The Global Light Vehicle (LV) selling rate rose to 85 mn units/year in June 2022, making it the best result in 2022 to date. However, in year-to-date (YTD) terms, sales are -8.5% below the same period in 2021, according to LMC Automotive.

In LMC’s expert view this means that the global market has a long road to recovery. “While supply issues are still impacting demand in most regions, a strong sales recovery in China, supported by the easing of lock-downs that allowed OEMs to ramp up production as well as a new temporary tax cut for Passenger Vehicles (PVs), meant last month’s selling rate jumped up from May,” LMC* said in a release today.

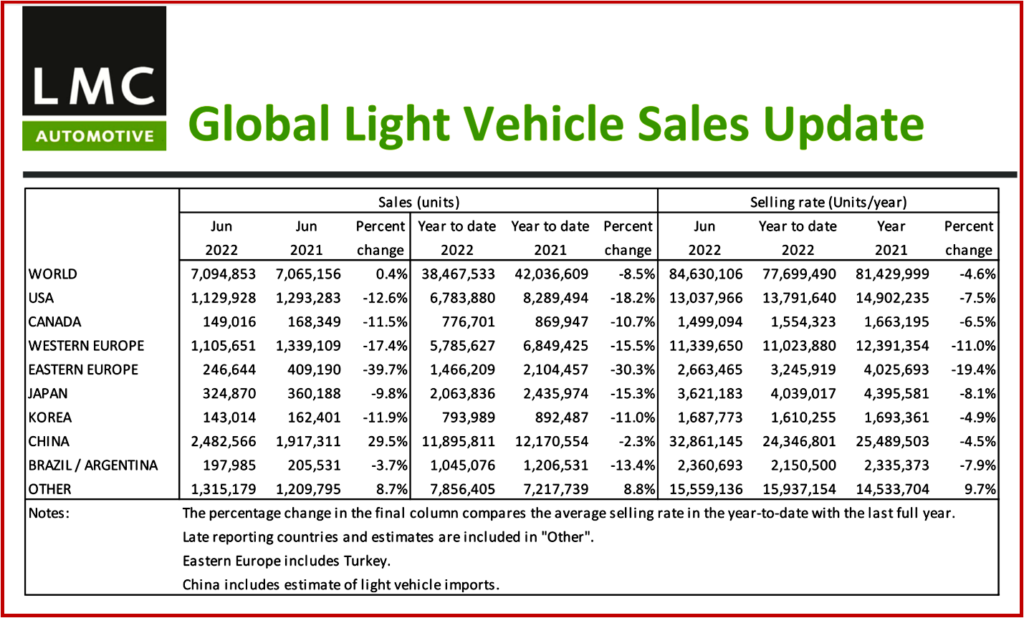

Click to Enlarge.

US Light Vehicle sales fell by -12.6% YoY in June, to 1.13 mn units. The annual comparison was helped by the fact that sales were beginning to decline in June 2021 due to the semi-conductor shortage. “However, the lack of inventory is still plaguing the market. The selling rate rose slightly to 13.0 mn units/year in June, but supply issues are disrupting regular seasonality, distorting this metric. In addition, record-high average transaction prices of $45,988 in June are starting to impact some consumers,” LMC said.

Canadian LV sales are estimated to have declined by -11.5% YoY in June, to 149,000 units. The selling rate is calculated to have picked up slightly in June, to just under 1.5 mn units/year. “The market is clearly still in a slump due to the lingering inventory shortages.”

In Mexico, sales grew by 4.0% YoY in June, to 90,000 units. The selling rate slowed to 1.11 mn units/year, from 1.18 mn units/year in May.

Europe

The West European selling rate remained flat on the month before in June. At 11.3 mn units/year, this brought the H1 2022 average to just 11.0 mn units/year. New vehicle registrations remain poor shape due to supply constraints, with selling rates below annual results during the pandemic years of 2020 and 2021.

The East European selling rate was 2.7 mn units/year in June. There was no improvement from the month before as the regional market struggles with the fallout from the war in Ukraine, as well as supply issues.

China

In China, the selling rate set a record high in June, as the country has lifted the major lockdowns and OEMs have increased production. Preliminary data indicates that, in June, normally a slow sales month in the year, the selling rate was 32.9 mn units, up 40% from the previous month. That followed a 65% MoM increase in May. In YoY terms, sales (wholesales) expanded by almost 30%, but contracted by 2.3% YTD.

“Behind such an outstanding performance are the faster-than-expected recovery in the supply chain and the temporary purchase tax cut for Passenger Vehicles (PVs), which was launched on 1 June (through 31 December 2022). In June, PV sales contributed to the entire YoY gain, while sales of Light Commercial Vehicles remained sluggish, reflecting stricter safety regulations that resulted in higher prices and a slowing economy,” LMC said.

Other Asia

The Japanese market decelerated for the second consecutive month in June, as the shortages of components intensified in Q2 during China’s lockdowns. The June selling rate was 3.62 mn units/year, down 5% from a weak May. YoY sales contracted by 10% in June (the 12th consecutive month of decline) and 15% YTD. “Yet, demand currently remains robust, continuing to outstrip supply.”

In Korea, sales accelerated in June, as 30 June was the original expiry date for the temporary excise tax cut on PVs (it has been extended to December 2022). The June selling rate surged to 1.69 mn units/year, up 7.5% from a weak May. “Nonetheless, that was a sluggish result for Korea. The ongoing procurement crisis and the week-long truckers’ strike in the country disrupted supply and sales in June. In YoY terms, sales declined by 12% last month and 11% YTD,” according to LMC.

