China

The opaque Chinese market is off to a listless start in the New Year. “Advance data indicates that the January selling rate was 24.1 million units/year, down 5% from a lackluster December. In YoY terms, sales (i.e., wholesales) plunged by 33%. The slowdown was caused by the spike in COVID‐19 infections across the country and the termination of the tax incentives. In December, the temporary purchase tax cut on ICE Passenger Vehicle (PV) models and the decade‐old NEV subsidy program both ended. The timing of the Chinese New Year holiday (which started on 21st January this year, while it began on 31st January last year) distorted YoY comparisons, too,” LMC said.

According to China Passenger Car Association, NEVs (new electric vehicles) accounted for almost 26% of retail passenger vehicle sales in January. “Sales of NEVs continued to outpace those of non‐NEVs and Chinese brands performed relatively well, compared to foreign brands. Sales are likely to grow in 2023, with COVID infections subsiding and economic activities normalizing fast,” said LMC.

Elsewhere in Asia

The Japanese market recorded the highest selling rate since April 2021 at 4.9 million units/year in January. Sales increased by 17% YoY compared to a weak 2022 and continued to improve along with an easing of the supply‐chain bottlenecks. “Mini Vehicles’ sales (accounting for about 40% of total LV sales) have been recovering at a faster pace than those of non‐Mini Vehicles, as they require less semiconductors than larger vehicles. Yet, demand continues to outstrip supply,” said LMC.

The Korean market started the New Year with mixed results. PV sales expanded by 9% YoY with the extension of the temporary excise tax cut and abolishment of the mandatory public bond purchase (a kind of tax) for smaller PVs, which became effective on 1 January 2023. Brisk sales of the all‐new Hyundai Grandeur (406% YoY) led the PV market. In contrast, Light Commercial Vehicle sales declined by 22% YoY, as buyers held off on purchases, waiting for the government to finalize the BEV subsidies for LCVs.

South America

Brazilian LV sales grew by 11.3% YoY in January to 130,000, recording the second lowest January result since 2016. The selling rate declined to 1.7 million units/year, which is the lowest since April 2022. LMC thinks that the increasing cost of vehicles is starting to impact demand. Despite improvements in inventory since 2022, dealership stocks did decline between December and January.

In Argentina, sales are estimated to have grown by 15.4% YoY in January, to 47.7k units, although the selling rate declined to 374,000 units/year. While this is a slowdown from the surge at the end of 2022, it is the best January result since 2016. The uptick in sales comes despite inflation nearing 100%.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector.

The Global Light Vehicle Sales Forecast. Published in association with Jato Dynamics Ltd, builds on macro‐economic forecasts generated by our partner, the renowned Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve‐year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

In its most detailed form, model level forecasts are updated monthly and are provided in annual, quarterly and monthly time slices. Quarterly summary reports analyze the current market situation and likely future evolution from the perspective of developments at a country level and from the position of each major OEM. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.