South America

Brazilian LV sales fell by 2.8% YoY in June, to 165k units – one of the better results in the year to date. The selling rate slowed to 1.96 mn units/year in June. Availability is improving – inventory stood at 145,500 units in June, up substantially from 124,000 units in May, while days’ supply grew to 24 days, from 21 days previously. “Still, the market is facing headwinds from a turbulent economic environment, including rising vehicle prices. The average interest rate on a vehicle purchase was 28% in the last week of June, denting affordability for many potential buyers,” LMC noted.

In Argentina, LV sales fell by 7.8% YoY in June, to 33,000 units. The YoY decline does not tell the whole story. “A year ago, the country was emerging from pandemic restrictions and sales jumped as a result, providing a high base effect. In fact, June 2022 delivered a relatively good performance, as the selling rate climbed to 405k units/year, the strongest rate since November 2020. Overall, however, the market is still being held back by low inventory and import restrictions,” LMC said.

Footnotes

- Late reporting countries and estimates are included in “Other.” Eastern Europe includes Turkey.

- China includes estimate of light vehicle imports

LMC Automotive

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

June Global Light Vehicle Sales Still Lag 2021

The Global Light Vehicle (LV) selling rate rose to 85 mn units/year in June 2022, making it the best result in 2022 to date. However, in year-to-date (YTD) terms, sales are -8.5% below the same period in 2021, according to LMC Automotive.

In LMC’s expert view this means that the global market has a long road to recovery. “While supply issues are still impacting demand in most regions, a strong sales recovery in China, supported by the easing of lock-downs that allowed OEMs to ramp up production as well as a new temporary tax cut for Passenger Vehicles (PVs), meant last month’s selling rate jumped up from May,” LMC* said in a release today.

Click to Enlarge.

US Light Vehicle sales fell by -12.6% YoY in June, to 1.13 mn units. The annual comparison was helped by the fact that sales were beginning to decline in June 2021 due to the semi-conductor shortage. “However, the lack of inventory is still plaguing the market. The selling rate rose slightly to 13.0 mn units/year in June, but supply issues are disrupting regular seasonality, distorting this metric. In addition, record-high average transaction prices of $45,988 in June are starting to impact some consumers,” LMC said.

Canadian LV sales are estimated to have declined by -11.5% YoY in June, to 149,000 units. The selling rate is calculated to have picked up slightly in June, to just under 1.5 mn units/year. “The market is clearly still in a slump due to the lingering inventory shortages.”

In Mexico, sales grew by 4.0% YoY in June, to 90,000 units. The selling rate slowed to 1.11 mn units/year, from 1.18 mn units/year in May.

Europe

The West European selling rate remained flat on the month before in June. At 11.3 mn units/year, this brought the H1 2022 average to just 11.0 mn units/year. New vehicle registrations remain poor shape due to supply constraints, with selling rates below annual results during the pandemic years of 2020 and 2021.

The East European selling rate was 2.7 mn units/year in June. There was no improvement from the month before as the regional market struggles with the fallout from the war in Ukraine, as well as supply issues.

China

In China, the selling rate set a record high in June, as the country has lifted the major lockdowns and OEMs have increased production. Preliminary data indicates that, in June, normally a slow sales month in the year, the selling rate was 32.9 mn units, up 40% from the previous month. That followed a 65% MoM increase in May. In YoY terms, sales (wholesales) expanded by almost 30%, but contracted by 2.3% YTD.

“Behind such an outstanding performance are the faster-than-expected recovery in the supply chain and the temporary purchase tax cut for Passenger Vehicles (PVs), which was launched on 1 June (through 31 December 2022). In June, PV sales contributed to the entire YoY gain, while sales of Light Commercial Vehicles remained sluggish, reflecting stricter safety regulations that resulted in higher prices and a slowing economy,” LMC said.

Other Asia

The Japanese market decelerated for the second consecutive month in June, as the shortages of components intensified in Q2 during China’s lockdowns. The June selling rate was 3.62 mn units/year, down 5% from a weak May. YoY sales contracted by 10% in June (the 12th consecutive month of decline) and 15% YTD. “Yet, demand currently remains robust, continuing to outstrip supply.”

In Korea, sales accelerated in June, as 30 June was the original expiry date for the temporary excise tax cut on PVs (it has been extended to December 2022). The June selling rate surged to 1.69 mn units/year, up 7.5% from a weak May. “Nonetheless, that was a sluggish result for Korea. The ongoing procurement crisis and the week-long truckers’ strike in the country disrupted supply and sales in June. In YoY terms, sales declined by 12% last month and 11% YTD,” according to LMC.

South America

Brazilian LV sales fell by 2.8% YoY in June, to 165k units – one of the better results in the year to date. The selling rate slowed to 1.96 mn units/year in June. Availability is improving – inventory stood at 145,500 units in June, up substantially from 124,000 units in May, while days’ supply grew to 24 days, from 21 days previously. “Still, the market is facing headwinds from a turbulent economic environment, including rising vehicle prices. The average interest rate on a vehicle purchase was 28% in the last week of June, denting affordability for many potential buyers,” LMC noted.

In Argentina, LV sales fell by 7.8% YoY in June, to 33,000 units. The YoY decline does not tell the whole story. “A year ago, the country was emerging from pandemic restrictions and sales jumped as a result, providing a high base effect. In fact, June 2022 delivered a relatively good performance, as the selling rate climbed to 405k units/year, the strongest rate since November 2020. Overall, however, the market is still being held back by low inventory and import restrictions,” LMC said.

Footnotes

LMC Automotive

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.